- Canada

- /

- Specialty Stores

- /

- TSX:GRGD

Undervalued Small Caps With Insider Action In Global June 2025

Reviewed by Simply Wall St

In June 2025, the global markets have been marked by a cooling U.S. labor market and rising small-cap stocks, with the Russell 2000 Index gaining momentum despite ongoing trade tensions between the U.S. and China. As investors navigate these conditions, identifying small-cap companies that demonstrate resilience through insider actions can offer valuable insights into potential opportunities amidst broader market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 12.0x | 0.5x | 33.67% | ★★★★★☆ |

| Lion Rock Group | 5.0x | 0.4x | 49.86% | ★★★★☆☆ |

| Tristel | 29.5x | 4.2x | 8.08% | ★★★★☆☆ |

| Nexus Industrial REIT | 6.6x | 2.9x | 19.59% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 38.43% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.6x | 39.28% | ★★★★☆☆ |

| Absolent Air Care Group | 22.2x | 1.8x | 49.51% | ★★★☆☆☆ |

| Fuller Smith & Turner | 12.0x | 0.9x | -55.70% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.8x | 1.9x | 8.36% | ★★★☆☆☆ |

| AInnovation Technology Group | NA | 2.4x | 46.86% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Abbisko Cayman (SEHK:2256)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Abbisko Cayman is a biopharmaceutical company focused on the development of innovative medicines, with a market capitalization of approximately CN¥1.50 billion.

Operations: The company's revenue is primarily derived from the development of innovative medicines, with recent figures reaching CN¥503.99 million. Despite consistent gross profit margins of 1.00%, the net income margin has shown significant improvement, moving from negative values to a positive 0.06% by the end of 2024. Operating expenses are substantial, driven mainly by R&D costs which were CN¥451.38 million at the end of 2024, alongside general and administrative expenses amounting to CN¥74.21 million in the same period.

PE: 207.0x

Abbisko Cayman, a dynamic player in the pharmaceutical industry, is making waves with its innovative drug developments. The recent acceptance of their New Drug Application for pimicotinib by China's NMPA highlights potential growth avenues. Insider confidence is evident as stakeholders have shown commitment through share purchases over the past year. Despite a volatile share price and reliance on external borrowing, Abbisko's strategic partnership with Merck for global commercialization rights underscores its promising prospects in targeted therapies.

- Unlock comprehensive insights into our analysis of Abbisko Cayman stock in this valuation report.

Review our historical performance report to gain insights into Abbisko Cayman's's past performance.

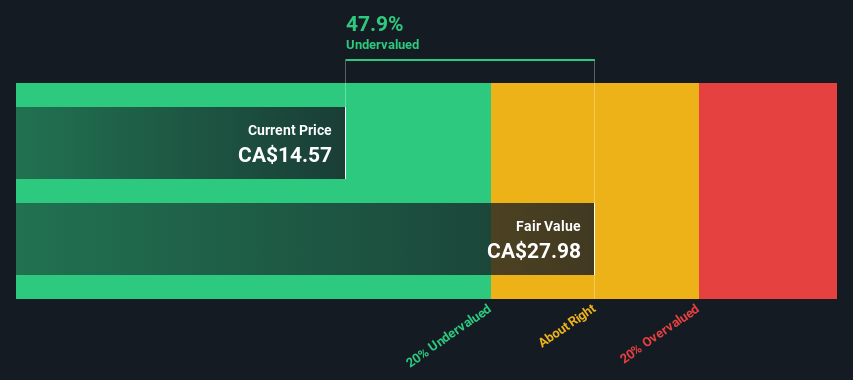

Groupe Dynamite (TSX:GRGD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Groupe Dynamite is a Canadian fashion retailer specializing in apparel, with operations generating CA$958.53 million in revenue.

Operations: Groupe Dynamite's primary revenue stream is from apparel, with recent figures showing CA$958.53 million. The company experienced a gross profit margin of 62.76% as of February 2025, reflecting its ability to manage production costs effectively relative to revenue. Operating expenses have been increasing, with general and administrative expenses reaching CA$313.16 million in the same period, impacting overall profitability metrics such as net income margin which was at 14.16%.

PE: 13.2x

Groupe Dynamite, a small company, has demonstrated potential for growth with recent earnings revealing a significant increase in sales to C$958.53 million for the year ending February 2025. Net income also rose to C$135.77 million from C$85.82 million the previous year, indicating improved profitability. Insider confidence is evident as Chris Arsenault acquired 32,000 shares valued at approximately C$438,910 on April 15, 2025. The company plans to repurchase up to 8.45% of its shares by April 2026, potentially enhancing shareholder value further.

- Dive into the specifics of Groupe Dynamite here with our thorough valuation report.

Examine Groupe Dynamite's past performance report to understand how it has performed in the past.

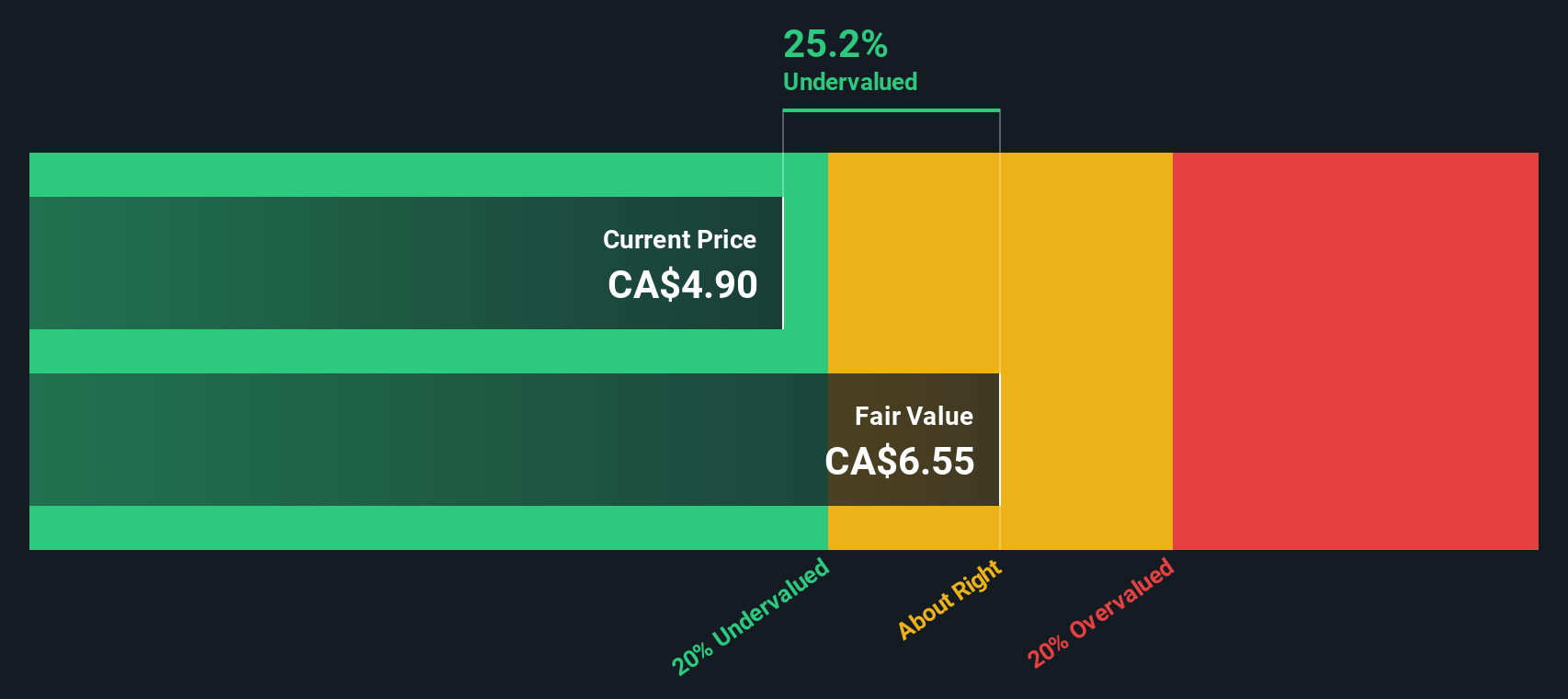

Tamarack Valley Energy (TSX:TVE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tamarack Valley Energy is a Canadian oil and gas company focused on exploration and production, with a market cap of approximately CA$1.95 billion.

Operations: The company generates revenue primarily from its oil and gas exploration and production activities, reporting CA$1.44 billion in the most recent period. Over time, the gross profit margin has shown fluctuations, reaching 79.98% recently, reflecting changes in cost of goods sold relative to revenue. Operating expenses have varied significantly, impacting net income margins which have also experienced considerable variation across periods.

PE: 9.1x

Tamarack Valley Energy, a smaller energy player, recently faced a CAD 25,500 penalty from the Alberta Energy Regulator for reporting lapses. Despite this, they reported strong Q1 2025 results with CAD 332 million in revenue and net income of CAD 64 million. President Brian Schmidt's purchase of 415,500 shares for over CAD 1.45 million signals insider confidence. The company repurchased significant shares worth CAD 145 million since January 2024. However, earnings are projected to decline by an average of nearly one-third annually over the next three years due to reliance on external borrowing for funding.

Seize The Opportunity

- Dive into all 174 of the Undervalued Global Small Caps With Insider Buying we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GRGD

Groupe Dynamite

Designs, distributes, and sells women’s apparel under the Dynamite and Garage brand names in Canada and the United States.

Outstanding track record with reasonable growth potential.

Market Insights

Community Narratives