- China

- /

- Electronic Equipment and Components

- /

- SZSE:300433

High Growth Tech Stocks To Watch In November 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape, characterized by the Federal Reserve's recent rate cut and a mixed performance among major U.S. stock indexes, the technology sector continues to capture investor attention with its robust growth potential driven by advancements in artificial intelligence. In this environment, identifying promising high-growth tech stocks involves assessing their ability to leverage emerging technologies and adapt to shifting economic conditions while maintaining strong fundamentals and innovation capabilities.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 36.36% | 39.76% | ★★★★★★ |

| Zhongji Innolight | 29.30% | 30.93% | ★★★★★★ |

| Pharma Mar | 26.56% | 58.15% | ★★★★★★ |

| Fositek | 37.45% | 48.50% | ★★★★★★ |

| Hacksaw | 26.40% | 37.63% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| KebNi | 23.66% | 69.18% | ★★★★★★ |

| CD Projekt | 35.47% | 51.01% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Giant Network Group (SZSE:002558)

Simply Wall St Growth Rating: ★★★★★★

Overview: Giant Network Group Co., Ltd. engages in the research, development, operation, and sale of online games both in China and internationally with a market capitalization of approximately CN¥67.17 billion.

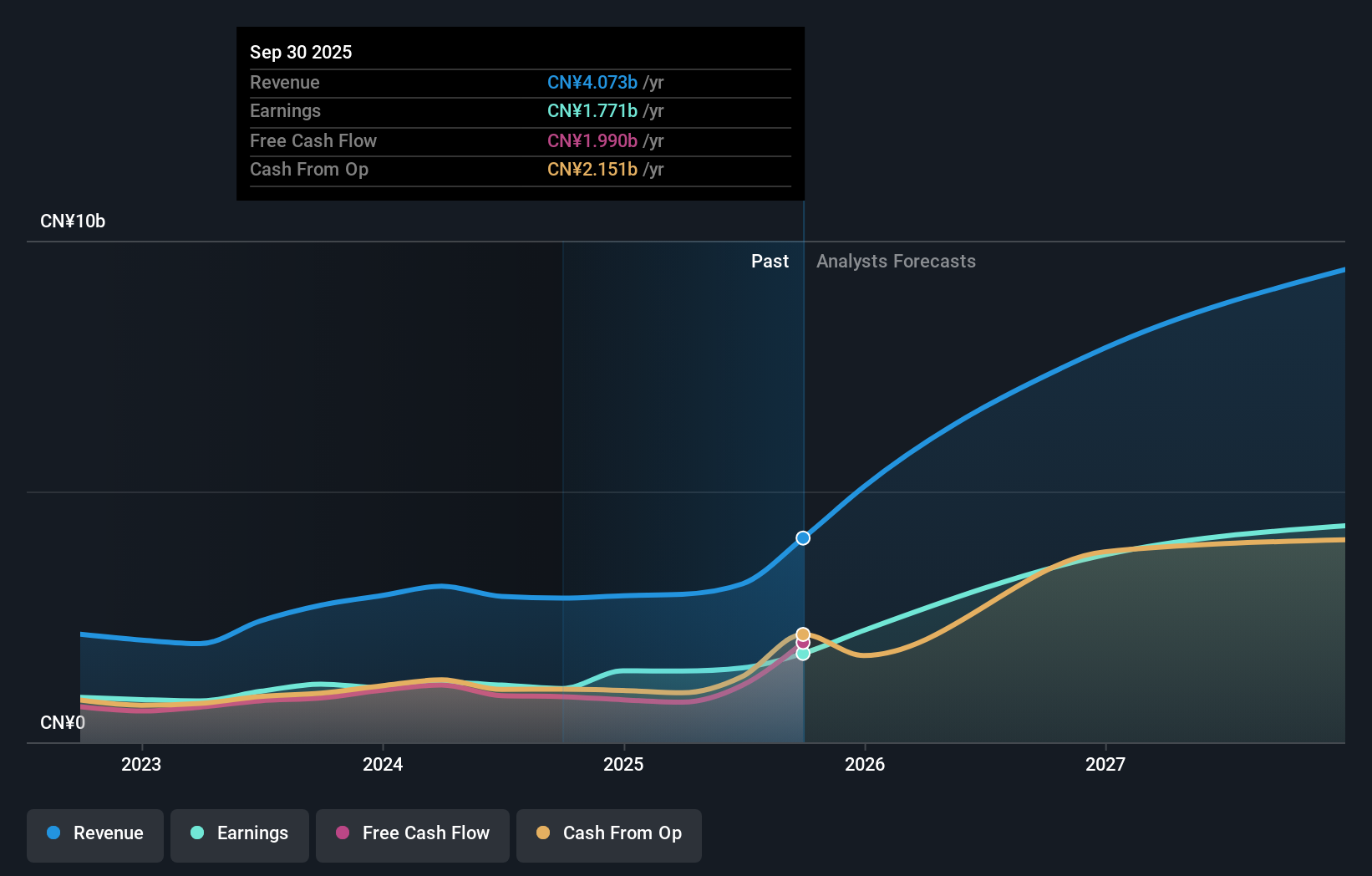

Operations: Giant Network Group generates revenue primarily from its game-related business, reporting CN¥4.07 billion in this segment.

Giant Network Group has demonstrated robust financial performance, with a notable increase in sales from CNY 2.22 billion to CNY 3.37 billion over nine months, reflecting a surge in revenue growth of 36.4% annually. This trend is complemented by an impressive earnings growth of 39.8% per year, outpacing the broader CN market's average. The company's commitment to innovation is evident from its R&D investments, crucial for sustaining its competitive edge in the fast-evolving tech landscape. Additionally, recent amendments to company bylaws and consistent dividend payouts underscore a strategic approach to governance and shareholder returns, positioning Giant Network well amidst industry shifts towards digital and interactive entertainment solutions.

Lens Technology (SZSE:300433)

Simply Wall St Growth Rating: ★★★★★☆

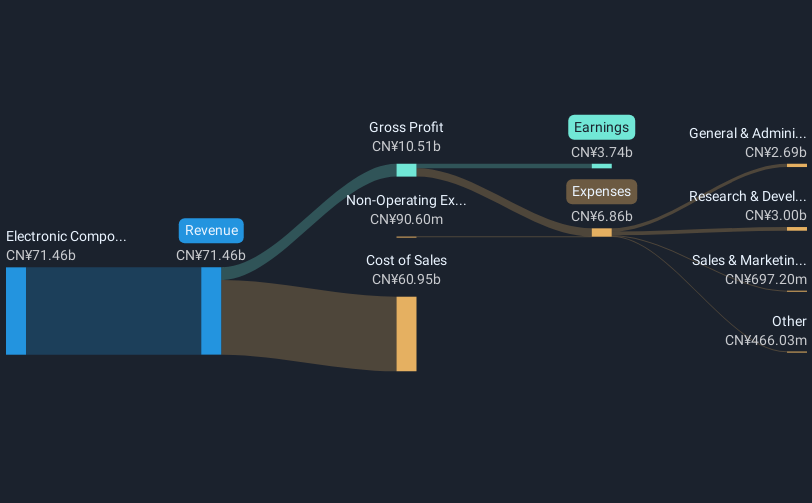

Overview: Lens Technology Co., Ltd. focuses on the R&D, production, and sale of structural parts, functional modules, and complete machine assemblies in China with a market cap of approximately CN¥148.89 billion.

Operations: The company generates revenue primarily through its electronic component manufacturing segment, which accounts for CN¥77.33 billion.

Lens Technology has shown a robust performance with a 16% increase in sales to CNY 53.66 billion and a 20% growth in net income to CNY 2.84 billion over the past nine months, reflecting strong market demand. The company's strategic focus on R&D is evident as it continues to innovate within the tech sector, ensuring its competitive edge. Recent corporate actions, including share buybacks and consistent dividend payments, highlight its commitment to shareholder value amidst dynamic market conditions. These financial maneuvers, coupled with regulatory updates and active participation in tech conferences, suggest Lens Technology is poised for sustained growth leveraging both operational strengths and strategic market engagements.

- Click here to discover the nuances of Lens Technology with our detailed analytical health report.

Examine Lens Technology's past performance report to understand how it has performed in the past.

Kinaxis (TSX:KXS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across various regions, including the United States, Europe, Asia, and Canada, with a market capitalization of approximately CA$4.73 billion.

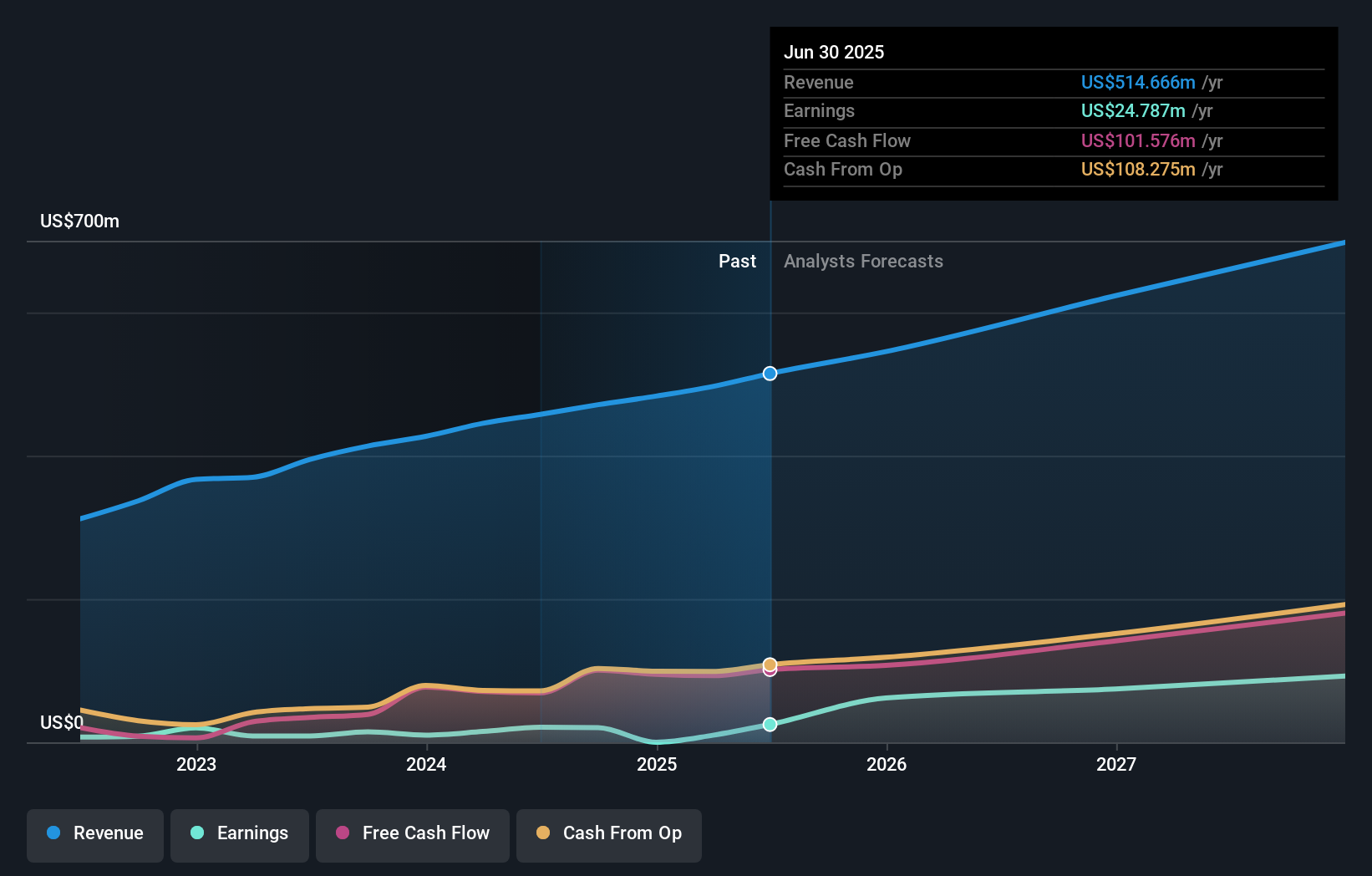

Operations: The company generates revenue primarily from its supply chain management software and solutions, amounting to $514.67 million.

Kinaxis Inc. has demonstrated a remarkable financial performance with third-quarter sales rising to USD 134.59 million from USD 121.53 million year-over-year, and net income surging to USD 16.85 million from USD 6.75 million in the same period, reflecting its robust operational efficiency and market adaptation strategies. The introduction of Maestro Agents marks a significant advancement in AI-driven supply chain management, offering real-time decision-making support that enhances productivity and responsiveness to market dynamics. This innovation not only streamlines operations for current users but also positions Kinaxis as a forward-thinking leader in supply chain solutions, potentially attracting new clients seeking sophisticated, AI-enabled logistics platforms.

- Get an in-depth perspective on Kinaxis' performance by reading our health report here.

Gain insights into Kinaxis' past trends and performance with our Past report.

Where To Now?

- Click through to start exploring the rest of the 230 Global High Growth Tech and AI Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300433

Lens Technology

Engages in the research and development, production, and sale of supporting services such as structural parts, functional modules, and complete machine, R&D, production and sales of structural parts, functional modules, complete machine assembly and other supporting services in China.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives