Market Might Still Lack Some Conviction On HIVE Digital Technologies Ltd. (CVE:HIVE) Even After 27% Share Price Boost

HIVE Digital Technologies Ltd. (CVE:HIVE) shares have continued their recent momentum with a 27% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 39% in the last twelve months.

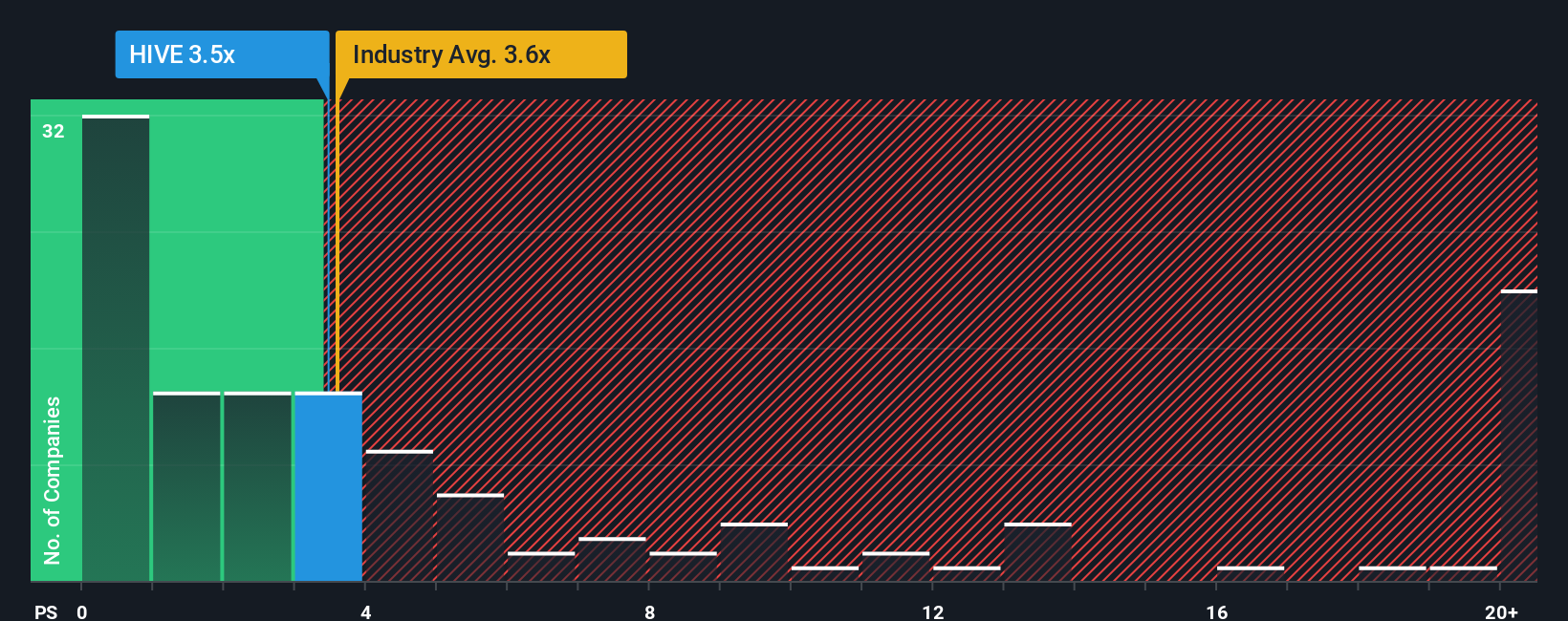

Even after such a large jump in price, you could still be forgiven for feeling indifferent about HIVE Digital Technologies' P/S ratio of 3.5x, since the median price-to-sales (or "P/S") ratio for the Software industry in Canada is also close to 3.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for HIVE Digital Technologies

What Does HIVE Digital Technologies' Recent Performance Look Like?

HIVE Digital Technologies could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on HIVE Digital Technologies will help you uncover what's on the horizon.How Is HIVE Digital Technologies' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like HIVE Digital Technologies' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 45% overall from three years ago. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 53% per annum during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 28% per year, which is noticeably less attractive.

In light of this, it's curious that HIVE Digital Technologies' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

HIVE Digital Technologies' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that HIVE Digital Technologies currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware HIVE Digital Technologies is showing 3 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HIVE Digital Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:HIVE

HIVE Digital Technologies

A technology company, engages in the building and operating data centers powered by green energy in Bermuda.

Flawless balance sheet with medium-low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion