A Fresh Look at Computer Modelling Group (TSX:CMG) Valuation Following Board and Chair Changes

Reviewed by Simply Wall St

When a company like Computer Modelling Group (TSX:CMG) refreshes its leadership, investors tend to perk up, and for good reason. The recent announcement that Anuroop Duggal and Andrew Pastor have joined the board, with Pastor stepping in as the new Chair, naturally invites new speculation about what comes next. These kinds of changes rarely pass unnoticed, as they can signal future strategy updates, risk recalibration, or even shifts in priorities that may affect how the market values the business moving forward.

This leadership transition lands at a time when Computer Modelling Group’s share price momentum has been subdued. Over the past year, shares have slid about 47%, capping off a challenging stretch that included an 11% dip over the past three months. Despite this, the longer arc shows the company’s ability to generate a positive return over three and five years, hinting at periods of renewed optimism. The blend of changing boardroom dynamics and evolving share price trends means investor sentiment could shift quickly on any hints of new direction.

So, are these boardroom changes an early cue for a potential turnaround, or is the market already pricing in all foreseeable growth for Computer Modelling Group?

Price-to-Earnings of 23.1x: Is it justified?

Based on the price-to-earnings ratio, Computer Modelling Group appears undervalued compared to the broader Software industry but slightly expensive compared to its fair ratio.

The price-to-earnings (P/E) multiple shows how much investors are willing to pay for each dollar of company earnings. It is widely used in the software sector as a quick gauge of value and growth expectations.

For Computer Modelling Group, the current P/E of 23.1 is well below the industry average of 65.2. This suggests the stock trades at a relative discount to peers. However, it is trading a little above its estimated fair P/E of 22.8, indicating the market may not be offering a deep bargain based on company-specific growth prospects.

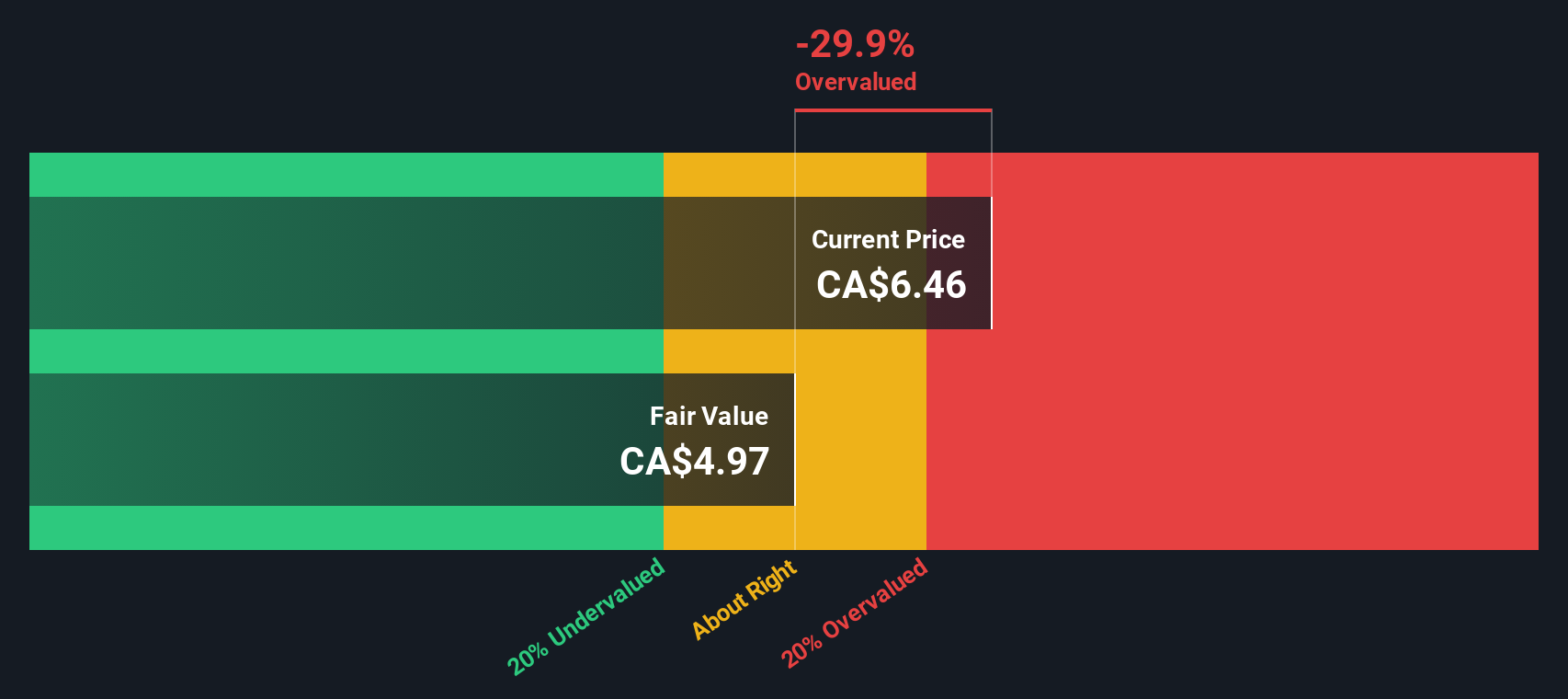

Result: Fair Value of $4.99 (OVERVALUED)

See our latest analysis for Computer Modelling Group.However, sluggish revenue growth and recent share price declines could undermine confidence if not countered by clear signs of operational turnaround.

Find out about the key risks to this Computer Modelling Group narrative.Another Perspective: What Does Our DCF Model Say?

Taking a different approach, the SWS DCF model suggests Computer Modelling Group may be overvalued. This offers a challenge to the view provided by market multiples. Which perspective better reflects reality for investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Computer Modelling Group Narrative

If you'd rather dive into the data yourself or you have your own perspective on Computer Modelling Group, you can build a narrative in just a few minutes using Do it your way.

A great starting point for your Computer Modelling Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Find your next opportunity by using the Simply Wall Street Screener. Don’t miss out while others move ahead. Take action now and expand your investing playbook with these tools:

- Uncover financial strength that lasts by zeroing in on companies offering dividend stocks with yields > 3% for consistent returns and peace of mind.

- Capitalize on breakthroughs in healthcare innovation by targeting healthcare AI stocks leading cutting-edge advances in medical technology and AI-driven treatments.

- Seize value opportunities others overlook by filtering for undervalued stocks based on cash flows with robust cash flows and overlooked growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CMG

Computer Modelling Group

A software and consulting technology company, engages in the development and licensing of reservoir simulation and seismic interpretation software and related services.

Excellent balance sheet and fair value.

Market Insights

Community Narratives