- Canada

- /

- Metals and Mining

- /

- TSXV:RCK

Discover BuildDirect.com Technologies And 2 Other Promising Penny Stocks On The TSX

Reviewed by Simply Wall St

As the Canadian market navigates a landscape marked by trade developments, central bank meetings, and fiscal debates, investors are keenly observing opportunities that may arise amidst potential volatility. Despite their vintage connotation, penny stocks continue to offer intriguing prospects for those interested in smaller or newer companies. In this article, we explore three promising penny stocks on the TSX that exhibit strong financial foundations and potential for growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.66 | CA$603.79M | ✅ 3 ⚠️ 3 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.29 | CA$691.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.51 | CA$190.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.73 | CA$485.67M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.93 | CA$17.24M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.35 | CA$98.18M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.20 | CA$132.66M | ✅ 3 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$177.31M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.95 | CA$5.42M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 878 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

BuildDirect.com Technologies (TSXV:BILD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BuildDirect.com Technologies Inc. operates an online marketplace for buying and selling building materials across the United States, Canada, and internationally, with a market cap of CA$50.90 million.

Operations: The company's revenue is divided into two main segments: BuildDirect, generating $15.59 million, and Pro Centers, contributing $49.38 million.

Market Cap: CA$50.9M

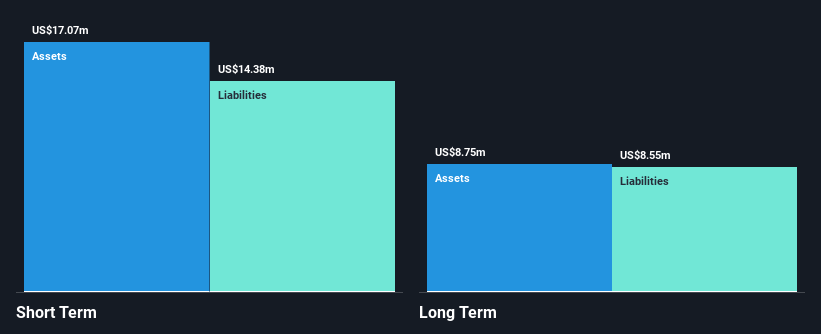

BuildDirect.com Technologies Inc., with a market cap of CA$50.90 million, operates in a challenging environment as it remains unprofitable despite reducing losses by 32.1% annually over five years. The company's short-term assets exceed both its long and short-term liabilities, indicating some financial stability, but it faces high net debt to equity levels at 369%. Recent earnings show a decline in sales to US$15.09 million for Q1 2025 compared to the previous year. A new supply agreement worth up to US$2 million signals potential growth opportunities, although auditor concerns about its going concern status persist.

- Jump into the full analysis health report here for a deeper understanding of BuildDirect.com Technologies.

- Examine BuildDirect.com Technologies' past performance report to understand how it has performed in prior years.

Rock Tech Lithium (TSXV:RCK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Rock Tech Lithium Inc. is involved in the exploration and development of lithium properties, with a market cap of CA$104.85 million.

Operations: There are no reported revenue segments for the company.

Market Cap: CA$104.85M

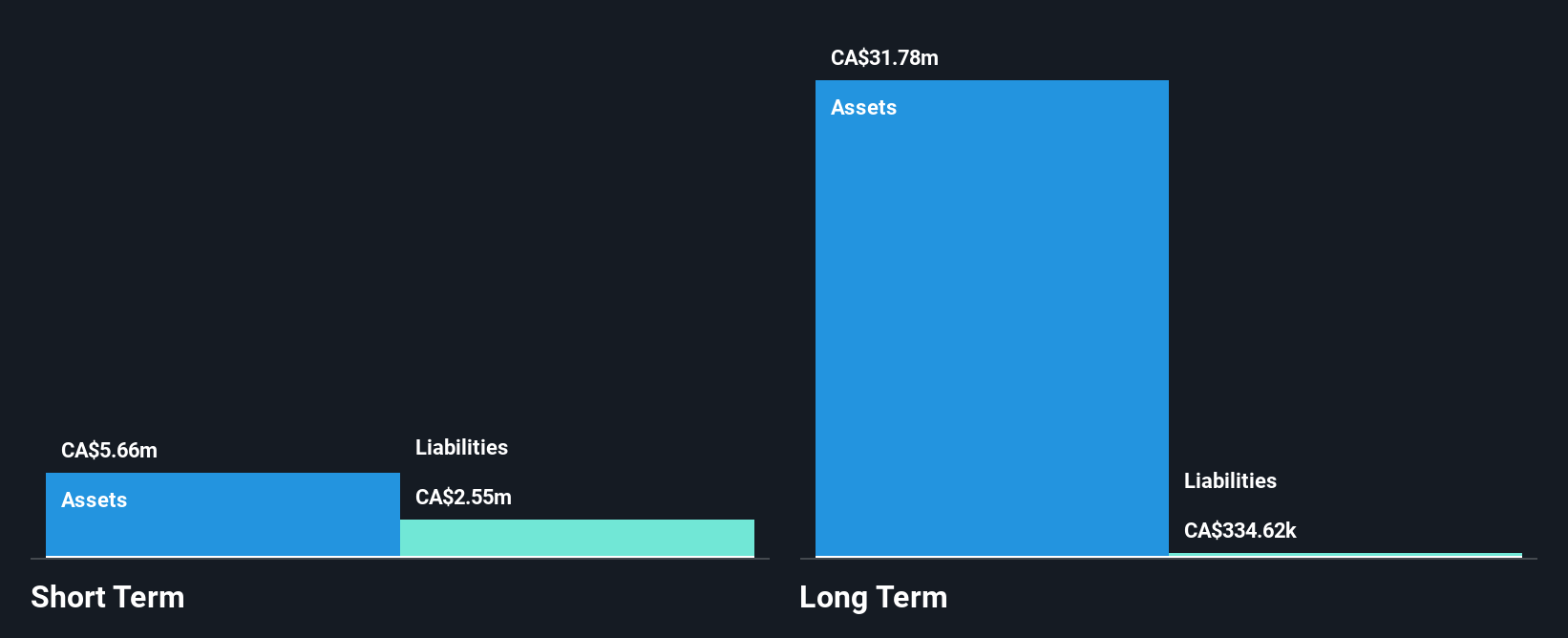

Rock Tech Lithium Inc., with a market cap of CA$104.85 million, is pre-revenue and faces challenges typical of early-stage mining ventures. Recent executive changes, including the appointment of Mirco Wojnarowicz as CEO and Christopher Wright as CFO, aim to strengthen its strategic direction toward becoming a key lithium supplier for European and North American markets. Despite being debt-free and having short-term assets exceeding liabilities, the company has less than a year's cash runway. Its recent private placements raised CA$4 million, which may provide some financial cushion amid ongoing operational losses.

- Navigate through the intricacies of Rock Tech Lithium with our comprehensive balance sheet health report here.

- Examine Rock Tech Lithium's earnings growth report to understand how analysts expect it to perform.

Vertex Resource Group (TSXV:VTX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vertex Resource Group Ltd. offers environmental and industrial services in Canada and the United States, with a market cap of CA$33.61 million.

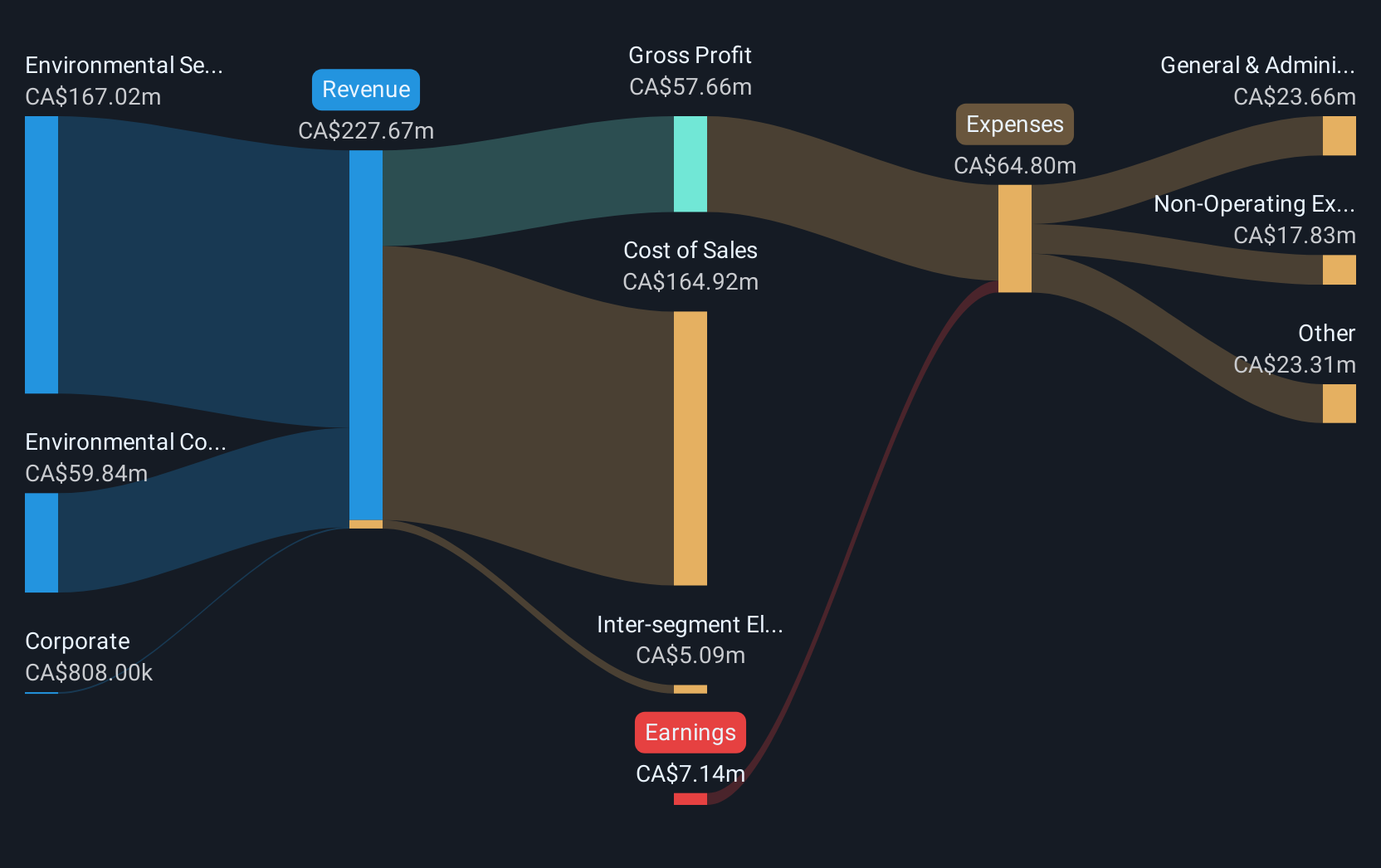

Operations: The company generates revenue primarily from Environmental Services (CA$167.02 million) and Environmental Consulting (CA$59.84 million).

Market Cap: CA$33.61M

Vertex Resource Group Ltd., with a market cap of CA$33.61 million, operates in the environmental services sector. Despite being unprofitable, the company has managed to reduce its losses over the past five years and maintains a positive cash flow, ensuring a cash runway exceeding three years. Recent earnings reports indicate declining revenues and increasing net losses compared to previous periods, reflecting ongoing financial challenges. The company's high debt-to-equity ratio remains a concern; however, its short-term assets cover immediate liabilities. Vertex's stock experiences high volatility but trades at good value relative to industry peers.

- Click here and access our complete financial health analysis report to understand the dynamics of Vertex Resource Group.

- Explore Vertex Resource Group's analyst forecasts in our growth report.

Taking Advantage

- Jump into our full catalog of 878 TSX Penny Stocks here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RCK

Rock Tech Lithium

Engages in the exploration and development of lithium properties.

Moderate with adequate balance sheet.

Market Insights

Community Narratives