- Canada

- /

- Semiconductors

- /

- TSXV:PTK

Shareholders May Be More Conservative With POET Technologies Inc.'s (CVE:PTK) CEO Compensation For Now

The share price of POET Technologies Inc. (CVE:PTK) has been growing in the past few years, however, the per-share earnings growth has been lacking, suggesting something is amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 14 October 2022. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

View our latest analysis for POET Technologies

How Does Total Compensation For Suresh Venkatesan Compare With Other Companies In The Industry?

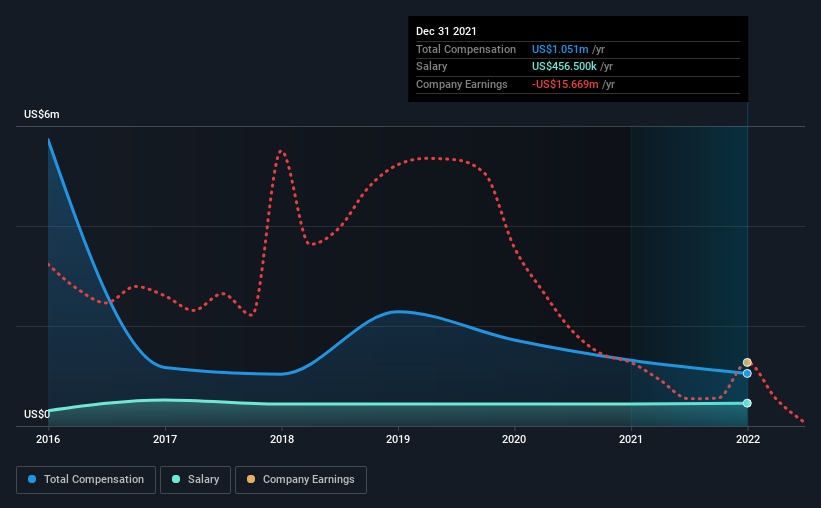

At the time of writing, our data shows that POET Technologies Inc. has a market capitalization of CA$147m, and reported total annual CEO compensation of US$1.1m for the year to December 2021. That's a notable decrease of 20% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$457k.

In comparison with other companies in the industry with market capitalizations under CA$274m, the reported median total CEO compensation was US$679k. This suggests that Suresh Venkatesan is paid more than the median for the industry. Moreover, Suresh Venkatesan also holds CA$190k worth of POET Technologies stock directly under their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | US$457k | US$440k | 43% |

| Other | US$594k | US$876k | 57% |

| Total Compensation | US$1.1m | US$1.3m | 100% |

Talking in terms of the industry, salary represented approximately 12% of total compensation out of all the companies we analyzed, while other remuneration made up 88% of the pie. It's interesting to note that POET Technologies pays out a greater portion of remuneration through salary, compared to the industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

POET Technologies Inc.'s Growth

POET Technologies Inc. has reduced its earnings per share by 12% a year over the last three years. It saw its revenue drop 42% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has POET Technologies Inc. Been A Good Investment?

POET Technologies Inc. has generated a total shareholder return of 16% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

While it's true that shareholders have owned decent returns, it's hard to overlook the lack of earnings growth and this makes us question whether these returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 5 warning signs (and 3 which can't be ignored) in POET Technologies we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:PTK

POET Technologies

Designs, develops, manufactures, and sells semiconductor products and services for commercial applications in the United States, Canada, Singapore, and China.

Flawless balance sheet with low risk.

Market Insights

Community Narratives