Will CGI's (TSX:GIB.A) HMRC Win and US ERP Milestones Redefine Its Public Sector Ambitions?

Reviewed by Sasha Jovanovic

- CGI recently announced new project milestones in Florida, where government organizations have upgraded to the CGI Advantage unified ERP platform, and also secured a contract with His Majesty's Revenue and Customs in the UK worth up to £250 million over five years to support integration and digital transformation.

- These developments underscore CGI's accelerating traction in the public sector, as it strengthens its role in digital modernization for large-scale government clients on both sides of the Atlantic.

- We'll explore how winning the UK HMRC contract could reinforce CGI's investment narrative focused on expanding digital government solutions.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CGI Investment Narrative Recap

To hold CGI shares, investors need to believe in the company's ability to win and retain large-scale digital transformation contracts, especially with public sector agencies, as a driver for recurring, higher-margin revenue. The recent HMRC contract in the UK signals expanding traction in digital government, but it does not completely resolve the most significant near-term risk: pressure on organic revenue growth from slow enterprise decision cycles, particularly in Europe.

Among recent announcements, the significant milestones achieved with Florida government organizations using the CGI Advantage platform stand out. These highlight operational gains from automation and cloud migration in the public sector, underscoring CGI’s pursuit of secure, higher-value managed services that back the company’s key growth catalyst in digital modernization. However, even with these wins, it’s important to keep in mind that…

Read the full narrative on CGI (it's free!)

CGI's narrative projects CA$17.9 billion revenue and CA$2.3 billion earnings by 2028. This requires 4.8% yearly revenue growth and a CA$0.6 billion earnings increase from CA$1.7 billion currently.

Uncover how CGI's forecasts yield a CA$155.08 fair value, a 26% upside to its current price.

Exploring Other Perspectives

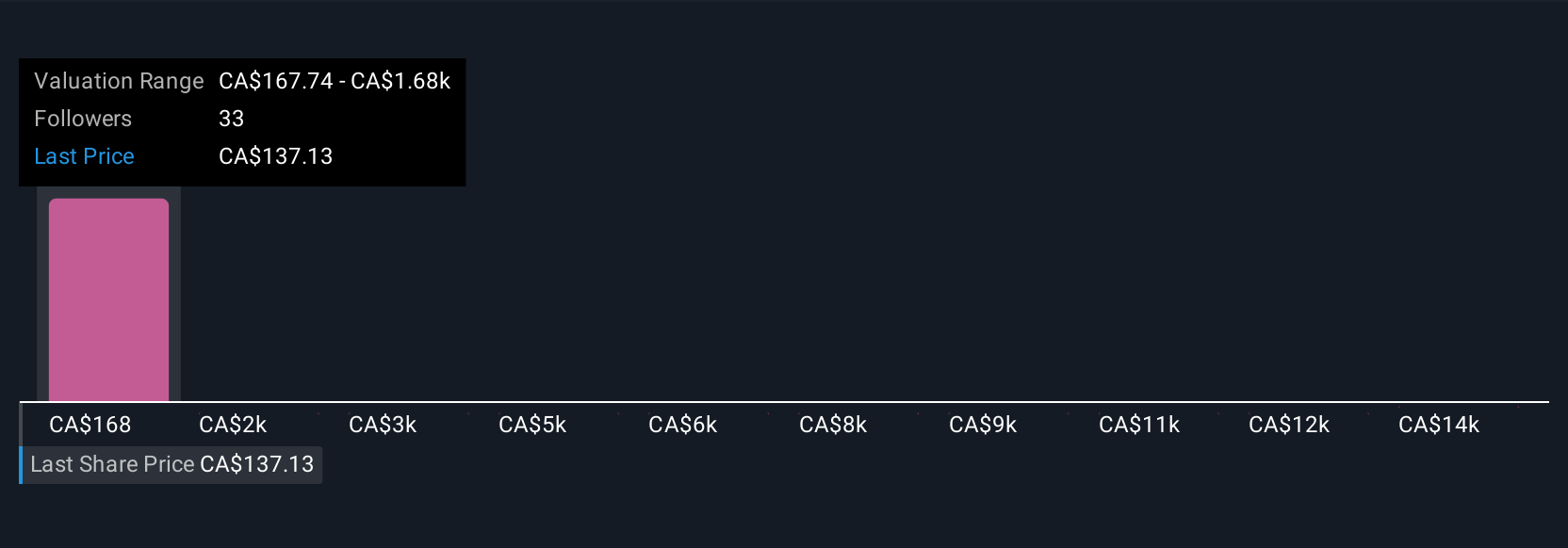

The Simply Wall St Community generated seven fair value estimates for CGI, ranging widely from CA$136.69 to CA$1,382.16 per share. While many see upside opportunity, pressure on organic growth and client spending cycles remains a key issue to watch for future performance.

Explore 7 other fair value estimates on CGI - why the stock might be a potential multi-bagger!

Build Your Own CGI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CGI research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free CGI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CGI's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GIB.A

CGI

Provides information technology and business process services in Western and Southern Europe, the United States, Canada, Scandinavia, Northwest and Central-East Europe, the United Kingdom, Australia, Germany, Finland, Poland, Baltics, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives