CGI (TSX:GIB.A) Secures CAD 750M in Private Placements and Lands NYC Contract, Boosting Growth Prospects

Reviewed by Simply Wall St

Unlock comprehensive insights into our analysis of CGI stock here.

Strengths: Core Advantages Driving Sustained Success For CGI

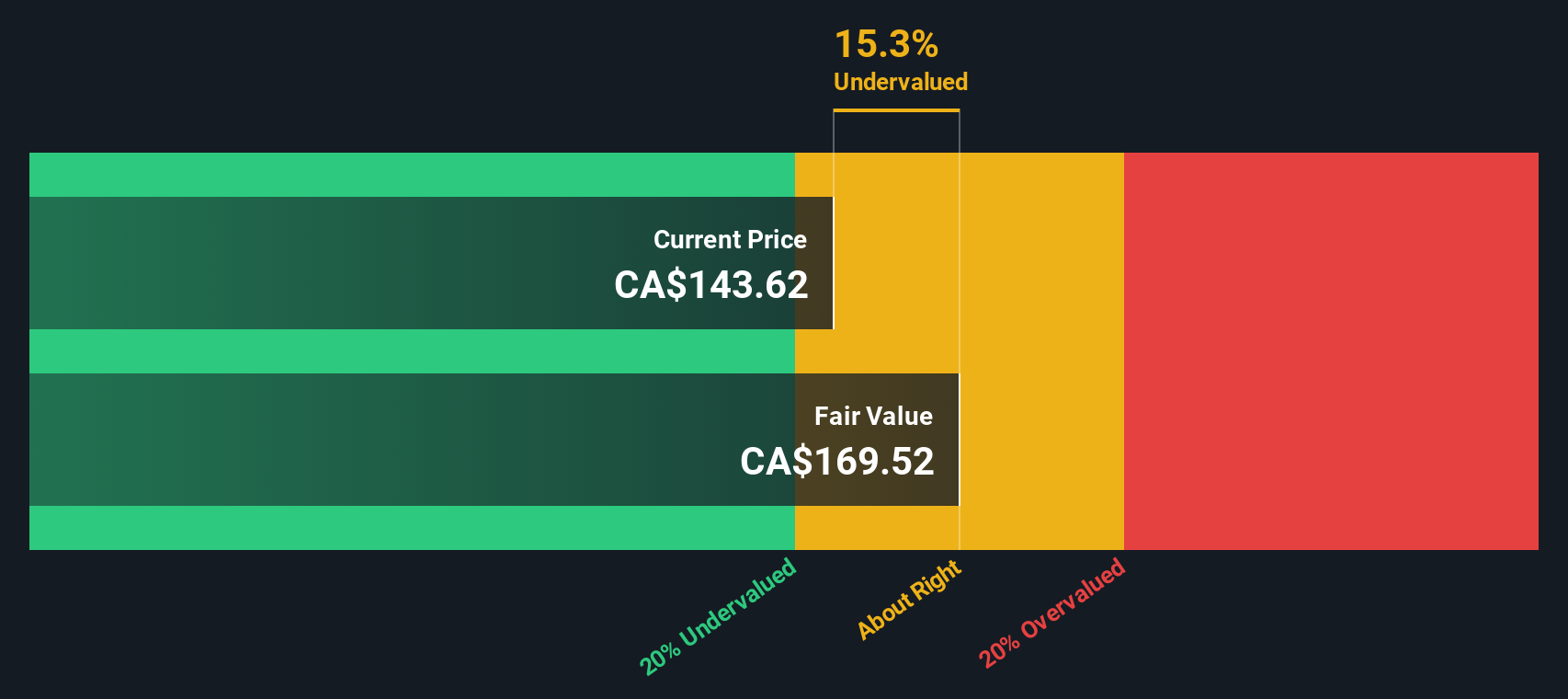

CGI has demonstrated robust financial health, evidenced by its strong revenue growth and profitability. In the latest earnings call, CFO Steve Perron highlighted that the company delivered $3.7 billion in revenue for Q3, marking a 1.3% year-over-year increase. Additionally, the company reported earnings before income taxes of $594 million, resulting in a margin of 16.2%, up 80 basis points year-over-year. This profitability is further supported by strong cash flow, with $497 million provided by operating activities, representing 13.5% of total revenue. Client satisfaction is notably high, with President and CEO George Schindler emphasizing rising levels of client satisfaction due to innovations, including AI technologies. Furthermore, CGI is trading at a Price-To-Earnings Ratio of 20.7x, which is considered good value compared to the North American IT industry average of 31x and the peer average of 71.6x, while also being undervalued at CA$153.75 compared to an estimated fair value of CA$237.98.

Weaknesses: Critical Issues Affecting CGI's Performance and Areas For Growth

Despite its strengths, CGI faces several challenges. The company is experiencing softness in specific verticals, particularly in financial services and communication sectors within Western and Southern Europe and North America, as noted by Steve Perron. Additionally, the macro business environment remains uncertain, with clients exhibiting caution in their spending, as highlighted by George Schindler. This caution has led to slower conversion rates from pipeline to booking and from booking to project initiation. Moreover, CGI's revenue growth forecast of 4.5% per year is slower than the Canadian market's 6.9% per year, and its earnings growth forecast of 7.6% per year lags behind the Canadian market's 15.1% per year. The company's Return on Equity is also forecasted to be relatively low at 16.3% in three years' time.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

CGI has several strategic opportunities to enhance its market position. The company announced two strategic acquisitions that will add 875 consultants and professionals, as highlighted by Steve Perron. This expansion is expected to strengthen CGI's service offerings and market reach. Additionally, the growing demand for managed services presents a significant opportunity, with George Schindler noting strong client interest in CGI's end-to-end offerings. The integration of generative AI into CGI's IP solutions portfolio through the CGI PulseAI platform is another strategic move that can drive innovation and client satisfaction. Furthermore, the IP pipeline has seen a more than 15% year-over-year increase, particularly in transport and logistics, manufacturing, and energy sectors, indicating potential for growth in these areas.

Threats: Key Risks and Challenges That Could Impact CGI's Success

CGI faces several external threats that could impact its growth and market share. Competition remains a significant challenge, with each client forging a unique path forward, requiring partners to meet them where they are, as mentioned by George Schindler. Economic factors also pose risks, with clients being cautious in their spending due to underlying signs of stability in the macro business environment. Regulatory risks related to pending approvals for acquisitions could delay or complicate strategic initiatives. Additionally, market risks such as delays in the timing of decisions for stand-alone SI&C projects could impact CGI's ability to secure new business and drive growth. Significant insider selling over the past three months further adds to the uncertainty.

Conclusion

CGI's strong financial health, evidenced by its revenue growth, profitability, and cash flow, positions it well against industry peers. Despite challenges in certain verticals and a cautious macro environment, the company's strategic acquisitions and innovations in AI present significant growth opportunities. The stock's Price-To-Earnings Ratio of 20.7x, compared to the North American IT industry average of 31x and a peer average of 71.6x, along with its trading price of CA$153.75 versus an estimated fair value of CA$237.98, suggests potential for substantial upside. However, external threats such as competition, economic uncertainties, and regulatory risks must be navigated carefully to realize this potential.

Turning Ideas Into Actions

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:GIB.A

CGI

Provides information technology and business process services in Western and Southern Europe, the United States, Canada, Scandinavia, Northwest and Central-East Europe, the United Kingdom, Australia, Germany, Finland, Poland, Baltics, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion