Here's Why Cloud Nine Web3 Technologies Inc.'s (CSE:CNI) CEO Compensation Is The Least Of Shareholders Concerns

Performance at Cloud Nine Web3 Technologies Inc. (CSE:CNI) has been rather uninspiring recently and shareholders may be wondering how CEO Al Larmour plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 14 September 2021. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. In our opinion, CEO compensation does not look excessive and we discuss why.

See our latest analysis for Cloud Nine Web3 Technologies

How Does Total Compensation For Al Larmour Compare With Other Companies In The Industry?

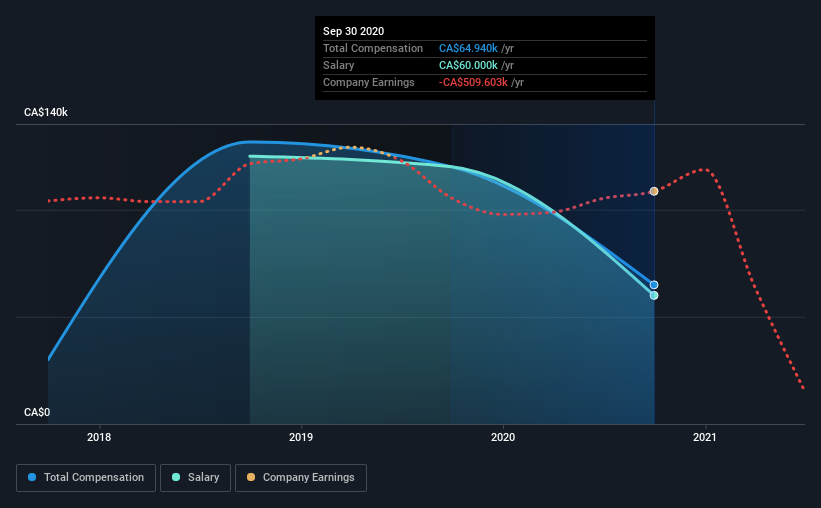

At the time of writing, our data shows that Cloud Nine Web3 Technologies Inc. has a market capitalization of CA$27m, and reported total annual CEO compensation of CA$65k for the year to September 2020. Notably, that's a decrease of 46% over the year before. We note that the salary portion, which stands at CA$60.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under CA$254m, the reported median total CEO compensation was CA$196k. Accordingly, Cloud Nine Web3 Technologies pays its CEO under the industry median. Moreover, Al Larmour also holds CA$233k worth of Cloud Nine Web3 Technologies stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Speaking on an industry level, nearly 79% of total compensation represents salary, while the remainder of 21% is other remuneration. It's interesting to note that Cloud Nine Web3 Technologies pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Cloud Nine Web3 Technologies Inc.'s Growth

Over the last three years, Cloud Nine Web3 Technologies Inc. has shrunk its earnings per share by 37% per year. It has seen most of its revenue evaporate over the past year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Cloud Nine Web3 Technologies Inc. Been A Good Investment?

We think that the total shareholder return of 134%, over three years, would leave most Cloud Nine Web3 Technologies Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean these strong returns may not continue. Shareholders might want to question the board about these concerns, and revisit their investment thesis for the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 6 warning signs (and 4 which make us uncomfortable) in Cloud Nine Web3 Technologies we think you should know about.

Important note: Cloud Nine Web3 Technologies is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:ANON

Anonymous Intelligence

Provides computational intelligence, decentralized network, and data technology services in Canada.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Beyond 2026, Beyond a Double

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion

Figma is still deeply embedded as the default design system in big companies, and the ecosystem (Buzz, Slides, Sites, Make) is clearly the strategic play rather than a one‑off product bet. None of those qualitative assumptions have really broken yet, the bigger change has been sentiment toward growth/AI software in general, not Figma’s product reality. Assuming ~30% annual growth, margins stepping up to 25%, and a 40x PE in 2030 with an 8.4% discount rate is too optimistic now considering how the broader market is now pricing similar SaaS names, which means you can believe in the long term thesis and still accept that the stock might chop sideways or even drift lower while expectations and multiples reset. I will be sharing an update soon.

CEO comp looks high on the surface, but context matters. Cognyte is approaching profitability — losses narrowed 23% YoY and they’re now guiding positive adjusted EBITDA of $47M for FY26. Revenue is growing 12-14% annually with a debt-free balance sheet. The board is compensating for execution on a turnaround, not rewarding stagnation. If they hit their $500M revenue / 20%+ EBITDA margin target by FY28, today’s comp will look like a bargain in hindsight. Imagine if everyone that has invested in Tesla 10 years ago had the same mentality...