Bitcoin Well Inc. (CVE:BTCW) Surges 107% Yet Its Low P/S Is No Reason For Excitement

Bitcoin Well Inc. (CVE:BTCW) shares have continued their recent momentum with a 107% gain in the last month alone. The last month tops off a massive increase of 138% in the last year.

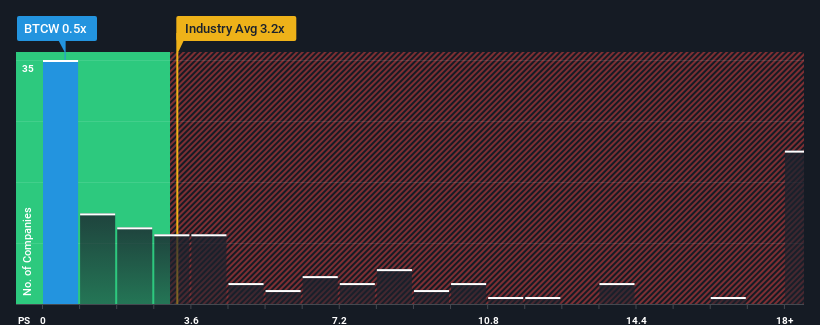

In spite of the firm bounce in price, Bitcoin Well's price-to-sales (or "P/S") ratio of 0.5x might still make it look like a strong buy right now compared to the wider Software industry in Canada, where around half of the companies have P/S ratios above 3.2x and even P/S above 9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Bitcoin Well

How Bitcoin Well Has Been Performing

For example, consider that Bitcoin Well's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bitcoin Well's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Bitcoin Well would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 5.8% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 14% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that to the industry, which is predicted to deliver 19% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why Bitcoin Well's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Bitcoin Well's P/S

Bitcoin Well's recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

In line with expectations, Bitcoin Well maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 5 warning signs for Bitcoin Well you should be aware of, and 3 of them can't be ignored.

If these risks are making you reconsider your opinion on Bitcoin Well, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bitcoin Well might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:BTCW

Bitcoin Well

Provides bitcoin and other cryptocurrency services in Canada.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives