Is Constellation Software's (TSX:CSU) Leadership Transition Shaping Its Acquisition-Driven Growth Strategy?

Reviewed by Sasha Jovanovic

- Constellation Software Inc. recently presented at The Maxim Growth Summit 2025 in New York and announced an upcoming release of its third quarter results on November 7, 2025, while discontinuing traditional quarterly conference calls in favor of a new online Q&A platform for shareholders.

- This shift in communication comes amid leadership changes, including the resignation of Mark Leonard, and rising discussions about the impact of AI-native competitors on vertical market software companies.

- We’ll examine how leadership transition influences Constellation Software’s investment narrative in the context of the company’s ongoing acquisition-driven growth strategy.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Constellation Software's Investment Narrative?

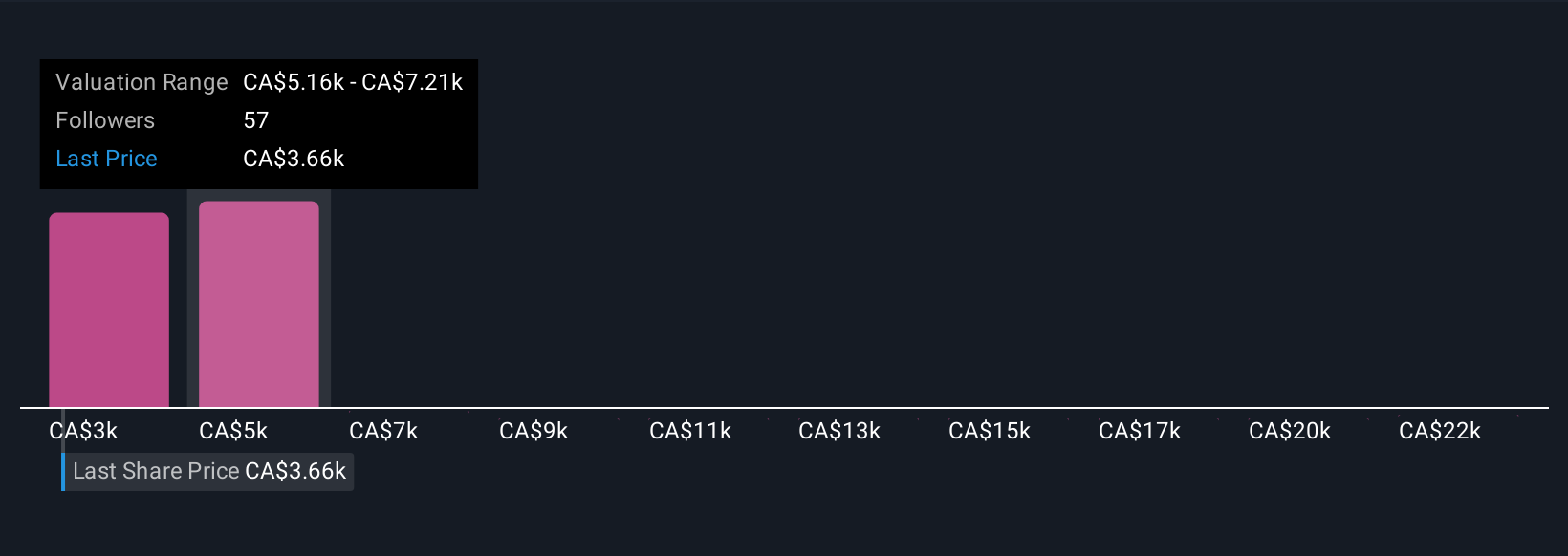

To be comfortable as a Constellation Software shareholder, you have to believe in the enduring strength of its acquisition-driven strategy and the company's resilience through leadership transitions. The recent resignation of longtime President Mark Leonard and the shift from traditional conference calls to an online Q&A platform are headline changes, but so far they don’t appear to fundamentally disrupt Constellation’s main catalysts, which include ongoing acquisitions, strong revenue growth, and robust analyst support. The most immediate risks remain: disruption from new AI-native competitors and questions about leadership continuity. The price has already fallen over 23% in three months and analysts’ fair value targets remain well above current levels, suggesting that the new information is not perceived as materially shifting the near-term risks or potential upside. Investors will be watching closely to see if the next earnings update and Q&A signal any unexpected shifts.

But investor focus isn’t only on leadership, there’s increasing attention on the threat of AI-native software entrants.

Exploring Other Perspectives

Explore 21 other fair value estimates on Constellation Software - why the stock might be worth over 2x more than the current price!

Build Your Own Constellation Software Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellation Software research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Constellation Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellation Software's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses to develop mission-critical software solutions for public and private sector markets.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives