HIVE Digital Technologies Ltd. (CVE:HIVE) Looks Just Right With A 28% Price Jump

HIVE Digital Technologies Ltd. (CVE:HIVE) shares have continued their recent momentum with a 28% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 16% is also fairly reasonable.

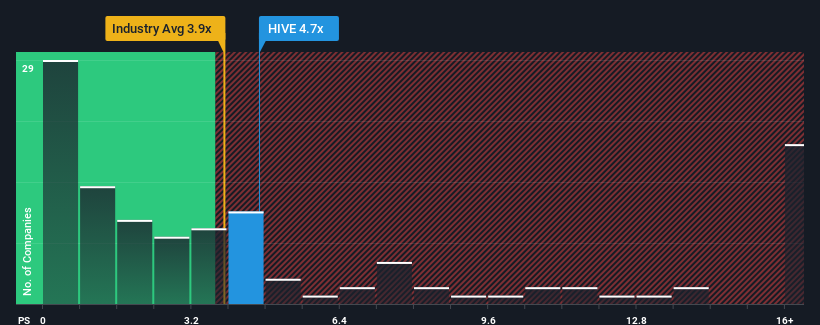

After such a large jump in price, HIVE Digital Technologies' price-to-sales (or "P/S") ratio of 4.7x might make it look like a sell right now compared to the wider Software industry in Canada, where around half of the companies have P/S ratios below 3.6x and even P/S below 1.5x are quite common. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for HIVE Digital Technologies

What Does HIVE Digital Technologies' Recent Performance Look Like?

Recent times have been advantageous for HIVE Digital Technologies as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on HIVE Digital Technologies will help you uncover what's on the horizon.How Is HIVE Digital Technologies' Revenue Growth Trending?

In order to justify its P/S ratio, HIVE Digital Technologies would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 56% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 13% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 46% as estimated by the six analysts watching the company. With the industry only predicted to deliver 19%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why HIVE Digital Technologies' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

HIVE Digital Technologies shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into HIVE Digital Technologies shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 2 warning signs for HIVE Digital Technologies (1 is concerning!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HIVE Digital Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:HIVE

HIVE Digital Technologies

A technology company, engages in the building and operating data centers powered by green energy in Bermuda.

Flawless balance sheet with medium-low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)