As global markets navigate a choppy start to the year, with small-cap stocks underperforming and inflation concerns causing volatility, investors are keeping a close eye on economic indicators such as the resilient U.S. labor market and Federal Reserve policy outlooks. In this environment, identifying high growth tech stocks involves looking for companies with strong fundamentals that can withstand market fluctuations and capitalize on sector-specific opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1227 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Ependion (OM:EPEN)

Simply Wall St Growth Rating: ★★★★☆☆

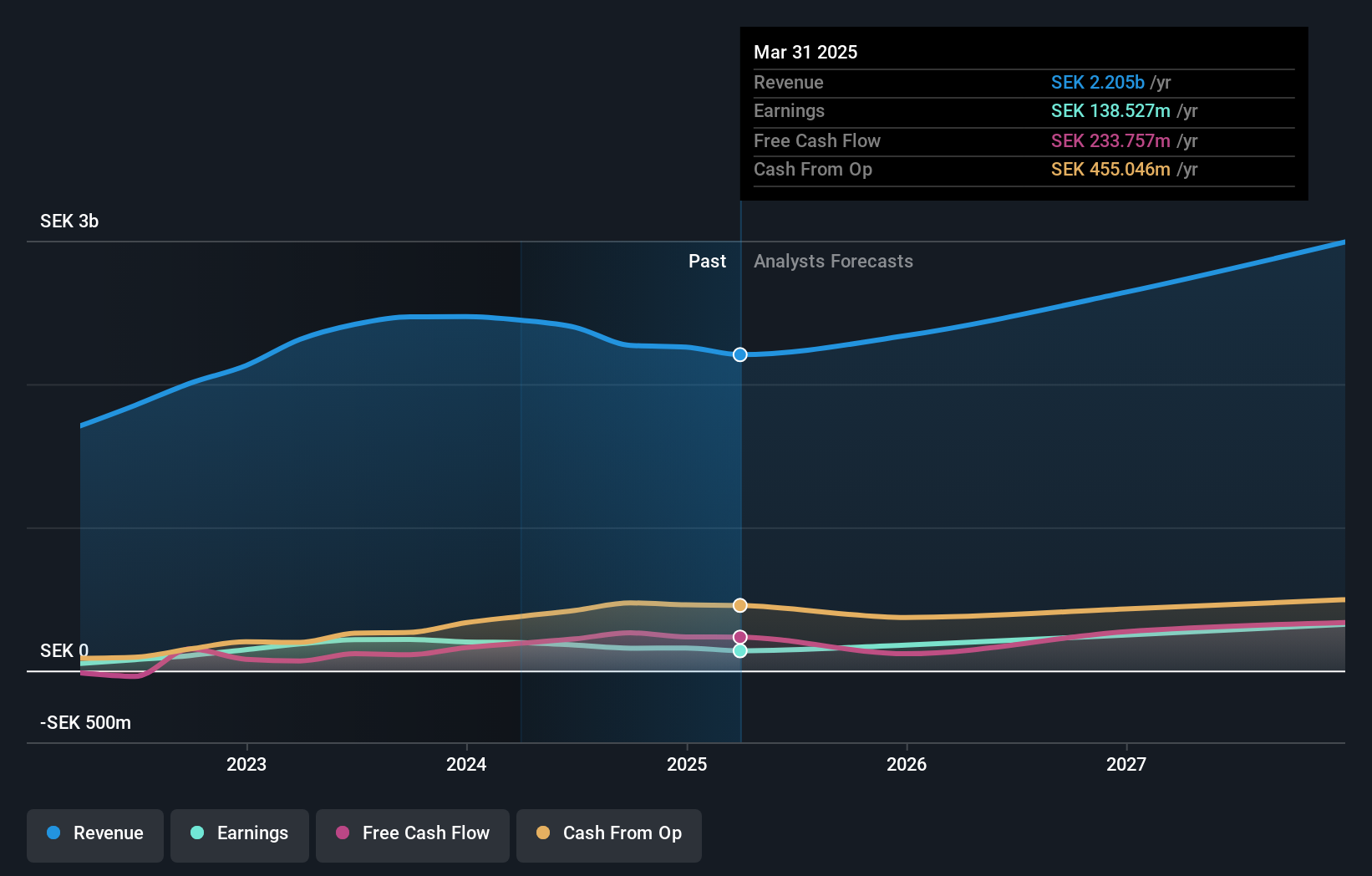

Overview: Ependion AB, with a market cap of SEK2.90 billion, offers digital solutions for secure control, management, visualization, and data communication tailored for industrial applications through its subsidiaries.

Operations: Ependion generates revenue primarily through its subsidiaries, Westermo and Beijer Electronics (including Korenix), with Westermo contributing SEK1.33 billion and Beijer Electronics SEK942.30 million.

Despite a challenging year with revenue and net income declines, Ependion AB remains poised for recovery, with anticipated annual earnings growth of 22.6%, significantly outpacing the Swedish market's average of 14.3%. This resilience is underscored by a robust R&D commitment, essential for maintaining competitiveness in the tech sector. At the recent investor forum, executive insights hinted at strategic shifts likely to bolster future performance. Moreover, Ependion's efforts to align its board composition with shareholder interests suggest a proactive governance approach that could enhance long-term value creation.

- Click here and access our complete health analysis report to understand the dynamics of Ependion.

Gain insights into Ependion's past trends and performance with our Past report.

Avant Group (TSE:3836)

Simply Wall St Growth Rating: ★★★★☆☆

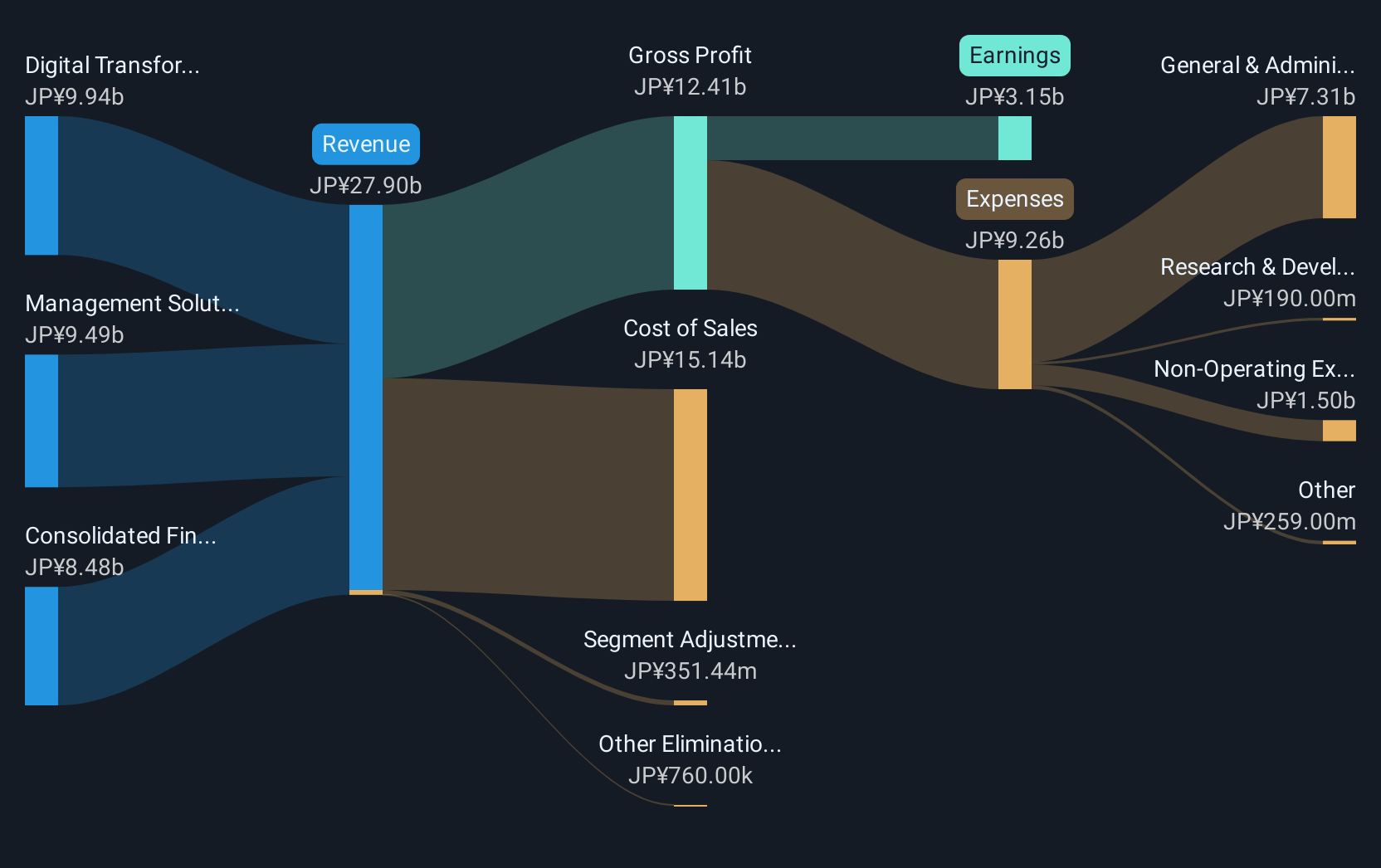

Overview: Avant Group Corporation, with a market cap of ¥68.28 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: Avant Group generates revenue primarily from its Management Solutions Business (¥8.96 billion), Digital Transformation Promotion Business (¥9.16 billion), and Group Governance Business (¥7.88 billion). The company focuses on providing specialized services in accounting, business intelligence, and outsourcing through these segments.

Avant Group, amid a competitive tech landscape, has demonstrated robust growth with an annual revenue increase of 15.8% and earnings expansion at 18.1% per year. Notably, the firm's commitment to innovation is evident from its R&D spending which stands at a significant 12% of its total revenue, aligning with industry leaders in software development and AI technologies. Recent strategic buybacks have seen Avant repurchase shares worth ¥828.93 million, enhancing shareholder value and reflecting confidence in their operational direction. This proactive approach in governance combined with high-profile clients like TSMC positions Avant well for sustained industry influence and potential market leadership.

- Take a closer look at Avant Group's potential here in our health report.

Understand Avant Group's track record by examining our Past report.

Computer Modelling Group (TSX:CMG)

Simply Wall St Growth Rating: ★★★★☆☆

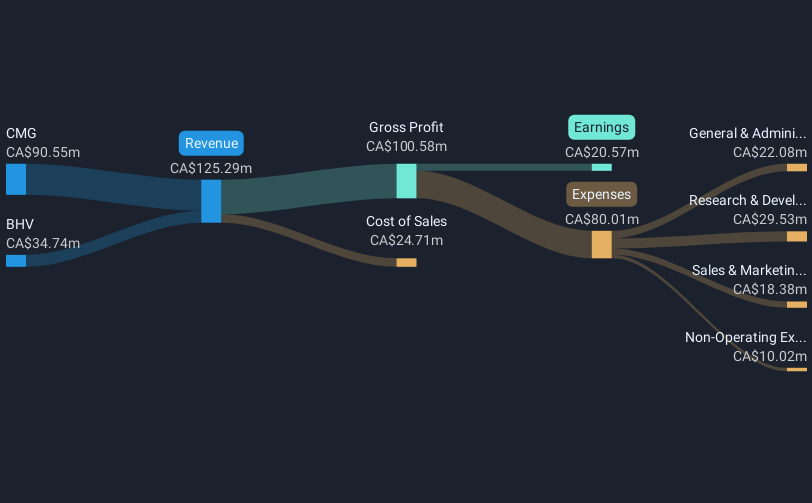

Overview: Computer Modelling Group Ltd. is a software and consulting technology company focused on developing and licensing reservoir simulation and seismic interpretation software, with a market cap of CA$845.50 million.

Operations: The company generates revenue primarily from its reservoir simulation and seismic interpretation software, with CA$90.55 million attributed to the CMG segment. Additionally, it earns CA$34.74 million from the BHV segment.

Computer Modelling Group (CMG) is navigating a transformative phase, with its recent collaboration with NVIDIA spotlighting its strategic pivot towards enhanced computational capabilities and energy efficiency. This partnership aims to refine CMG's simulation solutions, crucial for optimizing oil and gas production and advancing carbon capture storage technologies. Despite a challenging year with earnings growth contracting by 17.7%, CMG's forward-looking initiatives suggest a commitment to reclaiming growth momentum, underscored by an expected annual revenue increase of 12.8%. Moreover, the firm’s engagement in high-stakes energy transition projects could position it as a pivotal player in sustainable energy advancements.

- Unlock comprehensive insights into our analysis of Computer Modelling Group stock in this health report.

Evaluate Computer Modelling Group's historical performance by accessing our past performance report.

Key Takeaways

- Investigate our full lineup of 1227 High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3836

Avant Group

Through its subsidiaries, provides accounting, business intelligence, and outsourcing services in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion