Sylogist Ltd.'s (TSE:SYZ) investors are due to receive a payment of CA$0.13 per share on 15th of June. The dividend yield will be 6.6% based on this payment which is still above the industry average.

Check out our latest analysis for Sylogist

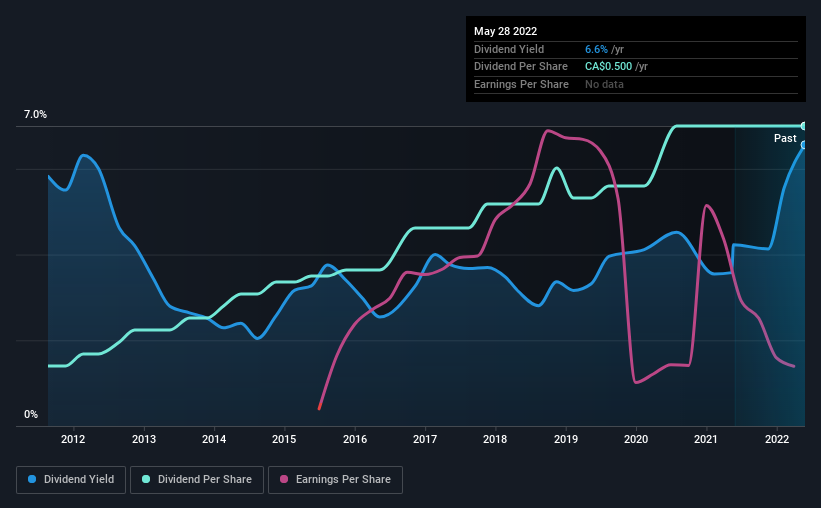

Sylogist Is Paying Out More Than It Is Earning

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, the company was paying out 629% of what it was earning and 95% of cash flows. This indicates that the company could be more focused on returning cash to shareholders than reinvesting to grow the business.

Earnings per share is forecast to rise by 54.0% over the next year. If the dividend continues on its recent course, the company could be paying out several times what it earns in the next 12 months, which could start applying pressure to the balance sheet.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2012, the first annual payment was CA$0.10, compared to the most recent full-year payment of CA$0.50. This means that it has been growing its distributions at 17% per annum over that time. Sylogist has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Over the past five years, it looks as though Sylogist's EPS has declined at around 23% a year. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments are bit high to be considered sustainable, and the track record isn't the best. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, Sylogist has 5 warning signs (and 2 which are a bit unpleasant) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SYZ

Sylogist

A software company, provides mission-critical software-as-a-service solutions to public sector customers in Canada, the United States, the United Kingdom, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives