Digi Power X Inc. (CVE:DGX) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

Digi Power X Inc. (CVE:DGX) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. The annual gain comes to 213% following the latest surge, making investors sit up and take notice.

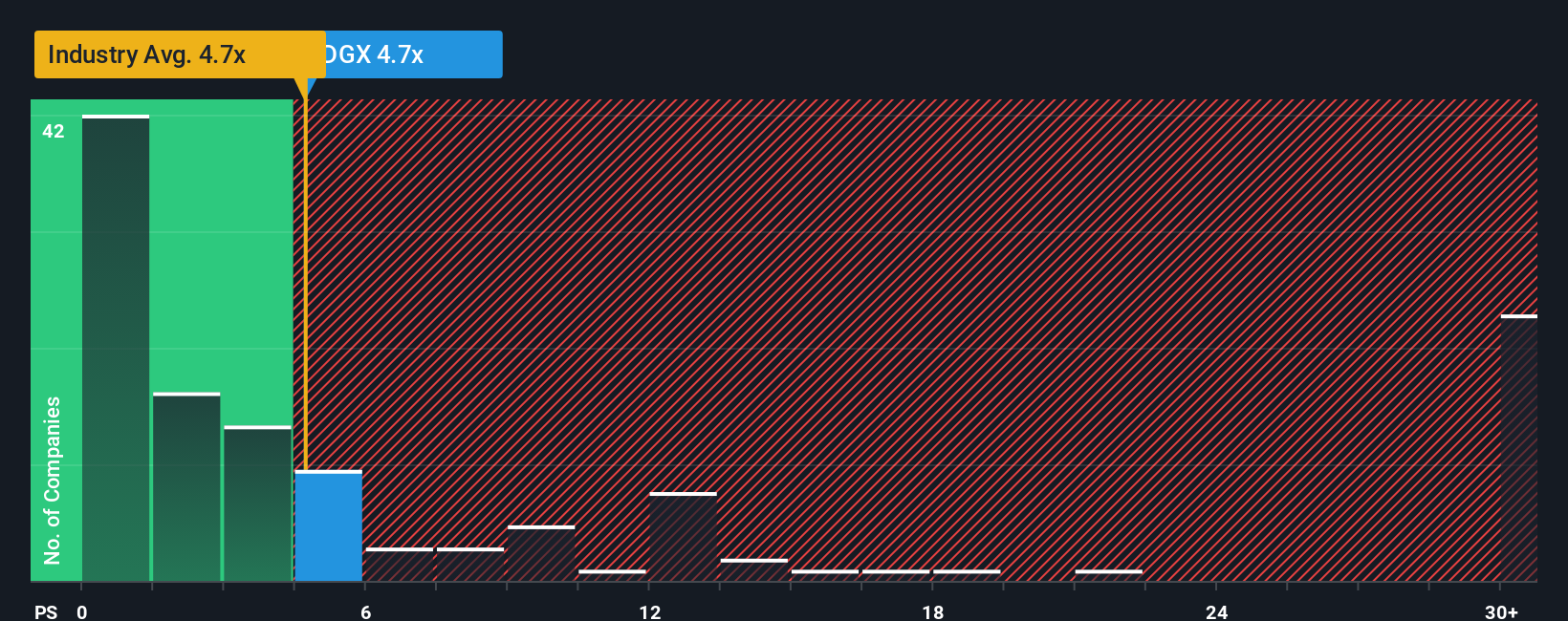

In spite of the firm bounce in price, there still wouldn't be many who think Digi Power X's price-to-sales (or "P/S") ratio of 4.7x is worth a mention when it essentially matches the median P/S in Canada's Software industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Digi Power X

What Does Digi Power X's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Digi Power X's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Digi Power X.How Is Digi Power X's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Digi Power X's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. Regardless, revenue has managed to lift by a handy 7.9% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 24% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 27%, which is not materially different.

In light of this, it's understandable that Digi Power X's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Digi Power X's P/S Mean For Investors?

Digi Power X appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Digi Power X maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

You should always think about risks. Case in point, we've spotted 4 warning signs for Digi Power X you should be aware of, and 2 of them don't sit too well with us.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:DGX

Digi Power X

An energy infrastructure company, develops data centers to drive the expansion of energy assets in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026