Slammed 25% HIVE Digital Technologies Ltd. (CVE:HIVE) Screens Well Here But There Might Be A Catch

To the annoyance of some shareholders, HIVE Digital Technologies Ltd. (CVE:HIVE) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Longer-term shareholders would now have taken a real hit with the stock declining 2.8% in the last year.

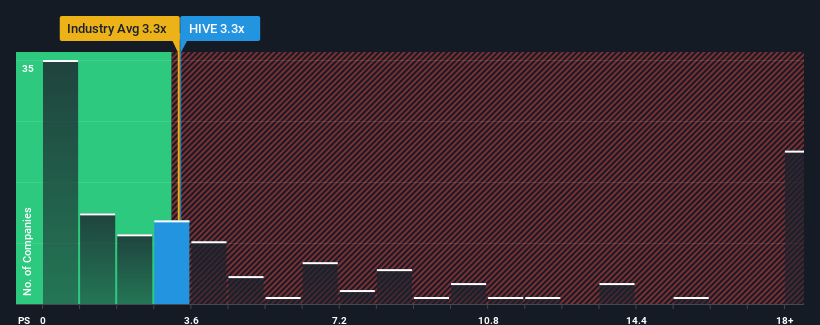

Even after such a large drop in price, it's still not a stretch to say that HIVE Digital Technologies' price-to-sales (or "P/S") ratio of 3.3x right now seems quite "middle-of-the-road" compared to the Software industry in Canada, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for HIVE Digital Technologies

What Does HIVE Digital Technologies' Recent Performance Look Like?

HIVE Digital Technologies could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on HIVE Digital Technologies will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For HIVE Digital Technologies?

The only time you'd be comfortable seeing a P/S like HIVE Digital Technologies' is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 31%. Still, the latest three year period has seen an excellent 149% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 22% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 19%, which is noticeably less attractive.

With this information, we find it interesting that HIVE Digital Technologies is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On HIVE Digital Technologies' P/S

Following HIVE Digital Technologies' share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that HIVE Digital Technologies currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 5 warning signs for HIVE Digital Technologies you should be aware of, and 2 of them are a bit concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if HIVE Digital Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:HIVE

HIVE Digital Technologies

A technology company, engages in the building and operating data centers powered by green energy in Bermuda.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives