Despite shrinking by US$257m in the past week, HIVE Blockchain Technologies (CVE:HIVE) shareholders are still up 609% over 5 years

Some HIVE Blockchain Technologies Ltd. (CVE:HIVE) shareholders are probably rather concerned to see the share price fall 54% over the last three months. But that does not change the realty that the stock's performance has been terrific, over five years. To be precise, the stock price is 609% higher than it was five years ago, a wonderful performance by any measure. So we don't think the recent decline in the share price means its story is a sad one. Only time will tell if there is still too much optimism currently reflected in the share price. It really delights us to see such great share price performance for investors.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for HIVE Blockchain Technologies

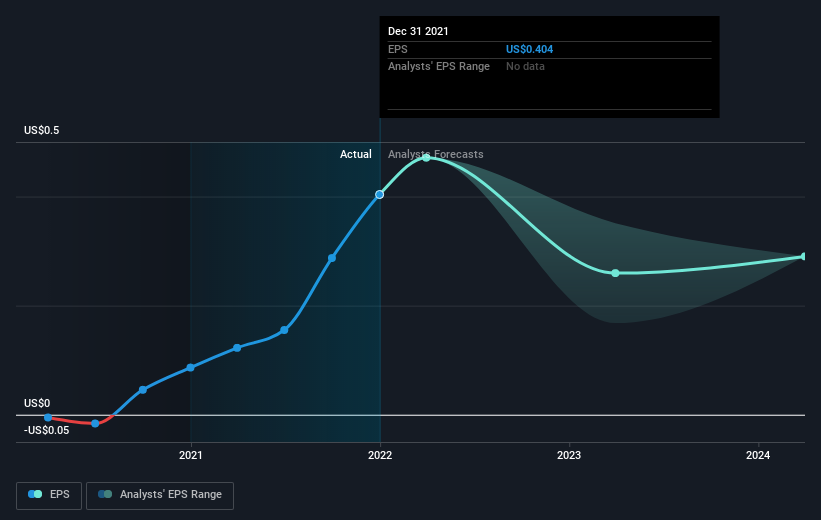

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, HIVE Blockchain Technologies became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on HIVE Blockchain Technologies' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

HIVE Blockchain Technologies shareholders are down 66% for the year, but the market itself is up 7.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 48% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand HIVE Blockchain Technologies better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for HIVE Blockchain Technologies you should be aware of, and 2 of them shouldn't be ignored.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HIVE Digital Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:HIVE

HIVE Digital Technologies

A technology company, engages in the building and operating data centers powered by green energy in Canada, Sweden, and Paraguay.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives