Docebo (TSX:DCBO) Reports Q2 Revenue Increase But Decline In Net Income

Reviewed by Simply Wall St

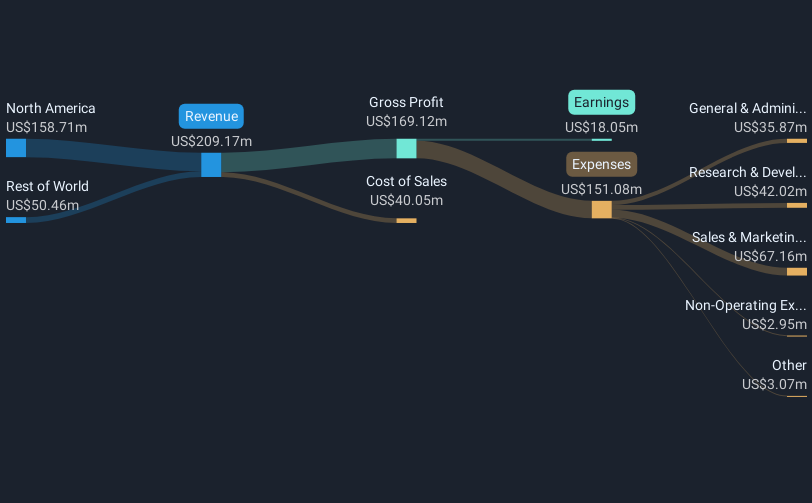

Docebo (TSX:DCBO) reported a quarterly sales increase to USD 60.73 million, a rise from last year's USD 53.05 million, while net income declined to USD 3.08 million. Despite the earnings drop, Docebo's share price rose 8%, likely buoyed by optimistic guidance for increasing subscription and total revenue. During the same period, broader market indexes, including the Nasdaq and S&P 500, recorded gains, reflecting overall investor confidence. The company also highlighted its FedRAMP Moderate Authorization for its platform, potentially adding weight to its price appreciation amidst the positive sentiment in the tech sector.

Buy, Hold or Sell Docebo? View our complete analysis and fair value estimate and you decide.

Docebo's quarterly sales increase to US$60.73 million, coupled with the FedRAMP Moderate Authorization, signals potential expansion into U.S. federal markets and enhances its market position. Despite a decline in net income to US$3.08 million, the company's recent optimistic revenue forecasts driven by AI-powered solutions may bolster future earnings. Analysts project Docebo's revenues will grow 9% annually, with earnings reaching US$47.6 million by 2028, reflecting confidence in the company's strategic direction.

Over the past three years, Docebo's total shareholder return, including dividends, was a 14.53% decline. In contrast, its recent price appreciation of 8% in the short term highlights a positive shift following the upbeat guidance and FedRAMP status announcement. Compared to the broader Canadian market's return of 21% and the software industry's 18% over the past year, Docebo underperformed, suggesting potential headwinds in maintaining competitive momentum.

The recent upward movement in Docebo's share price brings it closer to the analyst consensus price target of CA$49.63, which remains over 24% above the current share price of CA$40.00. The anticipated expansion into new markets and collaborations with integrators like Deloitte could drive sustained revenue and margin growth, aligning with the expected shift to an AI-first learning environment. These developments may influence the company's ability to meet or exceed forecasted metrics, although challenges such as fierce competition and changes within leadership could present obstacles.

Click to explore a detailed breakdown of our findings in Docebo's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DCBO

Docebo

Develops and provides a learning management platform for training in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives