- Canada

- /

- Retail REITs

- /

- TSX:SRU.UN

SmartCentres Real Estate Investment Trust Full-Year Results: Here's What Analysts Are Forecasting For Next Year

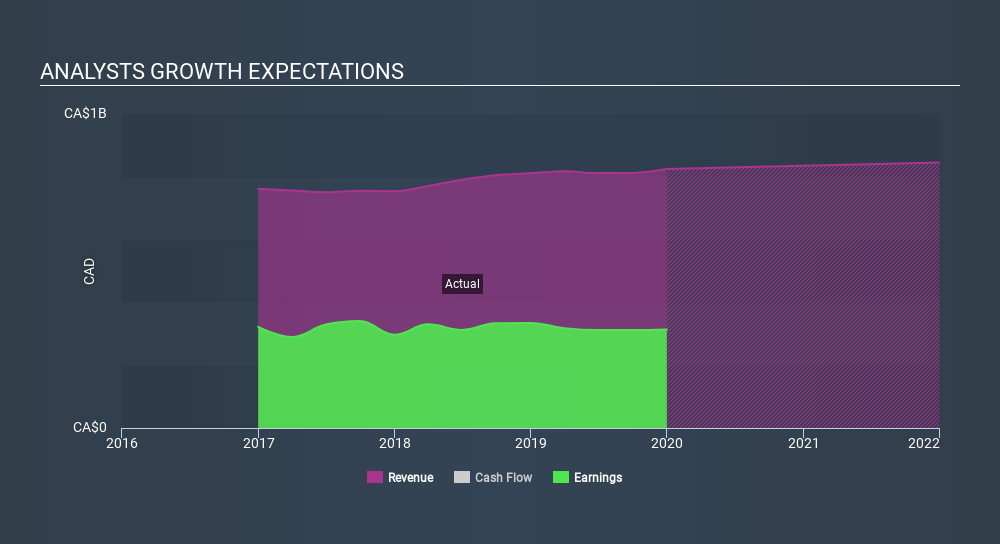

Last week saw the newest full-year earnings release from SmartCentres Real Estate Investment Trust (TSE:SRU.UN), an important milestone in the company's journey to build a stronger business. The results were positive, with revenue coming in at CA$825m, beating analyst expectations by 4.5%. This is an important time for investors, as they can track a company's performance in its report, look at what top analysts are forecasting for next year, and see if there has been any change to expectations for the business. With this in mind, we've gathered the latest statutory forecasts to see what analysts are expecting for next year.

See our latest analysis for SmartCentres Real Estate Investment Trust

Taking into account the latest results, SmartCentres Real Estate Investment Trust's two analysts currently expect revenues in 2020 to be CA$835.3m, approximately in line with the last 12 months. Before this earnings result, analysts had predicted CA$800.1m revenue in 2020, although there was no accompanying EPS estimate. So there's been a pretty clear uptick in analyst sentiment after these results, given the small lift in next year's revenue forecasts.

We'd also point out that that analysts have made no major changes to their price target of CA$34.50.

In addition, we can look to SmartCentres Real Estate Investment Trust's past performance and see whether business is expected to improve, and if the company is expected to perform better than wider market. It's pretty clear that analysts expect SmartCentres Real Estate Investment Trust's revenue growth will slow down substantially, with revenues next year expected to grow 1.3%, compared to a historical growth rate of 5.2% over the past five years. By way of comparison, other companies in this market with analyst coverage, are forecast to grow their revenue at 5.2% per year. Factoring in the forecast slowdown in growth, it seems obvious that analysts still expect SmartCentres Real Estate Investment Trust to grow slower than the wider market.

The Bottom Line

The biggest takeaway for us from these new estimates is the bullish forecast for profits next year. Fortunately, analysts also upgraded their revenue estimates, although our data indicates sales are expected to perform worse than the wider market. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

We have estimates for SmartCentres Real Estate Investment Trust from its two analysts , and you can see them free on our platform here.

It might also be worth considering whether SmartCentres Real Estate Investment Trust's debt load is appropriate, using our debt analysis tools on the Simply Wall St platform, here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:SRU.UN

SmartCentres Real Estate Investment Trust

SmartCentres is one of Canada's largest fully integrated REITs, with a best-in-class and growing mixed-use portfolio featuring 191 strategically located properties in communities across the country.

6 star dividend payer low.