- Canada

- /

- Real Estate

- /

- TSX:WFC

Have Insiders Been Buying Wall Financial Corporation (TSE:WFC) Shares This Year?

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So shareholders might well want to know whether insiders have been buying or selling shares in Wall Financial Corporation (TSE:WFC).

What Is Insider Buying?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, rules govern insider transactions, and certain disclosures are required.

We don't think shareholders should simply follow insider transactions. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

View our latest analysis for Wall Financial

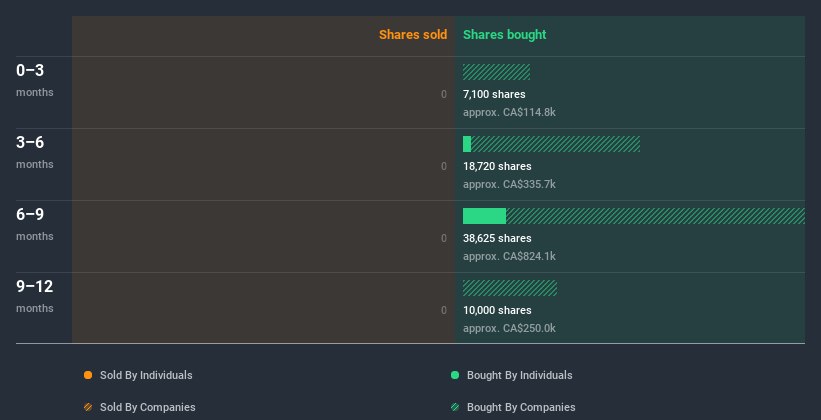

Wall Financial Insider Transactions Over The Last Year

In the last twelve months, the biggest single purchase by an insider was when Independent Director David Gruber bought CA$75k worth of shares at a price of CA$21.50 per share. That means that an insider was happy to buy shares at above the current price of CA$18.00. Their view may have changed since then, but at least it shows they felt optimistic at the time. To us, it's very important to consider the price insiders pay for shares. It is encouraging to see an insider paid above the current price for shares, as it suggests they saw value, even at higher levels. David Gruber was the only individual insider to buy shares in the last twelve months.

David Gruber purchased 5.55k shares over the year. The average price per share was CA$20.97. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership of Wall Financial

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. Wall Financial insiders own 27% of the company, currently worth about CA$167m based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Does This Data Suggest About Wall Financial Insiders?

There haven't been any insider transactions in the last three months -- that doesn't mean much. However, our analysis of transactions over the last year is heartening. With high insider ownership and encouraging transactions, it seems like Wall Financial insiders think the business has merit. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. To that end, you should learn about the 2 warning signs we've spotted with Wall Financial (including 1 which is significant).

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Wall Financial, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wall Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:WFC

Wall Financial

Operates as a real estate investment and development company in Canada.

Proven track record and fair value.

Market Insights

Community Narratives