Tecsys Inc. Just Beat EPS By 220%: Here's What Analysts Think Will Happen Next

Tecsys Inc. (TSE:TCS) just released its latest first-quarter results and things are looking bullish. It was overall a positive result, with revenues beating expectations by 4.7% to hit CA$28m. Tecsys also reported a statutory profit of CA$0.08, which was an impressive 220% above what the analysts had forecast. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for Tecsys

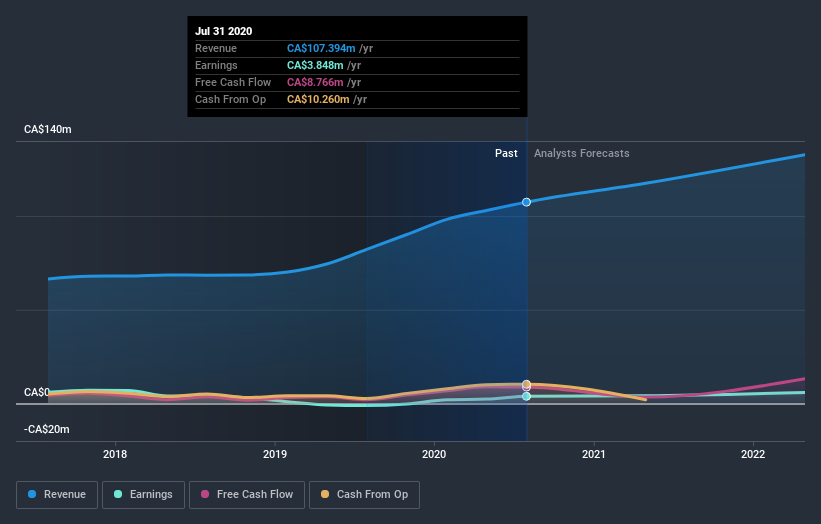

Taking into account the latest results, the current consensus from Tecsys' four analysts is for revenues of CA$117.5m in 2021, which would reflect a decent 9.4% increase on its sales over the past 12 months. Per-share earnings are expected to ascend 16% to CA$0.33. In the lead-up to this report, the analysts had been modelling revenues of CA$115.6m and earnings per share (EPS) of CA$0.22 in 2021. Although the revenue estimates have not really changed, we can see there's been a massive increase in earnings per share expectations, suggesting that the analysts have become more bullish after the latest result.

The consensus price target was unchanged at CA$35.38, implying that the improved earnings outlook is not expected to have a long term impact on value creation for shareholders. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Tecsys, with the most bullish analyst valuing it at CA$37.00 and the most bearish at CA$34.50 per share. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of Tecsys'historical trends, as next year's 9.4% revenue growth is roughly in line with 11% annual revenue growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 17% per year. So although Tecsys is expected to maintain its revenue growth rate, it's forecast to grow slower than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Tecsys following these results. On the plus side, there were no major changes to revenue estimates; although forecasts imply revenues will perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for Tecsys going out to 2022, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with Tecsys .

If you decide to trade Tecsys, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tecsys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:TCS

Tecsys

Engages in the development, marketing, and sale of enterprise-wide supply chain management software and related services in Canada, the United States, Europe, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026