The Canadian market has seen a positive trend with a 1.6% increase over the last week and an impressive 25% climb in the past year, with earnings projected to grow by 16% annually. In this favorable environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and robust financial health, aligning well with the current market dynamics.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.54% | 34.05% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| HIVE Digital Technologies | 49.31% | 94.00% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Cineplex | 7.15% | 179.27% | ★★★★☆☆ |

| Blackline Safety | 22.29% | 121.23% | ★★★★★☆ |

| BlackBerry | 21.68% | 81.78% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

| Sernova | 76.56% | 74.04% | ★★★★★☆ |

Click here to see the full list of 23 stocks from our TSX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc. is a company that acquires, develops, and manages vertical market software businesses globally, with a market cap of CA$93.45 billion.

Operations: Constellation Software generates revenue primarily from its software and programming segment, totaling $9.27 billion. The company focuses on acquiring and managing vertical market software businesses across various regions, including Canada, the United States, and Europe.

Constellation Software demonstrates robust growth with a significant revenue jump to USD 2.47 billion in Q2 2024, up from USD 2.04 billion the previous year, underscoring its strong market position. This financial uplift is mirrored in net income which soared by over 71% to USD 177 million. With R&D expenses strategically channeled to foster innovation—evident from a yearly forecasted earnings growth of 23.6%—the company is not just expanding but also enhancing its technological edge. Moreover, an expected annual revenue increase of 16.2% positions it well above the Canadian market's average, highlighting its potential to outpace broader market trends significantly. Despite these promising figures, it's crucial to note that such performance metrics do not guarantee future results but reflect a solid trajectory within the tech sector's competitive landscape as of October 2024.

- Click here to discover the nuances of Constellation Software with our detailed analytical health report.

Understand Constellation Software's track record by examining our Past report.

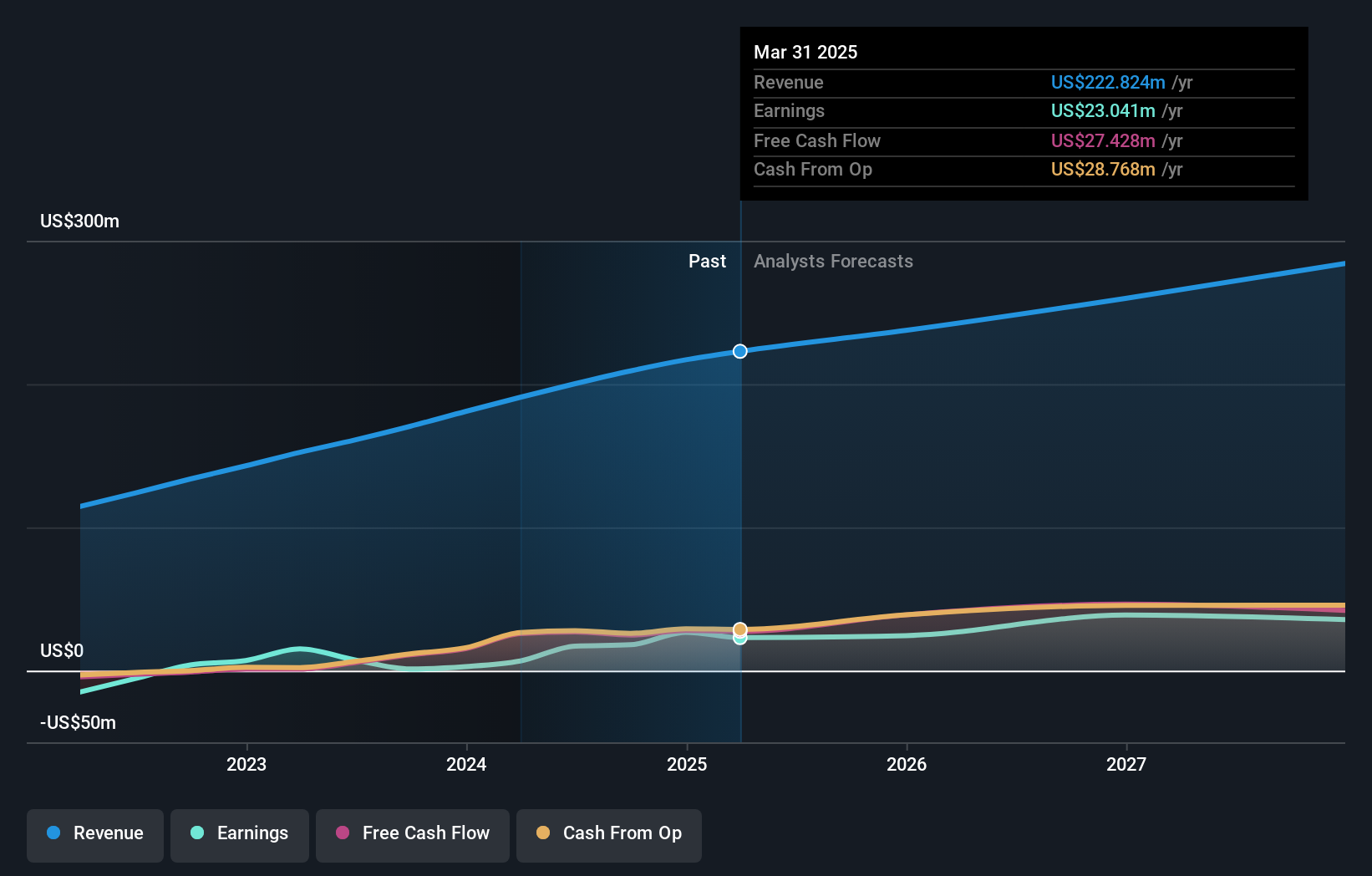

Docebo (TSX:DCBO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. is a learning management software company offering an AI-powered learning platform across North America and internationally, with a market cap of CA$1.89 billion.

Operations: The company generates revenue primarily from its educational software segment, which reported CA$200.24 million. The focus on AI-powered solutions suggests an emphasis on innovative technology to enhance learning experiences.

Docebo's strategic focus on R&D, with expenses accounting for a significant portion of revenue, underscores its commitment to innovation in the tech sector. This investment is reflected in its robust earnings growth of 34% annually, outpacing the Canadian market's average. Recently, Docebo announced a partnership with TEDAI Vienna as the official business learning partner, highlighting its role at the forefront of applying AI in educational contexts. This collaboration not only enhances Docebo's visibility but also aligns with its mission to integrate AI into enterprise learning solutions effectively.

- Get an in-depth perspective on Docebo's performance by reading our health report here.

Explore historical data to track Docebo's performance over time in our Past section.

HIVE Digital Technologies (TSXV:HIVE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HIVE Digital Technologies Ltd. operates in the mining and sale of digital currencies across Canada, Sweden, and Iceland, with a market cap of CA$568.74 million.

Operations: The company focuses on the mining and sale of digital currencies, generating CA$123.14 million in revenue from these operations.

HIVE Digital Technologies, amid a dynamic tech landscape, is steering towards profitability with expectations of earnings growth soaring by 94% annually. This growth trajectory is underscored by an aggressive R&D strategy, significantly investing in innovation to stay ahead in the competitive tech arena. Recent strategic moves include a potential $200 million equity distribution to fuel acquisitions, reflecting its adaptability and drive for expansion. With revenue forecasted to increase at 49.3% per year, HIVE's proactive market strategies and robust operational metrics position it as a noteworthy contender in the high-growth tech sector in Canada.

- Navigate through the intricacies of HIVE Digital Technologies with our comprehensive health report here.

Assess HIVE Digital Technologies' past performance with our detailed historical performance reports.

Taking Advantage

- Unlock our comprehensive list of 23 TSX High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses in Canada, the United States, Europe, and internationally.

High growth potential with solid track record.