- Canada

- /

- Specialty Stores

- /

- TSXV:RET.A

Did Changing Sentiment Drive Reitmans (Canada)'s (TSE:RET.A) Share Price Down A Worrying 51%?

While it may not be enough for some shareholders, we think it is good to see the Reitmans (Canada) Limited (TSE:RET.A) share price up 28% in a single quarter. But over the last half decade, the stock has not performed well. In fact, the share price is down 51%, which falls well short of the return you could get by buying an index fund.

Check out our latest analysis for Reitmans (Canada)

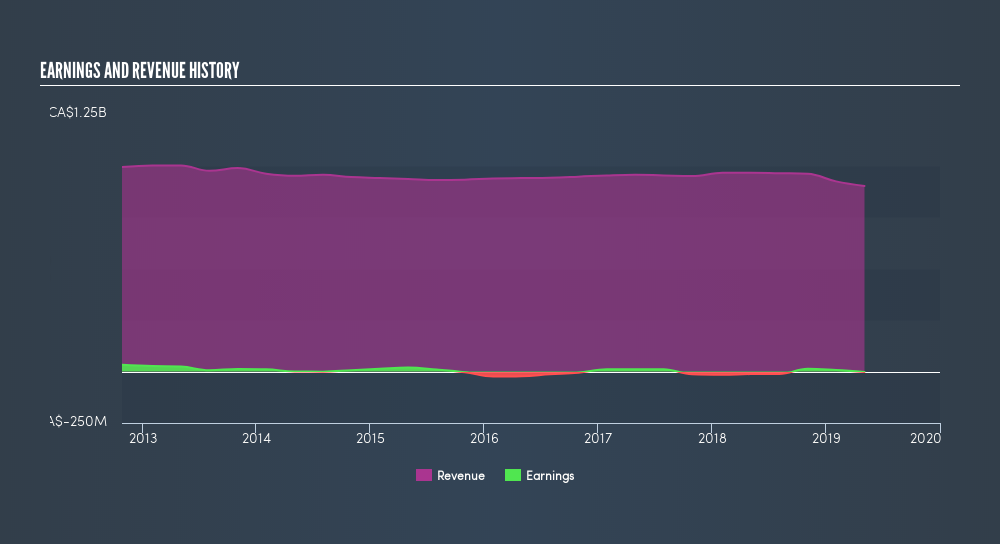

Because Reitmans (Canada) is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Reitmans (Canada) grew its revenue at 0.01% per year. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 13% for the last five years. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Reitmans (Canada). However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

This free interactive report on Reitmans (Canada)'s balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Reitmans (Canada)'s TSR for the last 5 years was -39%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 0.5% in the last year, Reitmans (Canada) shareholders lost 29% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9.3% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Keeping this in mind, a solid next step might be to take a look at Reitmans (Canada)'s dividend track record. This free interactive graph is a great place to start.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:RET.A

Reitmans (Canada)

Primarily engages in the retail sale of women’s specialty apparel in Canada under the Reitmans, Penningtons, and RW&CO brand names.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives