- Lumine Group, a Constellation Software company, has completed its acquisition of Synchronoss Technologies, expanding its SaaS and personal cloud tools for telecom operators.

- Constellation HomeBuilder Systems has launched Stella AI, an AI agent built on proprietary real time industry data for homebuilders.

- These moves add to Constellation Software's mix of vertical market software offerings and broaden its reach in telecom and residential construction technology.

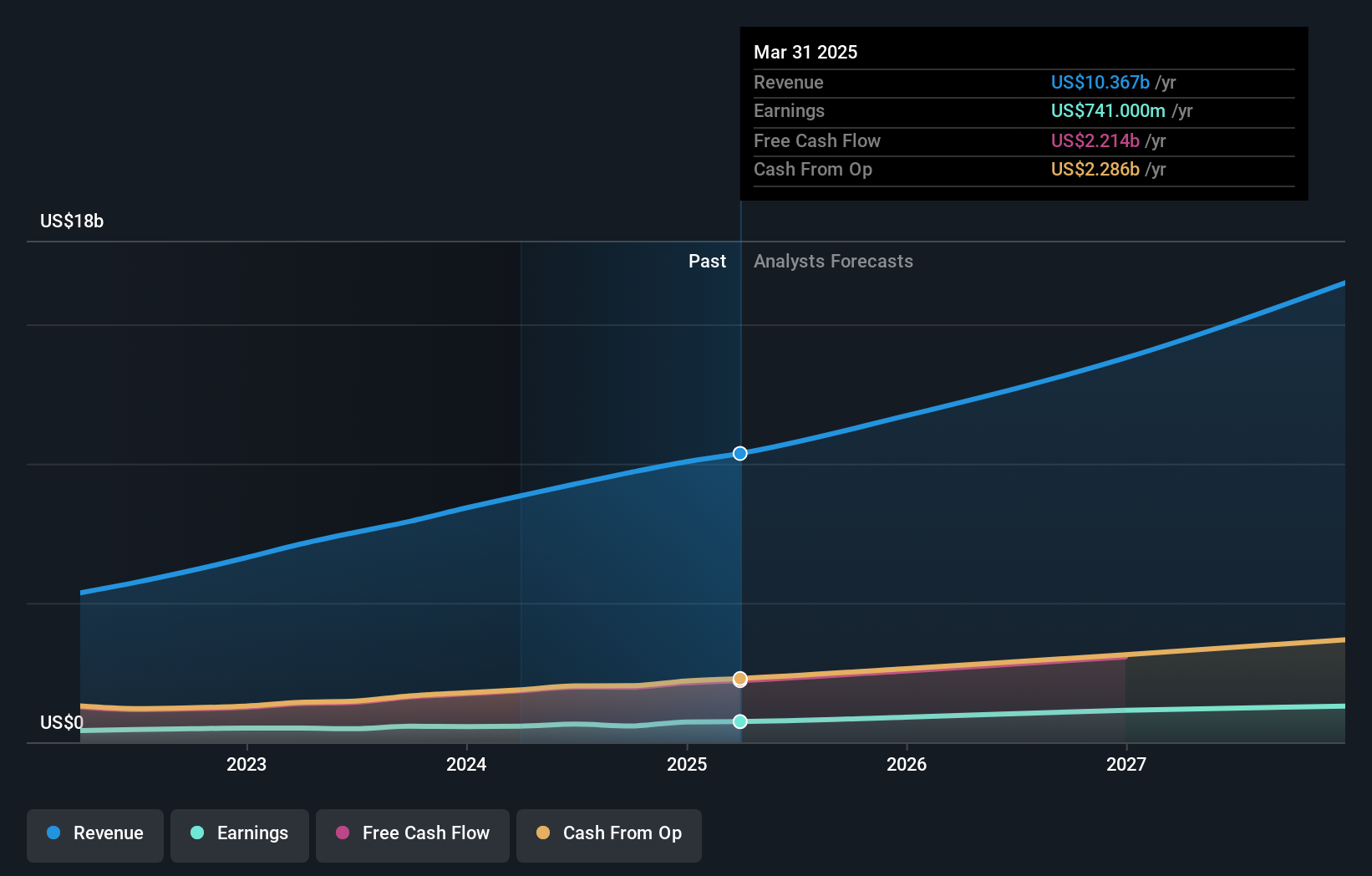

Constellation Software (TSX:CSU) continues to pursue its acquisition driven model, with Lumine Group adding Synchronoss Technologies to its telecom software portfolio. At a share price of CA$2,258.18, the stock has seen a 54.3% decline over the past year and a 30.3% decline year to date, which may influence how investors read these new developments.

Lumine's expanded cloud capabilities and the launch of Stella AI illustrate how Constellation is adding more specialized software and data tools across its verticals. Investors watching TSX:CSU may focus on how these new assets integrate into existing business units and what that could mean for the durability and diversity of revenue streams over time.

Stay updated on the most important news stories for Constellation Software by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Constellation Software.

4 things going right for Constellation Software that this headline doesn't cover.

Quick Assessment

- ✅ Price vs Analyst Target: At CA$2,258.18 versus a consensus target of CA$4,457.78, the price sits about 49% below analyst expectations.

- ✅ Simply Wall St Valuation: Shares are described as trading 57.6% below the estimated fair value.

- ❌ Recent Momentum: The 30 day return of a 20.6% decline shows recent weakness despite the product and M&A news.

To assess whether it may be the right time to buy, sell or hold Constellation Software, you can review Simply Wall St's company report for the latest analysis of Constellation Software's fair value.

Key Considerations

- 📊 The Synchronoss deal and Stella AI launch add more telecom and homebuilder software exposure, which could influence how you think about Constellation's sector mix and earnings drivers.

- 📊 Watch how SaaS and AI related revenues, margins and integration updates are discussed in future results and commentary.

- ⚠️ With 2 flagged minor risks including one related to debt levels, investors may want to weigh any further acquisitions against balance sheet flexibility.

Dig Deeper

For a broader view, including more detail on risks and potential rewards, you can explore the complete Constellation Software analysis. You can also visit the community page for Constellation Software to see how other investors believe this latest news may influence the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses to develop mission-critical software solutions for public and private sector markets.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

Figma is still deeply embedded as the default design system in big companies, and the ecosystem (Buzz, Slides, Sites, Make) is clearly the strategic play rather than a one‑off product bet. None of those qualitative assumptions have really broken yet, the bigger change has been sentiment toward growth/AI software in general, not Figma’s product reality. Assuming ~30% annual growth, margins stepping up to 25%, and a 40x PE in 2030 with an 8.4% discount rate is too optimistic now considering how the broader market is now pricing similar SaaS names, which means you can believe in the long term thesis and still accept that the stock might chop sideways or even drift lower while expectations and multiples reset. I will be sharing an update soon.