- Canada

- /

- Retail REITs

- /

- TSX:REI.UN

RioCan (TSX:REI.UN): Assessing Valuation Following New 10% Share Buyback Authorization

Reviewed by Simply Wall St

RioCan Real Estate Investment Trust (TSX:REI.UN) announced a new share buyback program, with approval to repurchase nearly 10% of its outstanding units. Investors often view buybacks as a signal of management’s belief in the business’s underlying value.

See our latest analysis for RioCan Real Estate Investment Trust.

RioCan’s latest buyback plans come on the heels of several positive updates, including fresh lease agreements at Toronto’s The Well and a recently affirmed monthly distribution. In the past year, the trust delivered a 6.7% total shareholder return, with recent share price momentum building steadily, up 3.7% over the last 90 days and closing at $18.95. Long-term returns remain impressive, with a 36.5% total shareholder return over five years.

If RioCan’s latest moves have you thinking about what’s next in real estate, why not broaden your horizons and discover fast growing stocks with high insider ownership

But with shares currently trading at a modest discount to analyst targets and strong recent performance, is RioCan’s stock offering real value for buyers? Or has the market already priced in its future growth?

Price-to-Earnings of 83.7x: Is it justified?

At a last close of CA$18.95, RioCan’s price-to-earnings ratio sits at 83.7x, placing the stock well above its peer group and the sector average.

The price-to-earnings (P/E) ratio measures how much investors are paying for each dollar of a company’s earnings. It signals expectations for future profitability. For REITs like RioCan, investors often use this metric to assess whether the current share price reflects the company’s income-generating power and growth outlook.

RioCan’s P/E ratio is significantly higher than the North American Retail REITs industry average of 24.4x and surpasses its direct peers’ average of 16.7x. The stock also trades well above the estimated Fair P/E Ratio of 30.3x, which could represent a more reasonable long-term level if market sentiment shifts or growth expectations come under scrutiny.

Explore the SWS fair ratio for RioCan Real Estate Investment Trust

Result: Price-to-Earnings of 83.7x (OVERVALUED)

However, slowing revenue growth and a notably high price-to-earnings ratio could temper enthusiasm and prompt a reassessment of RioCan’s near-term outlook.

Find out about the key risks to this RioCan Real Estate Investment Trust narrative.

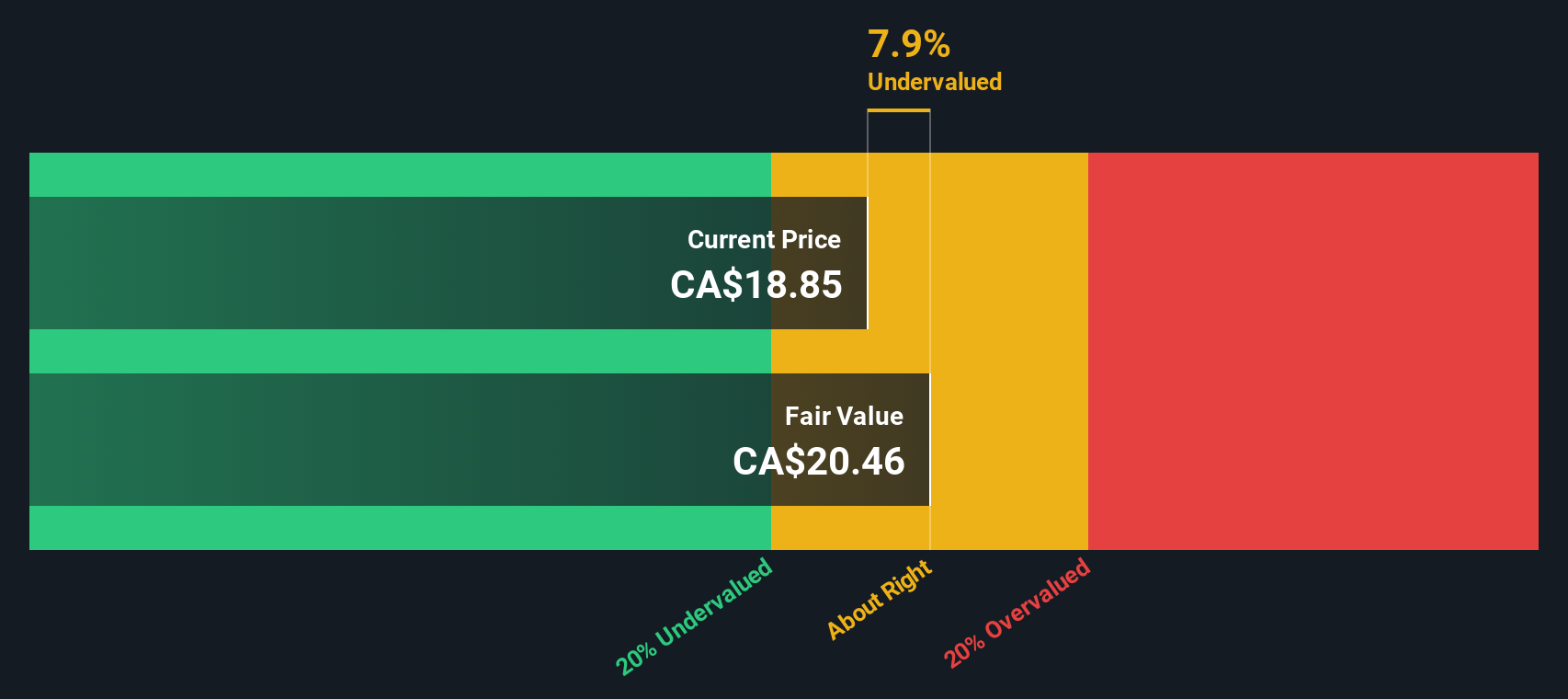

Another View: Our DCF Model Says Undervalued

While RioCan’s price-to-earnings ratio looks expensive compared to its peers, our SWS DCF model offers a more optimistic perspective. Based on projected future cash flows, the DCF suggests RioCan is trading about 11.6% below its estimated fair value of CA$21.44.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RioCan Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RioCan Real Estate Investment Trust Narrative

If you have your own perspective or want to explore the numbers firsthand, it’s easy to build your own narrative in just a few minutes. Do it your way

A great starting point for your RioCan Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Use the Simply Wall Street Screener to target stocks across key growth trends, niche sectors, and value picks you might otherwise overlook.

- Uncover smart bargains and seize the chance to review these 926 undervalued stocks based on cash flows based on real cash flows and sound fundamentals.

- Tap into high-yield income by checking out these 16 dividend stocks with yields > 3% that provide consistently strong dividend returns above 3%.

- Get ahead of tech trends with these 26 AI penny stocks pushing the boundaries of artificial intelligence and transforming industries worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:REI.UN

RioCan Real Estate Investment Trust

RioCan meets the everyday shopping needs of Canadians through the ownership, management and development of necessity-based retail and mixed-use properties in densely populated communities.

Average dividend payer with slight risk.

Market Insights

Community Narratives