Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Tiny Ltd. (TSE:TINY) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

How Much Debt Does Tiny Carry?

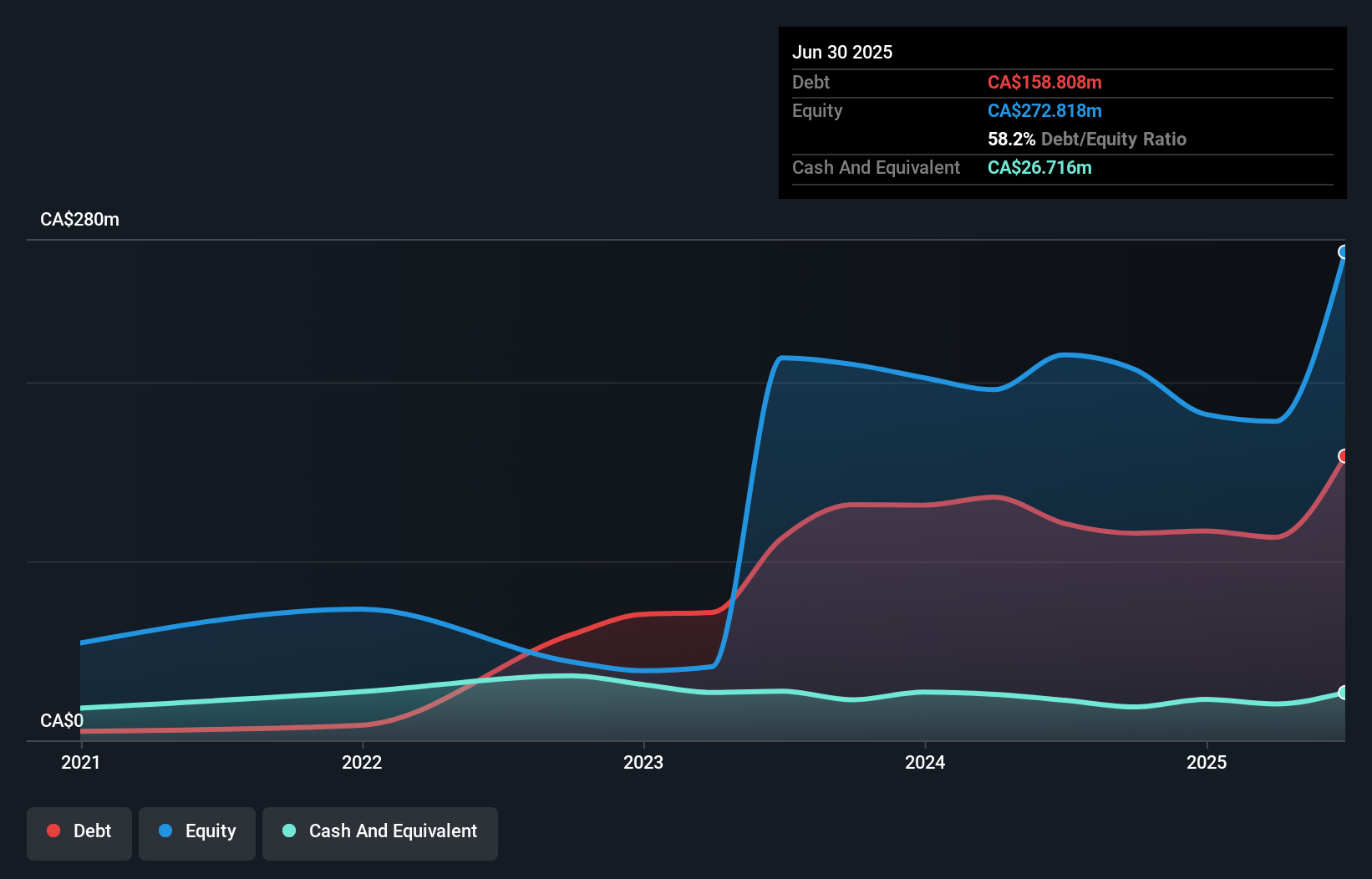

As you can see below, at the end of June 2025, Tiny had CA$158.8m of debt, up from CA$121.1m a year ago. Click the image for more detail. However, it also had CA$26.7m in cash, and so its net debt is CA$132.1m.

How Strong Is Tiny's Balance Sheet?

We can see from the most recent balance sheet that Tiny had liabilities of CA$52.3m falling due within a year, and liabilities of CA$199.3m due beyond that. On the other hand, it had cash of CA$26.7m and CA$25.8m worth of receivables due within a year. So its liabilities total CA$199.1m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of CA$233.3m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

View our latest analysis for Tiny

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Tiny shareholders face the double whammy of a high net debt to EBITDA ratio (14.9), and fairly weak interest coverage, since EBIT is just 0.16 times the interest expense. This means we'd consider it to have a heavy debt load. One redeeming factor for Tiny is that it turned last year's EBIT loss into a gain of CA$1.6m, over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Tiny's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, Tiny actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Tiny's interest cover and net debt to EBITDA definitely weigh on it, in our esteem. But its conversion of EBIT to free cash flow tells a very different story, and suggests some resilience. When we consider all the factors discussed, it seems to us that Tiny is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Tiny is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Tiny might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TINY

Tiny

A venture capital and private equity firm specializing in buyouts.

Undervalued with low risk.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.