Kinaxis (TSX:KXS) Chosen by Shimadzu Corporation to Enhance Global Supply Chain Strategy

Reviewed by Simply Wall St

Kinaxis (TSX:KXS) saw a slight stock movement over the last week, coinciding with its recent partnership announcement with Shimadzu Corporation. This collaboration highlights the increased adoption of the Kinaxis Maestro platform to enhance supply chain strategies. Meanwhile, the broader market saw notable performance, with the S&P 500 and Nasdaq hitting all-time highs and the Federal Reserve’s potential rate cuts on the horizon. This market optimism likely supported Kinaxis’ stable price, while the client announcement may have given additional positive momentum.

You should learn about the 1 risk we've spotted with Kinaxis.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

The partnership between Kinaxis and Shimadzu Corporation potentially underscores Kinaxis' narrative of leveraging AI and cloud solutions to transform supply chain operations. This collaboration could enhance Kinaxis' platform differentiation and potentially improve revenue streams by attracting more enterprise customers seeking robust, real-time supply chain solutions. Over the last three years, Kinaxis has delivered a total return of 36.37%, showcasing its ability to generate consistent shareholder value despite broader market fluctuations. This contrasts with its recent one-year performance, where it outperformed the Canadian Software industry, which returned 13.3%.

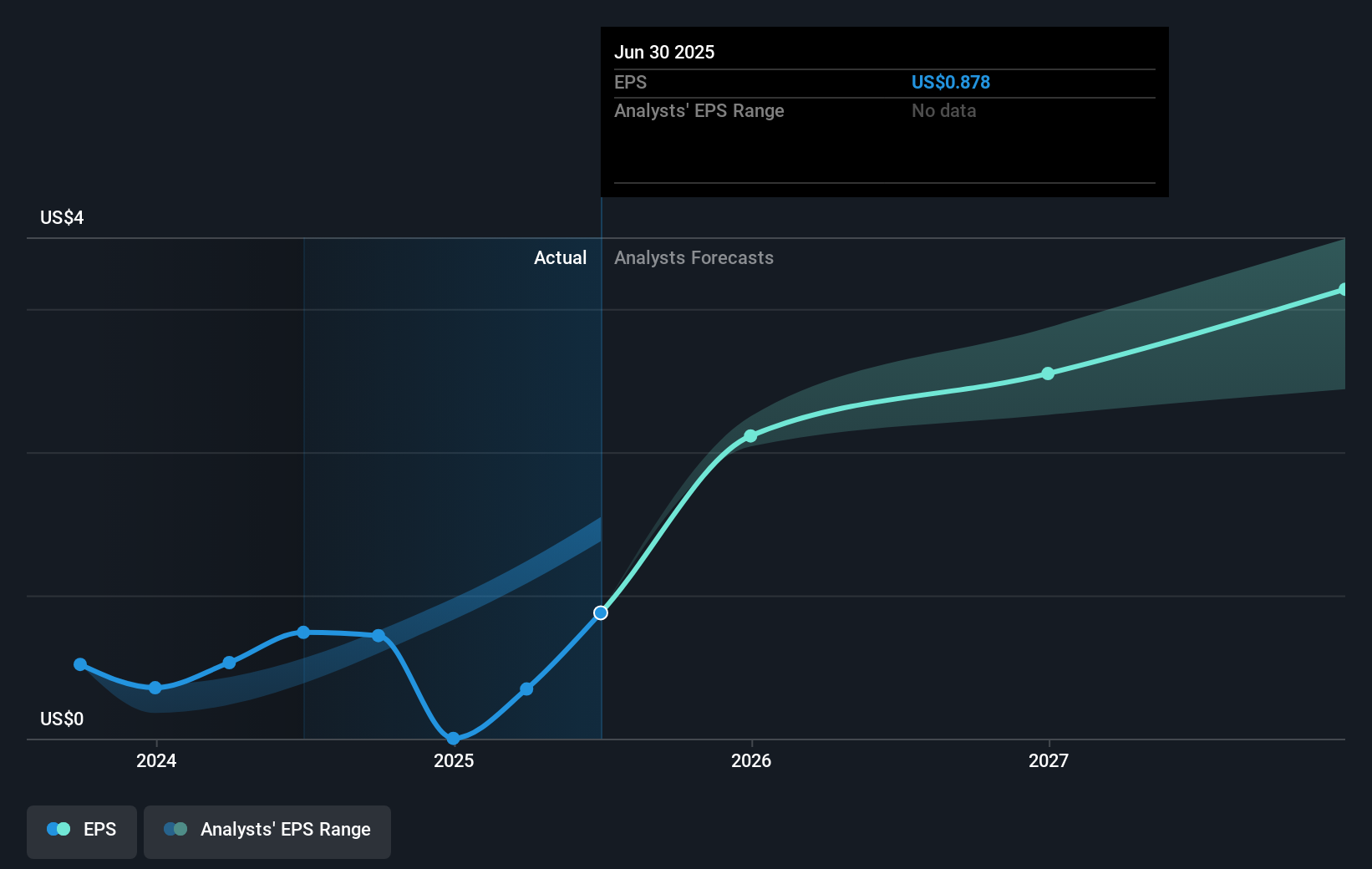

The interplay of short-term positive market sentiment, driven by potential Federal Reserve rate cuts, and long-term growth strategies are likely to impact Kinaxis' revenue and earnings forecasts. Analysts project an annual revenue growth of 12.4% for Kinaxis, which is faster than the Canadian market's anticipated growth of 4%. With a current share price of CA$189.65, Kinaxis trades at a discount of approximately 17% to the analyst price target of CA$227.33. This suggests optimism about the company's potential, although it's prudent for investors to continually reassess these forecasts against actual company performance and broader market conditions.

Review our historical performance report to gain insights into Kinaxis' track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kinaxis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KXS

Kinaxis

Provides cloud-based subscription software for supply chain operations in the United States, Europe, Asia, and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion