Imagine Owning UpSnap (CNSX:UP) And Trying To Stomach The 75% Share Price Drop

Even the best investor on earth makes unsuccessful investments. But it should be a priority to avoid stomach churning catastrophes, wherever possible. We wouldn't blame UpSnap, Inc. (CNSX:UP) shareholders if they were still in shock after the stock dropped like a lead balloon, down 75% in just one year. That'd be a striking reminder about the importance of diversification. To make matters worse, the returns over three years have also been really disappointing (the share price is 67% lower than three years ago).

Check out our latest analysis for UpSnap

UpSnap isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

UpSnap's revenue didn't grow at all in the last year. In fact, it fell 32%. That's not what investors generally want to see. The market obviously agrees, since the share price tanked 75%. Holders should not lose the lesson: loss making companies should grow revenue. But markets do over-react, so there opportunity for investors who are willing to take the time to dig deeper and understand the business.

This free interactive report on UpSnap's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

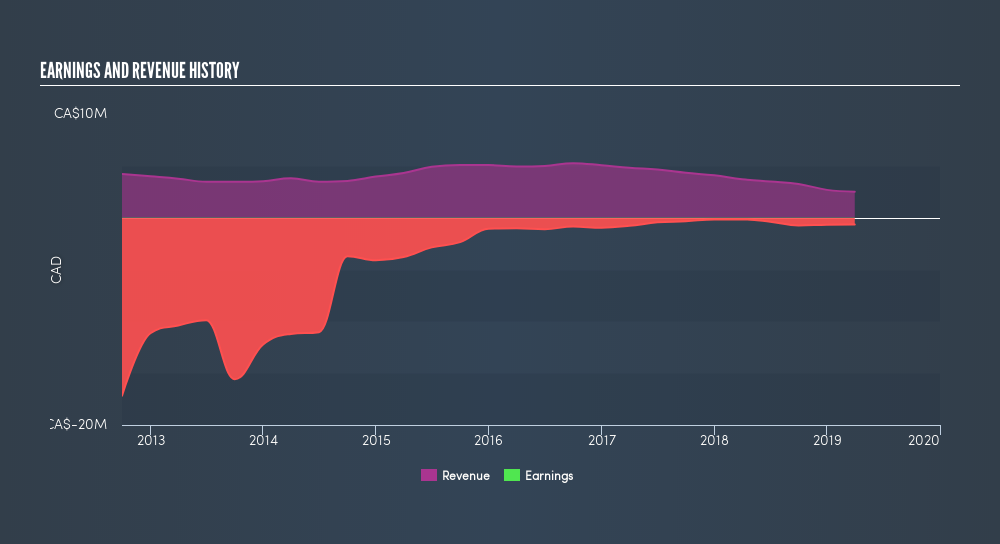

The last twelve months weren't great for UpSnap shares, which cost holders 75%, while the market was up about 1.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 31% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. You could get a better understanding of UpSnap's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About CNSX:UP

UpSnap

UpSnap, Inc. provides mobile advertising and direct mail solutions in the United States and internationally.

Slightly overvalued with weak fundamentals.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion