Kinaxis (TSX:KXS) Valuation in Focus After Strong Q3, Raised Outlook and Share Buyback

Reviewed by Simply Wall St

Kinaxis (TSX:KXS) just announced third quarter results showing increases in both revenue and net income compared to last year. The company also raised its financial outlook and introduced a new share buyback program.

See our latest analysis for Kinaxis.

After a surge of upbeat news, including robust quarterly growth and the rollout of a new buyback program, Kinaxis has seen its share price edge up 1.01% over the past day and climb 3.57% this week. Despite some volatility through the year, its 1-year total shareholder return sits at 2.16%, while longer-term holders have enjoyed a 13.29% gain over three years. This momentum hints at both resilience and cautious optimism as the company sharpens its outlook.

If Kinaxis's upward swing has you watching the tech sector closely, the next smart move is to check out See the full list for free..

With stronger results, an optimistic outlook, and a fresh share buyback sending signals to the market, investors now face a familiar question: are these gains just the beginning or is Kinaxis's next chapter already factored into the price?

Most Popular Narrative: 22% Undervalued

Compared to the last close at CA$176.73, the most widely followed narrative sees Kinaxis’s fair value much higher, hinting that the current price does not fully capture the company’s growth runway. What is driving this significant gap?

The rapid evolution and integration of AI and generative/agentic AI features within Kinaxis's Maestro platform, including partnerships like Databricks, is expected to drive new product differentiation, incremental expansion revenue, and higher win rates. This could positively impact recurring revenue and potential pricing power. Organizations' growing need for supply chain risk resilience and digital transformation is leading to increased enterprise adoption of real-time, AI-enabled SaaS platforms. This trend is fueling a robust pipeline of new customers and expansions, and may support sustained double-digit ARR and SaaS revenue growth.

Want a peek behind this ambitious valuation? The narrative leans on bold future financials, with higher margins and accelerated recurring revenues forming the backbone of the projection. What numbers light the path from today’s price to the target, and why do analysts think Kinaxis can achieve them? The answers may surprise you.

Result: Fair Value of $227.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increasing data privacy regulations or fast-moving competition in AI could pose real challenges to Kinaxis's global ambitions and valuation outlook.

Find out about the key risks to this Kinaxis narrative.

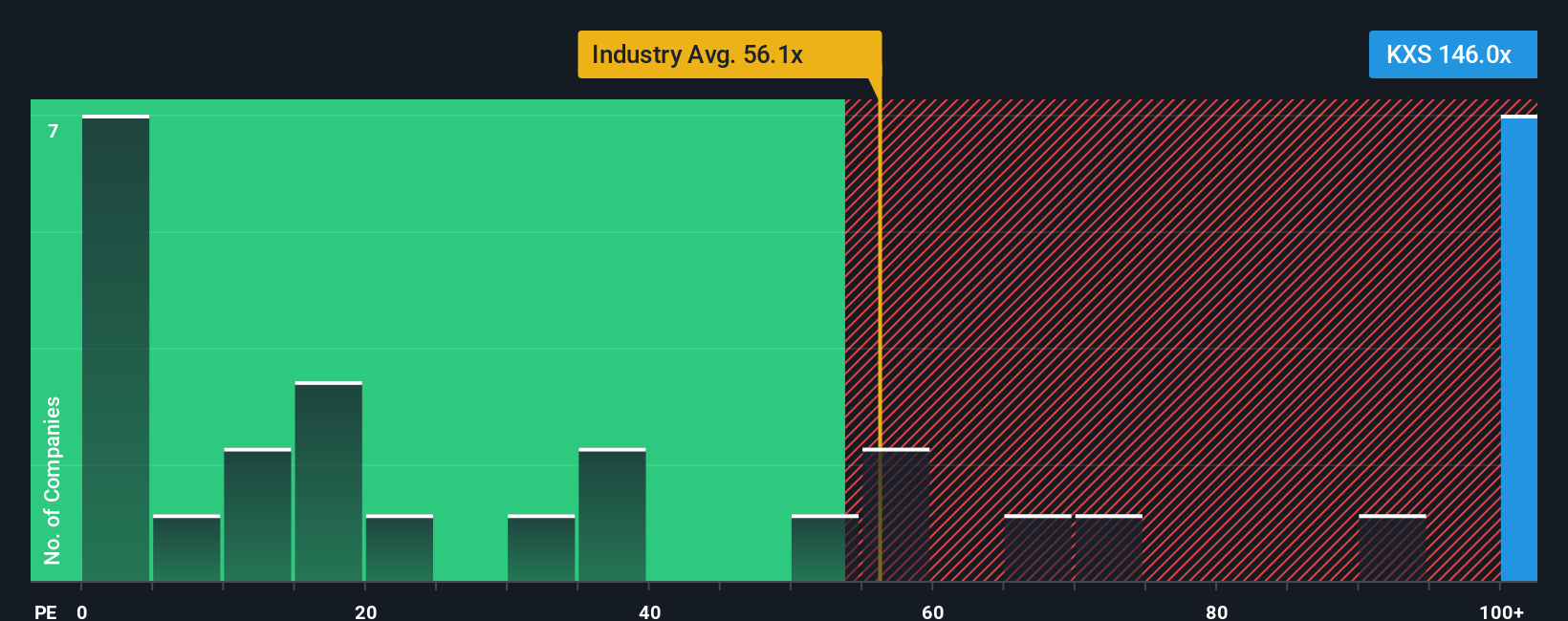

Another View: Price Ratios Hint at Valuation Risk

While analyst consensus sees Kinaxis as undervalued, looking through the lens of market price ratios tells a different story. The company trades at a price-to-earnings ratio of 101.5x, which is far above peers at 35.8x and the industry average of 50.9x. The fair ratio is just 37.9x, suggesting the market’s optimism may be stretched and potentially raising the risk of disappointment if earnings growth slows. Is the premium justified, or could expectations be getting ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinaxis Narrative

If you think the story looks different after running the numbers your own way, you can shape your perspective and build a personal view in just a few minutes. So why not give it a try and Do it your way.

A great starting point for your Kinaxis research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Too many investors settle for the usual picks and miss out on tomorrow's winners. Step up your research and spot opportunities others are overlooking, before the crowd catches on!

- Unlock high potential by scanning for these 883 undervalued stocks based on cash flows that savvy investors are adding for their attractive valuations and positive cash flow signals.

- Tap into technological breakthroughs and see what’s possible with these 27 quantum computing stocks, featuring pioneers at the frontier of computation and data security.

- Target reliable passive income streams with these 14 dividend stocks with yields > 3%, showcasing companies whose generous yields could boost your long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinaxis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KXS

Kinaxis

Provides cloud-based subscription software for supply chain operations in the United States, Europe, Asia, and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives