Shareholders May Be More Conservative With Enghouse Systems Limited's (TSE:ENGH) CEO Compensation For Now

Key Insights

- Enghouse Systems will host its Annual General Meeting on 9th of March

- Salary of CA$735.0k is part of CEO Steve Sadler's total remuneration

- Total compensation is 38% above industry average

- Over the past three years, Enghouse Systems' EPS grew by 9.7% and over the past three years, the total loss to shareholders 4.6%

As many shareholders of Enghouse Systems Limited (TSE:ENGH) will be aware, they have not made a gain on their investment in the past three years. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. The AGM coming up on the 9th of March could be an opportunity for shareholders to bring these concerns to the board's attention. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Enghouse Systems

How Does Total Compensation For Steve Sadler Compare With Other Companies In The Industry?

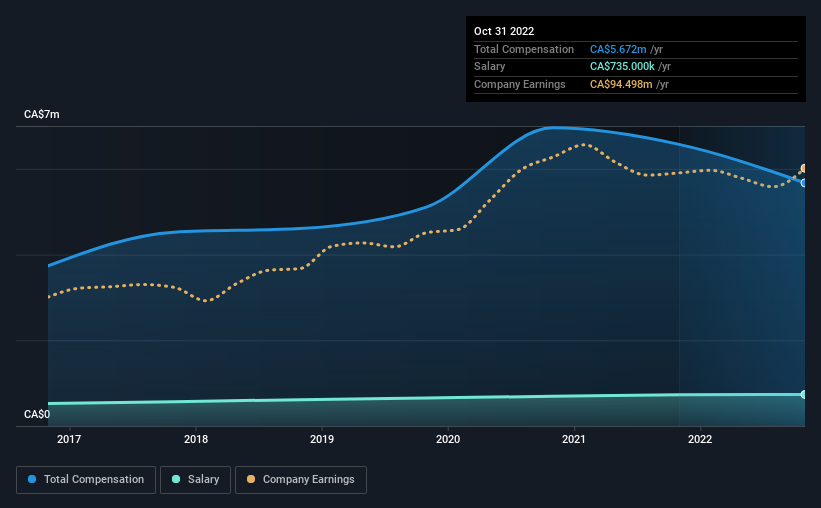

Our data indicates that Enghouse Systems Limited has a market capitalization of CA$2.5b, and total annual CEO compensation was reported as CA$5.7m for the year to October 2022. That's a notable decrease of 14% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CA$735k.

On comparing similar companies from the Canadian Software industry with market caps ranging from CA$1.4b to CA$4.4b, we found that the median CEO total compensation was CA$4.1m. Accordingly, our analysis reveals that Enghouse Systems Limited pays Steve Sadler north of the industry median. What's more, Steve Sadler holds CA$286m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CA$735k | CA$729k | 13% |

| Other | CA$4.9m | CA$5.8m | 87% |

| Total Compensation | CA$5.7m | CA$6.6m | 100% |

Talking in terms of the industry, salary represented approximately 71% of total compensation out of all the companies we analyzed, while other remuneration made up 29% of the pie. Enghouse Systems pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Enghouse Systems Limited's Growth

Enghouse Systems Limited has seen its earnings per share (EPS) increase by 9.7% a year over the past three years. Its revenue is down 8.5% over the previous year.

We generally like to see a little revenue growth, but the modest EPS growth gives us some relief. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Enghouse Systems Limited Been A Good Investment?

Since shareholders would have lost about 4.6% over three years, some Enghouse Systems Limited investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would be keen to know what's holding the stock back when earnings have grown. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Enghouse Systems that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Enghouse Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ENGH

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion