- Canada

- /

- Specialty Stores

- /

- TSX:ATZ

Aritzia (TSX:ATZ): Assessing Valuation After Notable Insider Share Sale by Senior Executive

Reviewed by Simply Wall St

Interest in Aritzia (TSX:ATZ) surged after Jennifer Michelle Wong Neal, a senior officer and director, sold 27,609 shares in the public market over two days in November. Moves like this often catch investors’ attention and raise questions about insider outlook and timing.

See our latest analysis for Aritzia.

While insider activity always sparks conversation, it is Aritzia’s momentum that is turning even more heads. The stock’s share price has more than doubled year-to-date, with a 1-year total shareholder return of 141% and a strong 36% climb just in the past 3 months. Renewed optimism about growth prospects and shifting investor sentiment have kept the rally alive even as recent news brings extra scrutiny.

If you’re curious about what other fast-moving companies with strong insider confidence look like, this is the perfect time to discover fast growing stocks with high insider ownership

But with shares now trading close to analyst targets after a year of powerful gains, is Aritzia trading at a discount or is the future growth story already fully reflected in today’s price? Is there still a buying opportunity?

Most Popular Narrative: 4% Overvalued

Despite a new fair value target of CA$107.00, Aritzia’s share price recently topped CA$110.92. The narrative points to upgraded profitability expectations as the foundation of this higher price, but also signals that current enthusiasm might have moved the stock just past consensus fair value.

Upgrades also highlight growing expectations for sustained revenue and earnings growth as Aritzia benefits from strong brand momentum and expansion initiatives. Maintained outperform and buy ratings signal the market's belief in above-average long-term returns compared to peers.

Curious which headline numbers underpin such optimism? The narrative builds on beliefs about future margins, aggressive top-line growth, and a confidence premium that hints at even bigger profit potential. Read on to uncover which forward-looking financial moves analysts are betting on next.

Result: Fair Value of $107 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if U.S. expansion falters or marketing spending fails to boost lasting sales, Aritzia’s ambitious growth story could face challenges.

Find out about the key risks to this Aritzia narrative.

Another View: Discounted Cash Flow Paints a Different Picture

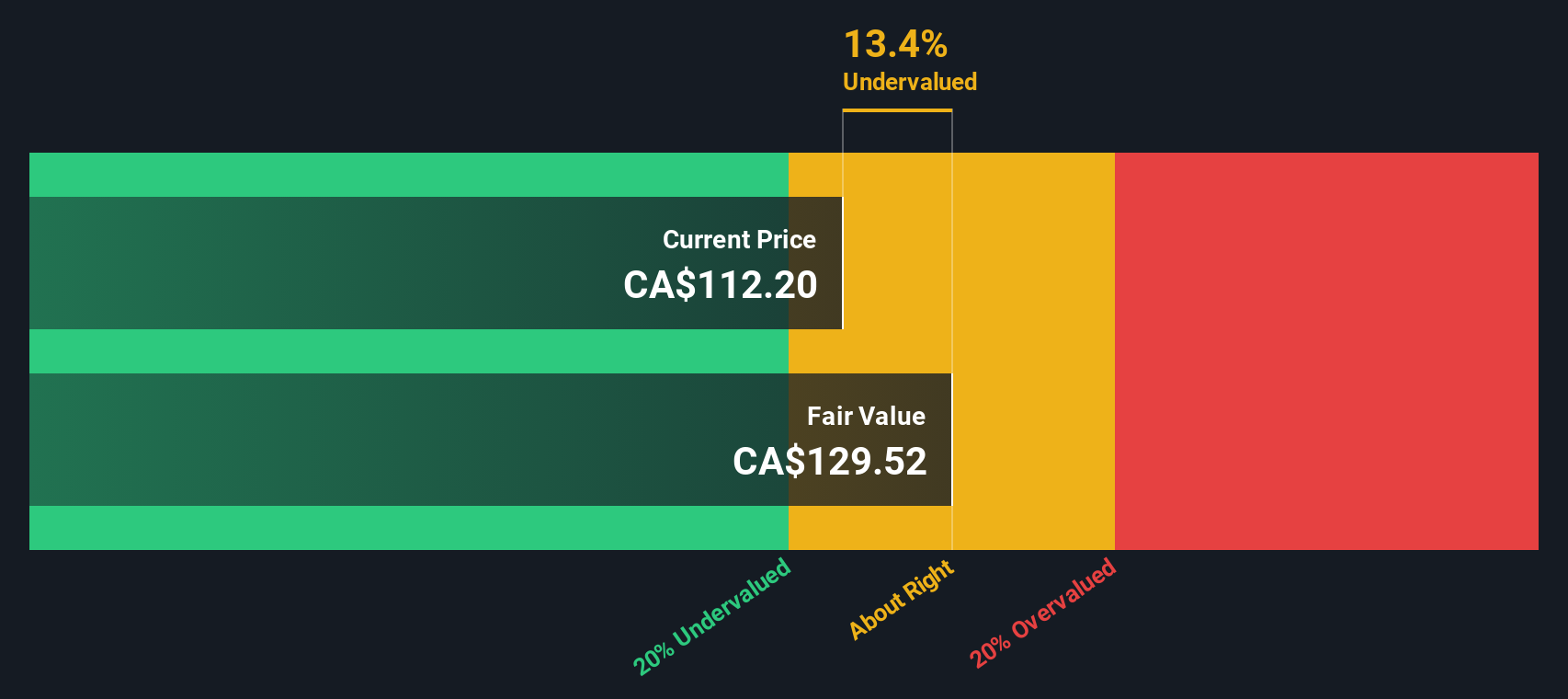

While the market has pushed Aritzia’s share price above most analyst targets, our SWS DCF model suggests a different story. According to this approach, the stock currently trades about 14.5% below its estimated fair value. This implies the market might be underestimating the company’s long-term cash flow potential. Could this signal an overlooked value opportunity, or are short-term risks outweighing what the numbers show?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aritzia for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 930 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aritzia Narrative

If you want to see the numbers from a different angle or test your outlook with your own research, you can craft your perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Aritzia.

Looking for more investment ideas?

Don’t let this rally pass you by. Use the right tools to find tomorrow’s winners before everyone else. Head over to the Simply Wall Street Screener for fresh opportunities built on rigorous financial data and unique insights.

- Uncover tomorrow’s innovators by checking out these 25 AI penny stocks which are shaking up entire industries with breakthroughs in artificial intelligence and automation.

- Fuel your portfolio with growth by reviewing these 930 undervalued stocks based on cash flows that are trading well below their cash flow potential and may offer future upside.

- Secure steady income and peace of mind by reviewing these 15 dividend stocks with yields > 3% offering yields above 3% and strong financial foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATZ

Aritzia

Designs, develops, and sells apparels and accessories for women in the United States and Canada.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success