Stock Analysis

Exploring High Growth Canadian Tech Stocks In October 2024

Reviewed by Simply Wall St

The Canadian market has shown impressive resilience with a 1.4% rise in the last week and a substantial 28% increase over the past year, while earnings are projected to grow by 16% annually. In this thriving environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation, scalability, and adaptability to leverage these favorable conditions.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.54% | 34.05% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| Wishpond Technologies | 12.29% | 118.36% | ★★★★☆☆ |

| HIVE Digital Technologies | 49.31% | 94.00% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| Blackline Safety | 22.29% | 121.23% | ★★★★★☆ |

| BlackBerry | 21.68% | 81.78% | ★★★★★☆ |

| Sernova | 78.22% | 74.04% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our TSX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★★☆

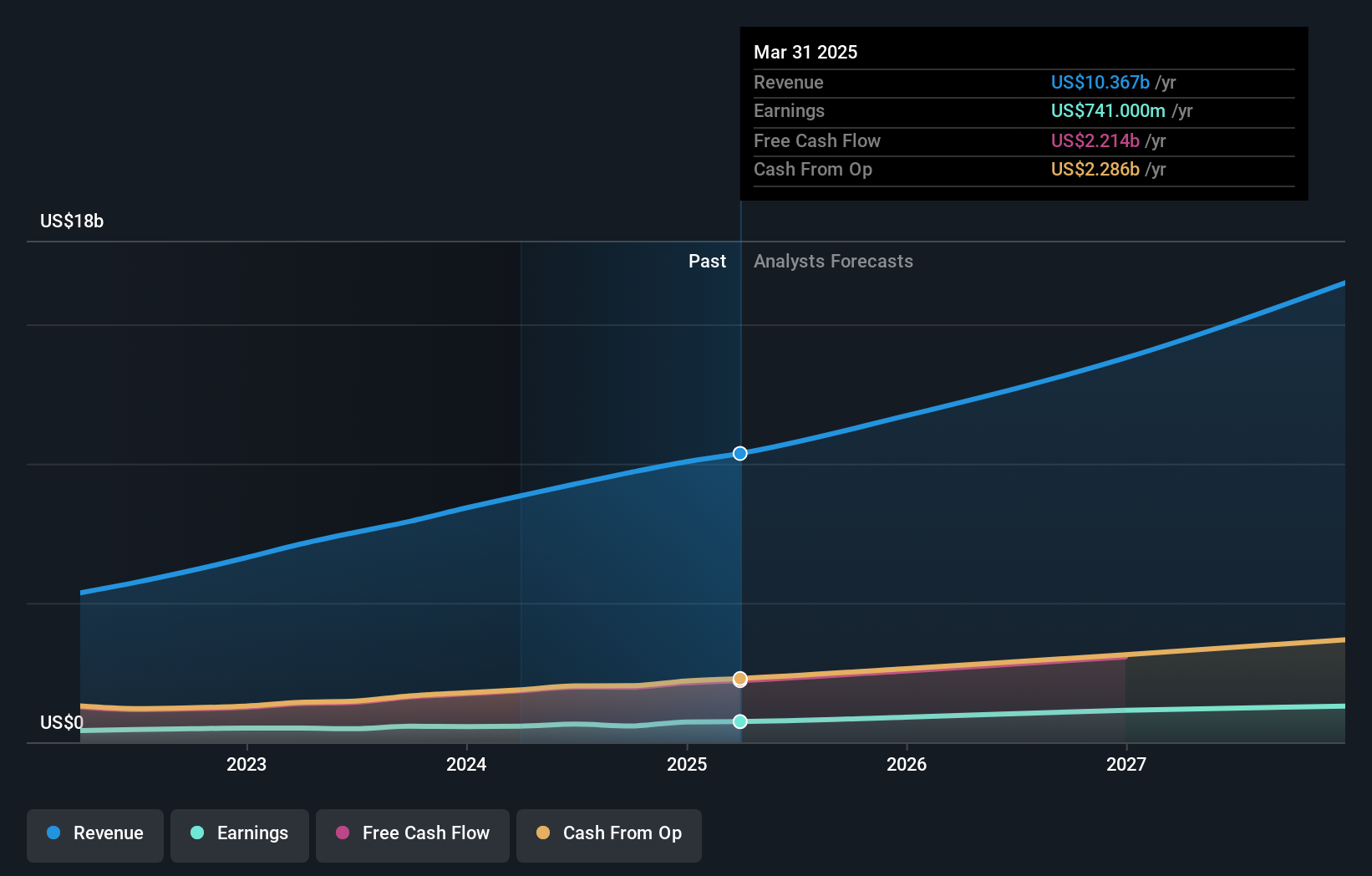

Overview: Constellation Software Inc., along with its subsidiaries, focuses on acquiring, building, and managing vertical market software businesses across Canada, the United States, Europe, and internationally, with a market capitalization of CA$93.90 billion.

Operations: With a market cap of CA$93.90 billion, Constellation Software Inc. generates revenue primarily from its Software & Programming segment, amounting to $9.27 billion. The company specializes in acquiring and managing vertical market software businesses globally.

Constellation Software's recent financial performance underscores its robust position in the tech sector, with a significant revenue increase to USD 2.47 billion and net income rising to USD 177 million in Q2 2024, reflecting year-over-year growths of 21% and 72%, respectively. This growth trajectory is complemented by a strong R&D focus, crucial for sustaining innovation and competitiveness; however, specific R&D spending figures remain undisclosed. Looking ahead, earnings are expected to surge by an impressive 23.6% annually over the next three years, outpacing the Canadian market's forecast of 15.7%. Despite these promising indicators, potential investors should note the company's high debt levels which could impact future financial flexibility.

- Click here and access our complete health analysis report to understand the dynamics of Constellation Software.

Assess Constellation Software's past performance with our detailed historical performance reports.

Docebo (TSX:DCBO)

Simply Wall St Growth Rating: ★★★★★☆

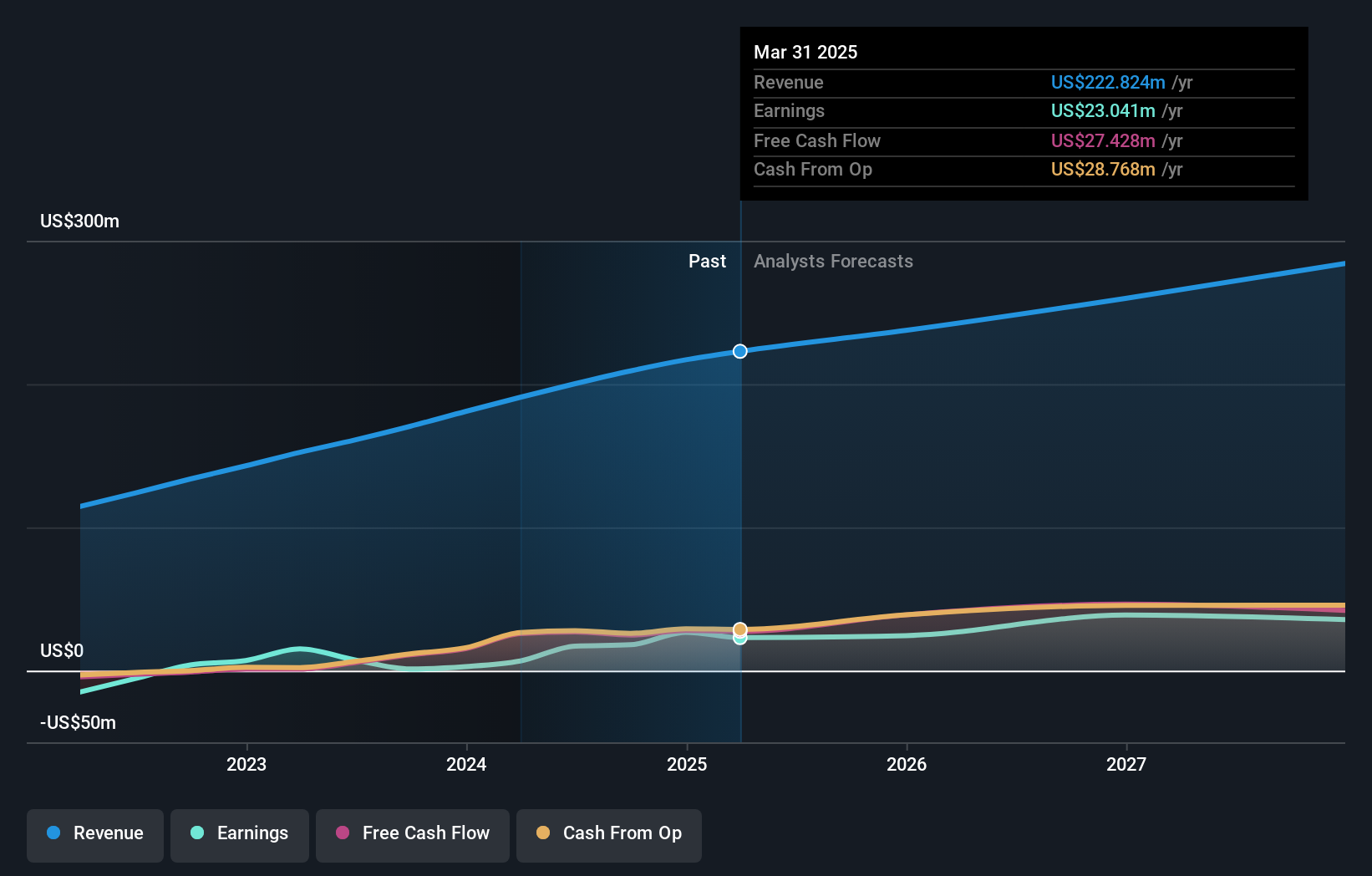

Overview: Docebo Inc. is a company that offers an AI-powered learning management software platform, serving clients in North America and internationally, with a market cap of CA$1.92 billion.

Operations: The company generates revenue primarily from its AI-powered educational software, with sales reaching $200.24 million.

Docebo's strategic alignment with cutting-edge AI initiatives, as showcased by its role in the TEDAI Vienna event, underscores its commitment to leveraging technology for educational advancement. This focus is mirrored in its financials; a robust 34% expected annual earnings growth outpaces the broader Canadian market forecast of 15.7%. Furthermore, with R&D expenses marking a significant part of their budget, Docebo not only champions innovation but also effectively translates it into substantial revenue growth, evidenced by a 14.5% yearly increase. This approach not only enhances their service offerings but also solidifies their position in the competitive tech landscape.

- Unlock comprehensive insights into our analysis of Docebo stock in this health report.

Understand Docebo's track record by examining our Past report.

HIVE Digital Technologies (TSXV:HIVE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HIVE Digital Technologies Ltd. is involved in the mining and sale of digital currencies across Canada, Sweden, and Iceland with a market capitalization of CA$621.20 million.

Operations: HIVE Digital Technologies Ltd. focuses on generating revenue through the mining and sale of digital currencies, reporting CA$123.14 million from this segment. The company operates in Canada, Sweden, and Iceland to leverage favorable conditions for cryptocurrency mining activities.

HIVE Digital Technologies, amidst a volatile market, is navigating through unprofitability with strategic maneuvers aimed at robust future growth. With an expected revenue surge of 49.3% per year, outpacing the Canadian market's 7.2%, and earnings projected to grow by an impressive 94% annually, HIVE is setting a brisk pace in the tech sector. Recent operational efficiencies, such as mining 112 Bitcoin in September and enhancing ASIC miners for the Bitcoin Halving event, underscore its proactive approach to challenges and opportunities within the digital asset sphere. This blend of high forecasted growth and strategic operational adjustments positions HIVE intriguingly for future prospects despite current profitability hurdles.

- Dive into the specifics of HIVE Digital Technologies here with our thorough health report.

Gain insights into HIVE Digital Technologies' past trends and performance with our Past report.

Make It Happen

- Take a closer look at our TSX High Growth Tech and AI Stocks list of 21 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses in Canada, the United States, Europe, and internationally.