- Canada

- /

- Real Estate

- /

- TSXV:IEI

These 4 Measures Indicate That Imperial Equities (CVE:IEI) Is Using Debt Extensively

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Imperial Equities Inc. (CVE:IEI) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Imperial Equities

What Is Imperial Equities's Debt?

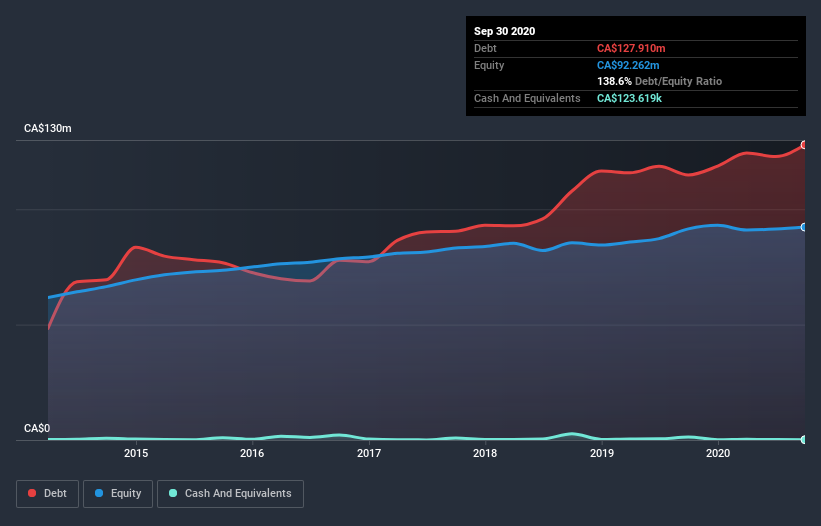

The image below, which you can click on for greater detail, shows that at September 2020 Imperial Equities had debt of CA$127.9m, up from CA$114.9m in one year. And it doesn't have much cash, so its net debt is about the same.

How Healthy Is Imperial Equities' Balance Sheet?

The latest balance sheet data shows that Imperial Equities had liabilities of CA$56.4m due within a year, and liabilities of CA$88.3m falling due after that. Offsetting this, it had CA$123.6k in cash and CA$264.9k in receivables that were due within 12 months. So its liabilities total CA$144.3m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the CA$34.1m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Imperial Equities would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 2.2 times and a disturbingly high net debt to EBITDA ratio of 13.2 hit our confidence in Imperial Equities like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Another concern for investors might be that Imperial Equities's EBIT fell 10% in the last year. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. There's no doubt that we learn most about debt from the balance sheet. But it is Imperial Equities's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Imperial Equities recorded free cash flow worth a fulsome 88% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

To be frank both Imperial Equities's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. We're quite clear that we consider Imperial Equities to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 6 warning signs we've spotted with Imperial Equities (including 2 which shouldn't be ignored) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Imperial Equities or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:IEI

Imperial Equities

Engages in the acquisition, development, redevelopment, leasing, and sale of industrial, agricultural, and commercial properties primarily in Canada.

Moderate risk and fair value.

Market Insights

Community Narratives