Stock Analysis

3 Canadian Penny Stocks On TSX With Market Caps Up To CA$30M

Reviewed by Simply Wall St

The Canadian market has been navigating the aftermath of a decisive U.S. election, with the TSX reaching record highs alongside favorable fundamental conditions. For investors looking beyond established giants, penny stocks—often representing smaller or newer companies—can offer intriguing opportunities. While the term may seem outdated, these stocks still hold potential for growth and value, especially when backed by strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.67 | CA$611.57M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.72 | CA$285.18M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$116.54M | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$183.06M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.155 | CA$4.87M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.77 | CA$190.72M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$237.5M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$29.28M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 955 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

First Lithium Minerals (CNSX:FLM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: First Lithium Minerals Corp. is a mineral exploration and development company operating in Chile, Ontario, and Quebec with a market cap of CA$8.57 million.

Operations: First Lithium Minerals Corp. currently does not report any revenue segments.

Market Cap: CA$8.57M

First Lithium Minerals Corp., with a market cap of CA$8.57 million, operates in the mineral exploration sector across Chile, Ontario, and Quebec. The company is pre-revenue and currently unprofitable, reporting a net loss of CA$0.25 million for Q2 2024. Despite this, it maintains a solid financial position with more cash than debt and sufficient short-term assets to cover liabilities. Recent private placements raised CA$400,000 in October 2024, although shareholder dilution occurred over the past year. The stock's high volatility remains a concern alongside an inexperienced board averaging 2.3 years in tenure.

- Jump into the full analysis health report here for a deeper understanding of First Lithium Minerals.

- Understand First Lithium Minerals' track record by examining our performance history report.

Nextleaf Solutions (CNSX:OILS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nextleaf Solutions Ltd. is a cannabis extraction technology company that manufactures and distributes cannabinoid vapes, oils, and softgels in Canada, with a market cap of CA$12.48 million.

Operations: The company generates CA$12.26 million from providing goods and services to the cannabis industry.

Market Cap: CA$12.48M

Nextleaf Solutions Ltd., with a market cap of CA$12.48 million, is actively expanding its product offerings and digital presence in the cannabis industry. The company recently launched an innovative virtual tour of its processing facility, enhancing transparency and user engagement. It announced 12 new product listings, focusing on minor cannabinoids like CBN and RSO extracts, leveraging its patented extraction technology. Despite reporting a net loss for Q3 2024, sales have increased significantly year-over-year. Management changes include Emma Andrews as CEO and Sam Kassem as CFO, both bringing extensive industry experience to bolster strategic growth initiatives amidst shareholder dilution concerns.

- Unlock comprehensive insights into our analysis of Nextleaf Solutions stock in this financial health report.

- Review our historical performance report to gain insights into Nextleaf Solutions' track record.

NamSys (TSXV:CTZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NamSys Inc. offers software solutions for currency management and processing tailored to the banking and merchant industries, with a market cap of CA$29.28 million.

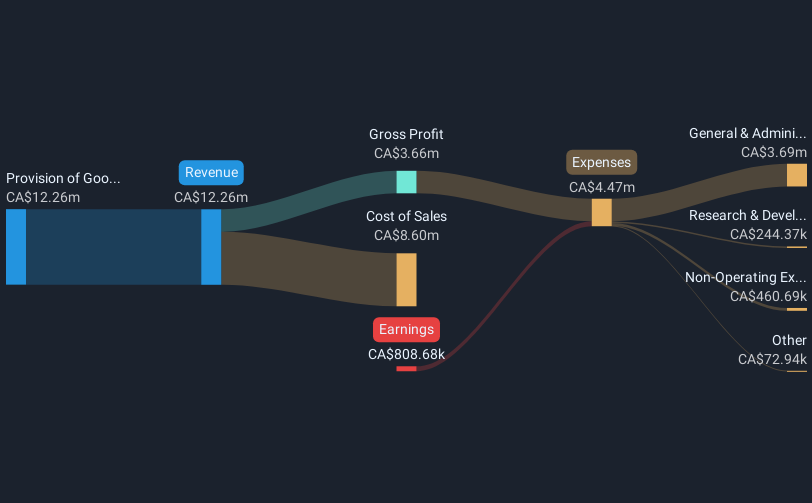

Operations: The company generates revenue from Software Related Sales and Services amounting to CA$6.54 million.

Market Cap: CA$29.28M

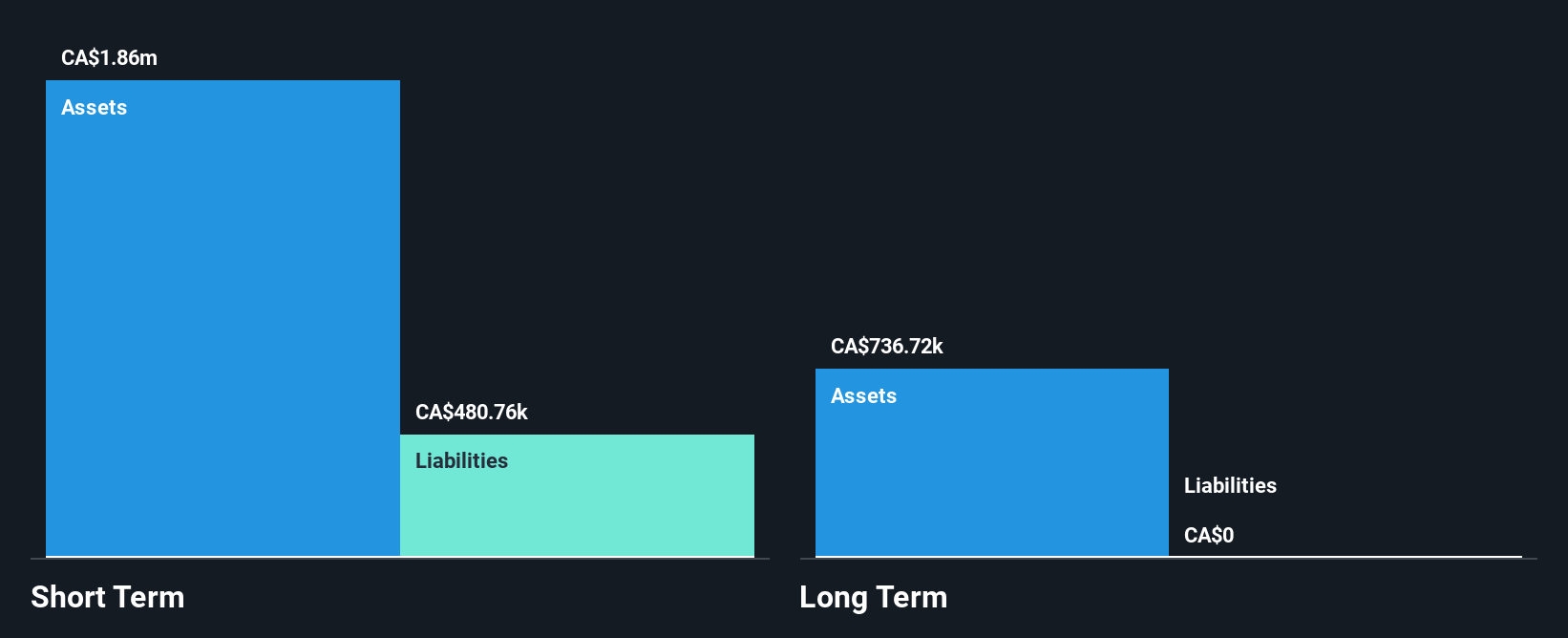

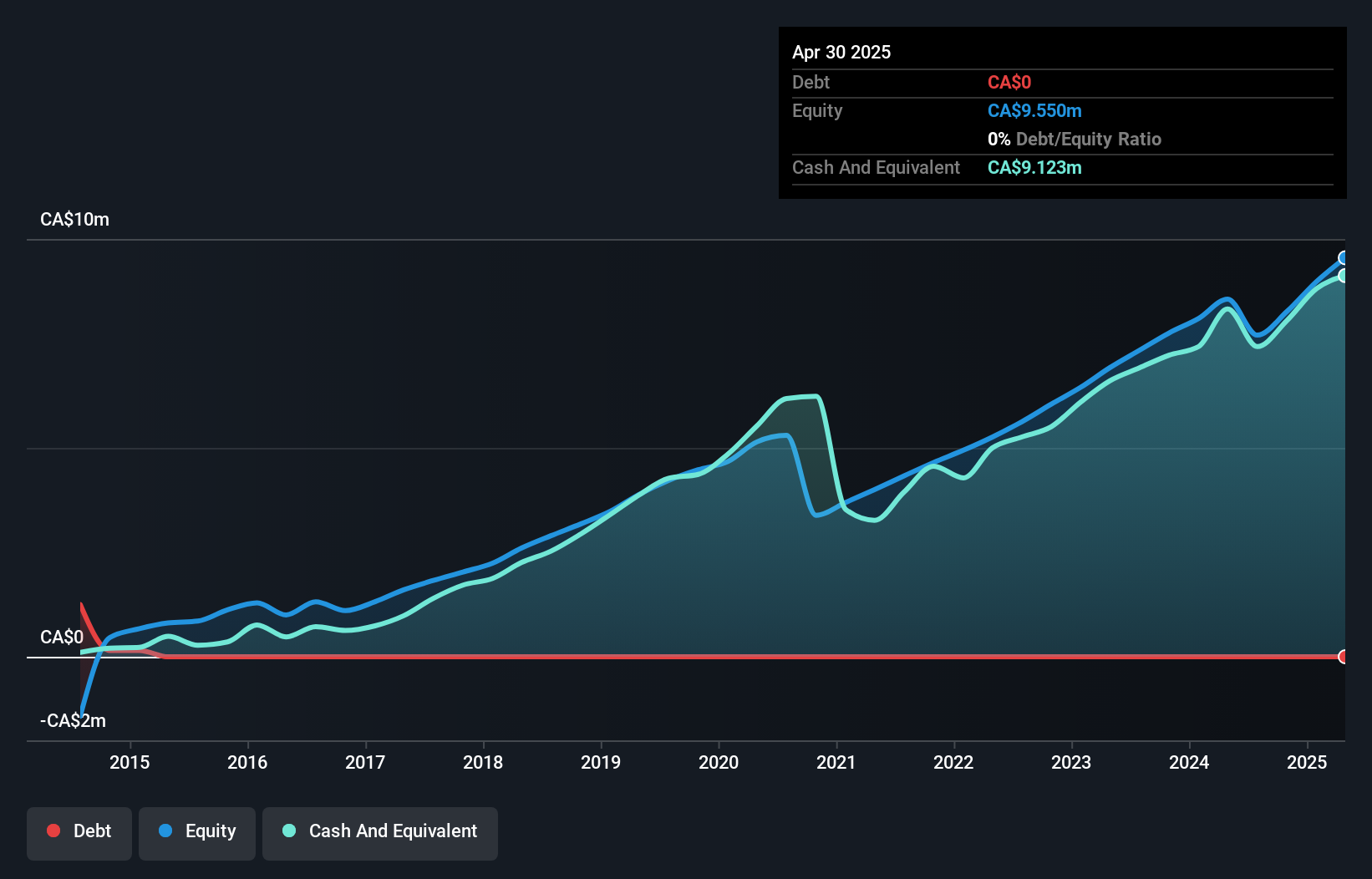

NamSys Inc., with a market cap of CA$29.28 million, is showing promising financial health and growth potential in the penny stock sector. The company reported third-quarter sales of CA$1.74 million, up from CA$1.52 million the previous year, with net income increasing to CA$0.58 million. NamSys operates debt-free and maintains high-quality earnings, supported by strong short-term assets exceeding liabilities. Its earnings growth rate of 26.7% surpasses industry averages, reflecting robust profit expansion over five years at 21.3% annually. Recent board changes include retirements and new appointments aimed at strengthening governance amidst a stable share buyback program completion.

- Get an in-depth perspective on NamSys' performance by reading our balance sheet health report here.

- Examine NamSys' past performance report to understand how it has performed in prior years.

Taking Advantage

- Get an in-depth perspective on all 955 TSX Penny Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NamSys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CTZ

NamSys

Provides software solutions for currency management and processing for the banking and merchant industries.