Dollarama (TSX:DOL): Assessing Valuation as Analysts Highlight Growth Drivers and Expansion Strategy

Reviewed by Simply Wall St

Recent analyst commentary has drawn attention to Dollarama (TSX:DOL) for its knack at achieving steady same-store sales growth and maintaining customer traffic, as a result of its value-oriented merchandise and disciplined pricing. The company continues to expand its store footprint across Canada and internationally, and these ongoing investments in automation and distribution are seen as key factors behind Dollarama’s performance, even as the broader retail sector faces challenges.

See our latest analysis for Dollarama.

Despite stepping back slightly from its 52-week high, Dollarama's share price has surged over 33% year-to-date, reflecting optimism around its strong execution and cycle-resistant model. The stock’s solid three-year total shareholder return of 146% makes its recent momentum especially notable in the retail space.

If Dollarama’s performance has you rethinking your portfolio, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares still slightly below their recent peak and analysts noting Dollarama’s resilience and expansion potential, investors are left wondering: Is there untapped value here, or has the market already priced in all the growth?

Most Popular Narrative: 5.7% Undervalued

With Dollarama's fair value estimated at CA$198.81, around 5.7% above the last close, narrative consensus suggests the current market is leaving a bit of upside on the table. Here is what is driving this perspective and why some see more room ahead for the retailer.

The company's aggressive international expansion, including opening Dollarcity's first store in Mexico and acquiring Australia's largest discount retailer, unlocks new, large addressable markets. This positions Dollarama for multi-year top-line revenue growth through broader geographic and demographic exposure.

Curious about the bold international moves underpinning this valuation? The real story lies in the narrative’s assumptions about sustainable sales strength, margin resilience, and the valuation assigned to the company’s global ambitions. See the numbers and logic that make this a bullish case for Dollarama.

Result: Fair Value of $198.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including possible challenges integrating acquisitions and the impact of market saturation, which could slow future sales growth.

Find out about the key risks to this Dollarama narrative.

Another View: Looking Through the Lens of Market Multiples

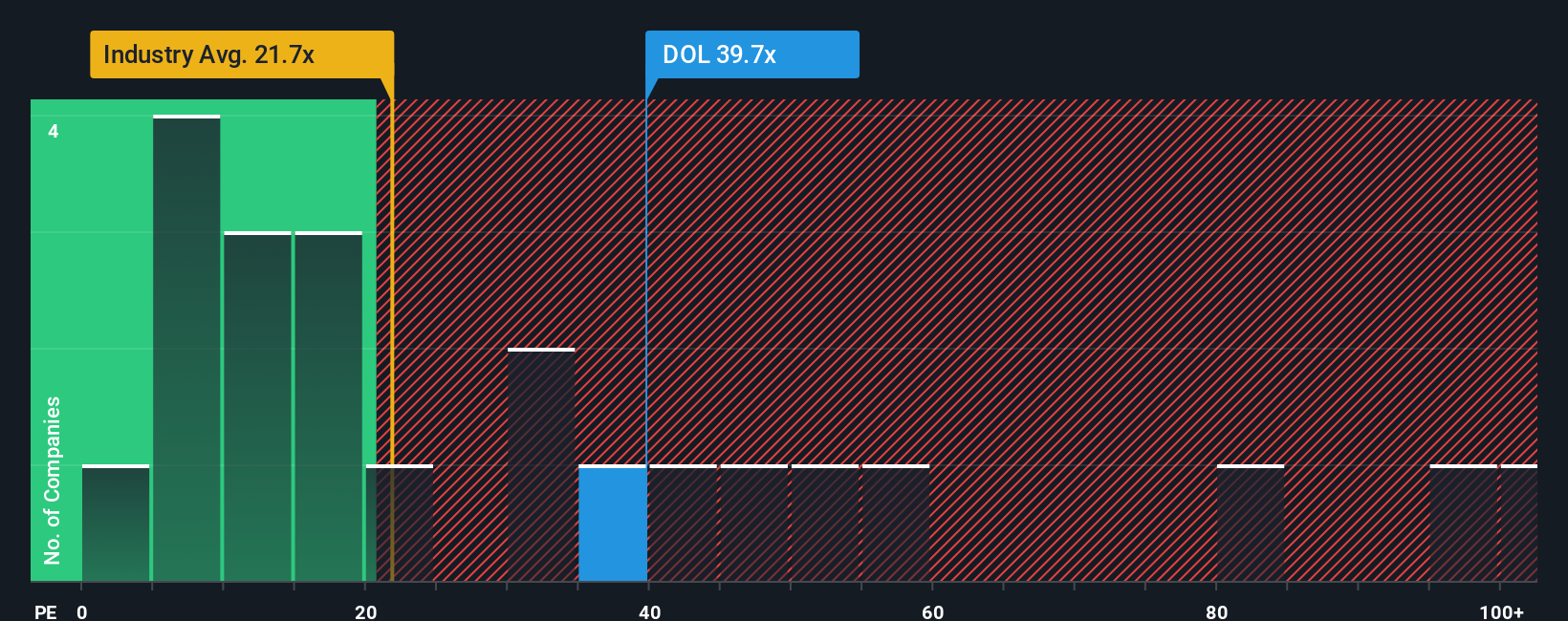

Examining Dollarama’s valuation through its price-to-earnings ratio provides a very different perspective. At 40.7x earnings, the stock is valued much higher than global industry peers averaging 19.9x and also above its fair ratio of 29.1x. This steep premium signals investor confidence, but it also raises questions about how much future growth is already built into today’s price. Could the stock be set up for a re-rating, or will strong growth justify the valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dollarama Narrative

If you’d rather dig into the figures yourself or would like to craft your own interpretation, you can explore the data and assemble a narrative in minutes, your way. Do it your way.

A great starting point for your Dollarama research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Smart portfolios thrive on variety. Make sure you are always a step ahead by tapping into fresh investment opportunities others overlook. Expand your search with handpicked strategies below and level up your investing game.

- Capture hidden value by targeting stable businesses trading well below their worth with these 874 undervalued stocks based on cash flows.

- Power your returns through reliable income streams when you tap into these 16 dividend stocks with yields > 3% offering yields above 3% for steady growth.

- Position yourself at the forefront of innovation and financial trends by acting on the potential offered by these 82 cryptocurrency and blockchain stocks today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOL

Dollarama

Operates a chain of stores and provides related logistical and administrative support activities.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives