- Canada

- /

- Specialty Stores

- /

- TSX:KITS

What You Can Learn From Kits Eyecare Ltd.'s (TSE:KITS) P/S After Its 26% Share Price Crash

Kits Eyecare Ltd. (TSE:KITS) shares have had a horrible month, losing 26% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 32%, which is great even in a bull market.

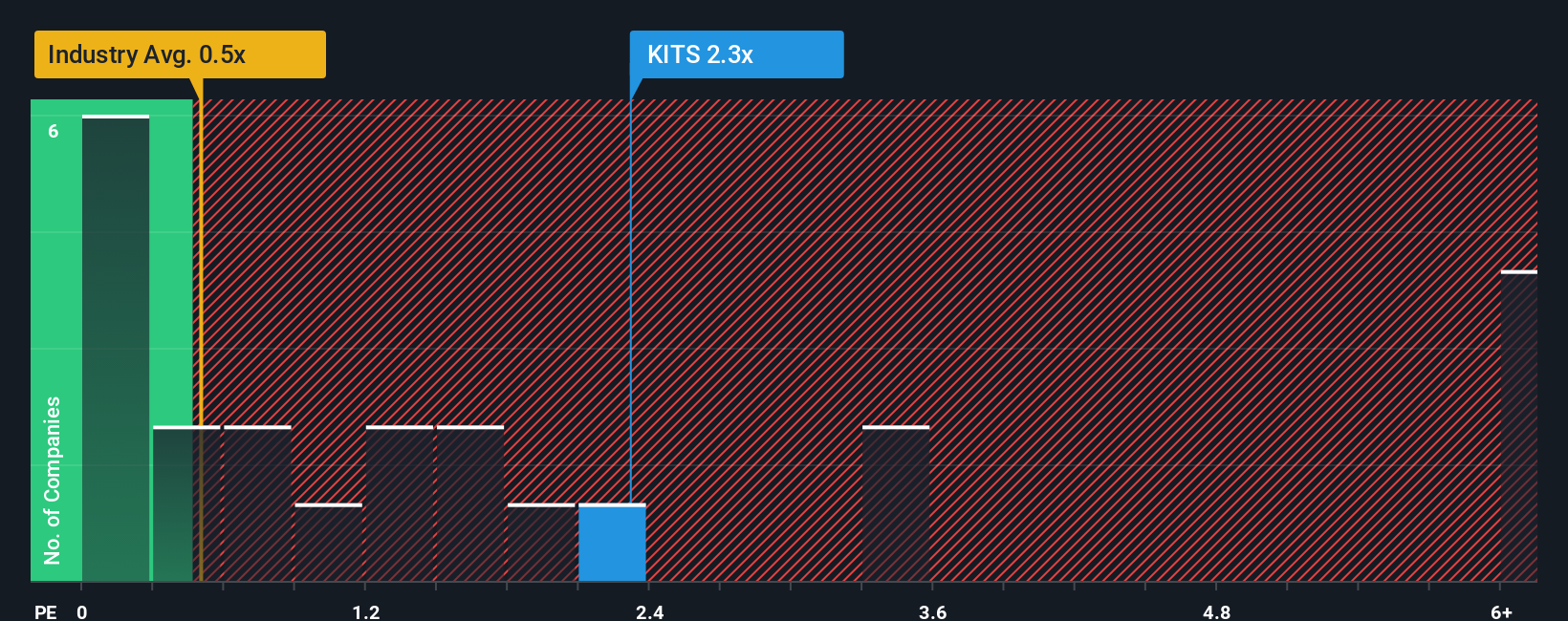

Although its price has dipped substantially, you could still be forgiven for thinking Kits Eyecare is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.3x, considering almost half the companies in Canada's Specialty Retail industry have P/S ratios below 1.5x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Kits Eyecare

How Kits Eyecare Has Been Performing

Kits Eyecare certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kits Eyecare.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Kits Eyecare's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 123% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 23% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 15%, which is noticeably less attractive.

In light of this, it's understandable that Kits Eyecare's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Kits Eyecare's P/S

Kits Eyecare's P/S remain high even after its stock plunged. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Kits Eyecare shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Kits Eyecare with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kits Eyecare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:KITS

Kits Eyecare

Operates a digital eyecare platform in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion