Tecsys' (TSE:TCS) Shareholders Will Receive A Bigger Dividend Than Last Year

The board of Tecsys Inc. (TSE:TCS) has announced that it will be paying its dividend of CA$0.075 on the 13th of April, an increased payment from last year's comparable dividend. This will take the annual payment to 1.0% of the stock price, which is above what most companies in the industry pay.

View our latest analysis for Tecsys

Tecsys' Payment Has Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, the company's dividend was higher than its profits, and made up 91% of cash flows. This indicates that the company could be more focused on returning cash to shareholders than reinvesting to grow the business.

Over the next year, EPS is forecast to expand by 59.4%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 70% which would be quite comfortable going to take the dividend forward.

Tecsys Has A Solid Track Record

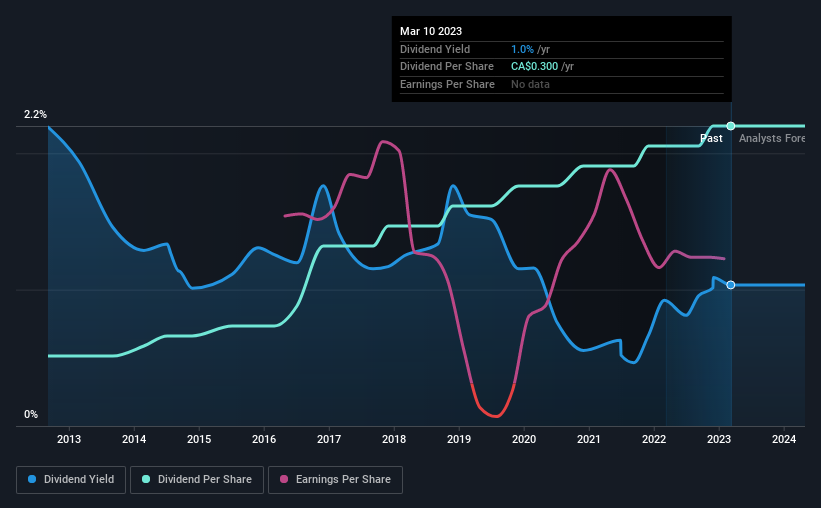

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The annual payment during the last 10 years was CA$0.07 in 2013, and the most recent fiscal year payment was CA$0.30. This works out to be a compound annual growth rate (CAGR) of approximately 16% a year over that time. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Let's not jump to conclusions as things might not be as good as they appear on the surface. Tecsys' earnings per share has shrunk at 12% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Tecsys' Dividend Doesn't Look Sustainable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. Although they have been consistent in the past, we think the payments are a little high to be sustained. We don't think Tecsys is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Given that earnings are not growing, the dividend does not look nearly so attractive. See if the 7 analysts are forecasting a turnaround in our free collection of analyst estimates here. Is Tecsys not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tecsys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TCS

Tecsys

Engages in the development, marketing, and sale of enterprise-wide supply chain management software and related services in Canada, the United States, Europe, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion