What Constellation Software (TSX:CSU)’s Leadership Transition and European Acquisitions Mean for Shareholders

Reviewed by Sasha Jovanovic

- Constellation Software’s founder and longtime President, Mark Leonard, abruptly resigned for health reasons in September, and COO/CFO Mark Miller was promoted to President with an emphasis on uninterrupted strategic direction.

- Amid this sudden leadership shift, the company pressed forward with significant European acquisitions, reinforcing its commitment to an acquisition-driven business model and steady revenue streams.

- We’ll explore how leadership continuity and recent acquisitions combine to impact Constellation Software’s overall investment thesis.

We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Constellation Software's Investment Narrative?

For anyone considering Constellation Software as a long-term holding, it often comes down to confidence in the company’s disciplined acquisition machine, recurring high-margin revenues, and the ability of leadership to integrate new additions across global markets. The abrupt resignation of founder Mark Leonard this September brings short-term uncertainty, especially given his role in shaping the company’s identity. Mark Miller’s swift promotion and the company’s continued pace of acquisitions in Europe signal a strong intent to maintain business as usual. Analysts, prior to this change, had consensus price targets suggesting substantial potential upside, but recent share price declines highlight that leadership transitions can shake investor sentiment, at least temporarily. Execution risk is now in sharper focus as the balance between continuity and fresh leadership is tested, even if the core strategy remains intact. On the other hand, sudden leadership changes can introduce risk to even the most resilient business models.

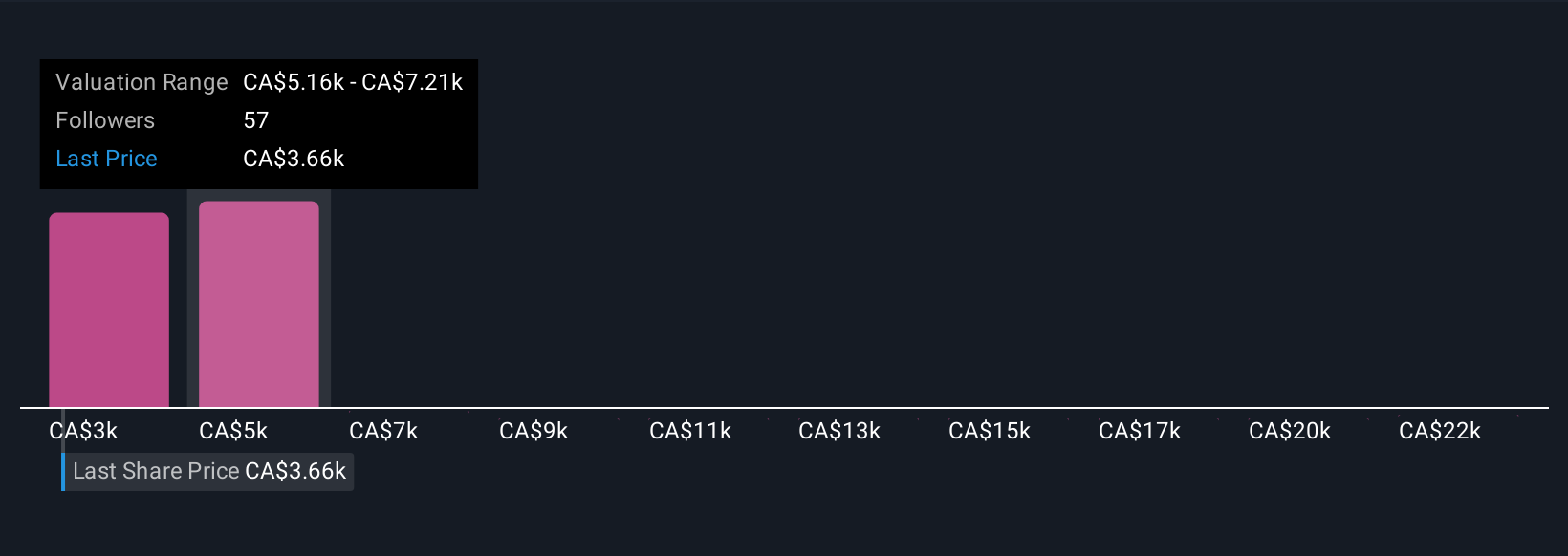

Despite retreating, Constellation Software's shares might still be trading 28% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 21 other fair value estimates on Constellation Software - why the stock might be worth just CA$3700!

Build Your Own Constellation Software Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellation Software research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Constellation Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellation Software's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses to develop mission-critical software solutions for public and private sector markets.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives