- Canada

- /

- Specialty Stores

- /

- TSX:GRGD

TSX Value Picks: Endeavour Mining And 2 More Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of moderating services inflation and an unemployment rate hovering around 6.9%, investors are keenly observing how these economic conditions might influence stock valuations. In such an environment, identifying stocks that are trading below their intrinsic value can be a prudent strategy, as these picks may offer potential opportunities for growth despite broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| West Fraser Timber (TSX:WFG) | CA$96.21 | CA$163.54 | 41.2% |

| TerraVest Industries (TSX:TVK) | CA$167.03 | CA$319.78 | 47.8% |

| OceanaGold (TSX:OGC) | CA$18.91 | CA$33.24 | 43.1% |

| Magellan Aerospace (TSX:MAL) | CA$17.22 | CA$26.90 | 36% |

| K92 Mining (TSX:KNT) | CA$14.37 | CA$21.87 | 34.3% |

| Ivanhoe Mines (TSX:IVN) | CA$10.65 | CA$19.35 | 45% |

| Groupe Dynamite (TSX:GRGD) | CA$33.96 | CA$67.49 | 49.7% |

| Exchange Income (TSX:EIF) | CA$65.99 | CA$100.43 | 34.3% |

| Endeavour Mining (TSX:EDV) | CA$42.21 | CA$82.48 | 48.8% |

| Blackline Safety (TSX:BLN) | CA$6.25 | CA$9.92 | 37% |

We're going to check out a few of the best picks from our screener tool.

Endeavour Mining (TSX:EDV)

Overview: Endeavour Mining plc, along with its subsidiaries, is a multi-asset gold producer operating in West Africa with a market capitalization of CA$10.21 billion.

Operations: The company generates revenue from several mines in West Africa, including $969.60 million from the Ity Mine, $460.30 million from the Mana Mine, $980.10 million from the Houndé Mine, and $736.80 million from the Sabodala Massawa Mine.

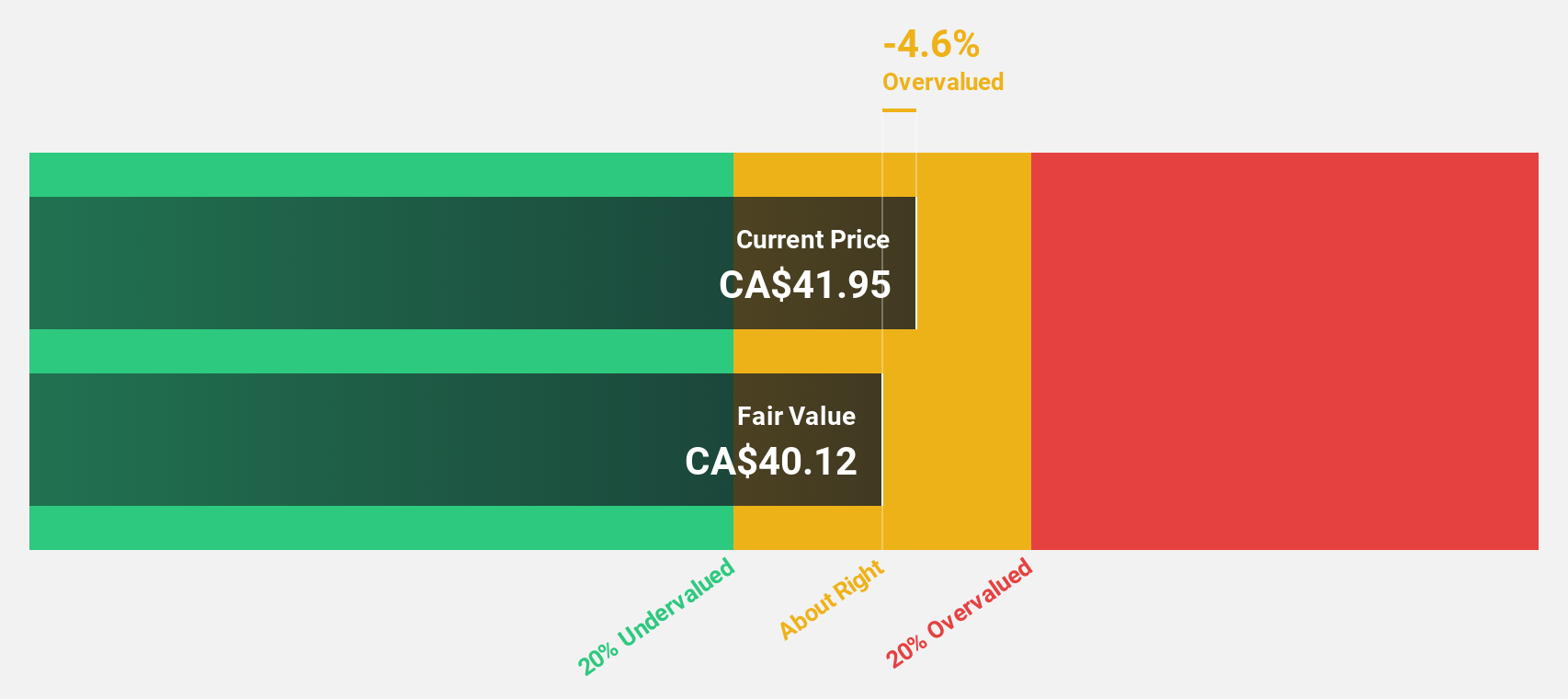

Estimated Discount To Fair Value: 48.8%

Endeavour Mining is trading at CA$42.21, significantly below its estimated fair value of CA$82.48, suggesting it may be undervalued based on cash flows. Despite a forecasted revenue decline, earnings are expected to grow significantly over the next three years at 22.4% annually, outpacing the Canadian market's growth rate of 11.3%. Recent financial performance shows robust profitability with net income reaching US$270.9 million in Q2 2025 compared to a loss last year, supporting its potential for strong cash flow generation despite challenges like increased power costs impacting AISC.

- The analysis detailed in our Endeavour Mining growth report hints at robust future financial performance.

- Navigate through the intricacies of Endeavour Mining with our comprehensive financial health report here.

Groupe Dynamite (TSX:GRGD)

Overview: Groupe Dynamite Inc. designs, distributes, and sells women's apparel under the Dynamite and Garage brand names in Canada and the United States, with a market cap of CA$3.67 billion.

Operations: The company generates revenue of CA$996.30 million from its apparel segment.

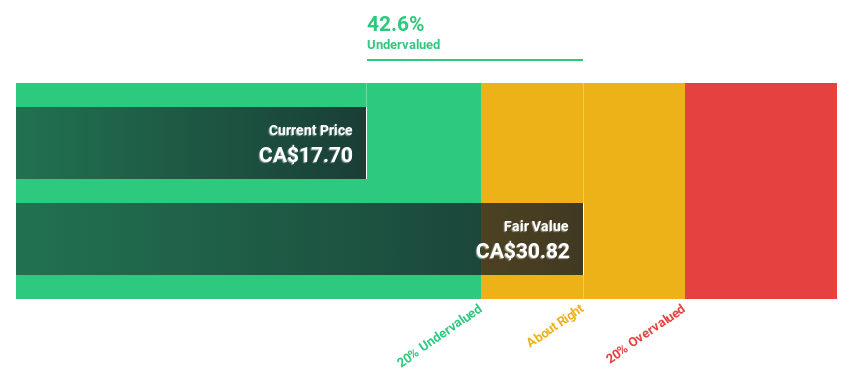

Estimated Discount To Fair Value: 49.7%

Groupe Dynamite is trading at CA$33.96, well below its estimated fair value of CA$67.49, indicating it could be undervalued based on cash flows. The company reported Q1 sales of CA$226.66 million and net income of CA$27.34 million, showing year-over-year growth in both metrics. Earnings are expected to grow 19.3% annually, surpassing the Canadian market average of 11.3%. Recent inclusion in the S&P Global BMI Index underscores its growing market presence.

- In light of our recent growth report, it seems possible that Groupe Dynamite's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Groupe Dynamite's balance sheet health report.

Savaria (TSX:SIS)

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and other international markets, with a market cap of CA$1.42 billion.

Operations: The company's revenue segments include CA$194.92 million from Patient Care, with a Segment Adjustment of CA$683.63 million.

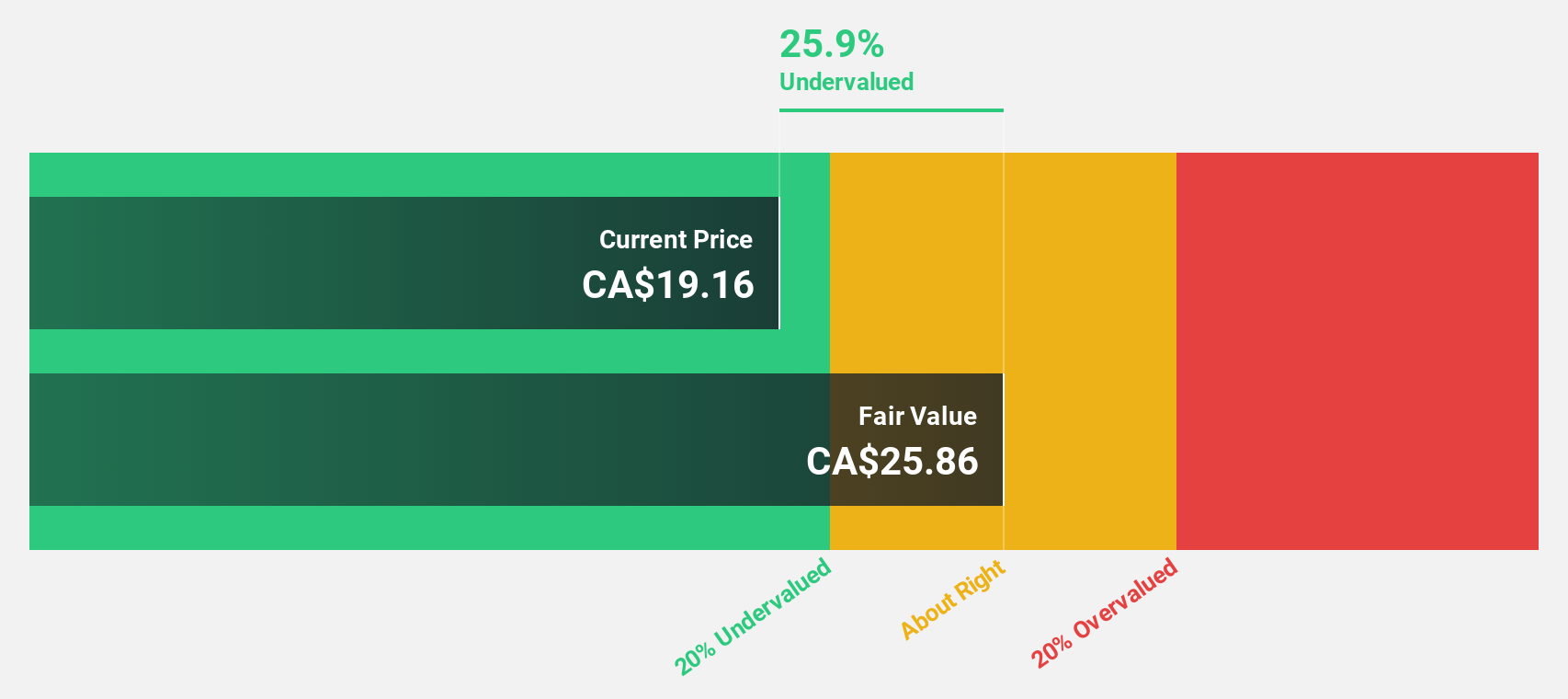

Estimated Discount To Fair Value: 26.4%

Savaria is trading at CA$19.84, below its estimated fair value of CA$26.97, suggesting it might be undervalued based on cash flows. Analysts forecast earnings growth of 28.9% annually, outpacing the Canadian market average of 11.3%. Recent financials show Q1 sales increased to CA$220.23 million with net income rising to CA$12.48 million year-over-year, despite significant insider selling in the past quarter and large one-off items affecting results.

- Our growth report here indicates Savaria may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Savaria.

Make It Happen

- Navigate through the entire inventory of 22 Undervalued TSX Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GRGD

Groupe Dynamite

Designs, distributes, and sells women’s apparel under the Dynamite and Garage brand names in Canada and the United States.

Outstanding track record with reasonable growth potential.

Market Insights

Community Narratives