- Canada

- /

- Retail REITs

- /

- TSX:PMZ.UN

Primaris REIT (TSX:PMZ.UN): Evaluating Value After Strong Q3 Results and Updated 2025 Guidance

Reviewed by Simply Wall St

Primaris Real Estate Investment Trust (TSX:PMZ.UN) just posted its third quarter results, revealing higher revenue and a strong return to profitability compared to last year. In addition to the earnings, the company updated its 2025 guidance.

See our latest analysis for Primaris Real Estate Investment Trust.

After a year of considerable swings, Primaris’ solid quarterly results appear to have boosted confidence. The share price gained 1.52% in the past day and has delivered a nearly 4% three-month share price return. Over the longer term, shareholders have seen a 3.56% total return over the past year and a 29.65% total return over three years. This suggests that momentum is gradually building as investors factor in improved profitability and updated guidance.

If this upswing has you curious about other real estate success stories, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With the latest results and a notable discount to analyst targets, the question looms: is Primaris trading below its intrinsic worth, or has the market already priced in its future growth potential, leaving little room for upside?

Price-to-Earnings of 12.6x: Is it justified?

Based on its price-to-earnings ratio of 12.6x compared to the recent close at CA$15.38, Primaris Real Estate Investment Trust looks attractively valued relative to direct competitors.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay per dollar of earnings, giving important context for companies operating in mature and income-oriented sectors like real estate. A lower P/E can indicate the market undervalues the company’s earnings power, or that it expects limited future growth or higher risk.

Primaris is trading at a substantial discount not only to its peer group average P/E of 16.9x but also to the broader North American Retail REITs industry average of 23.5x. When evaluated against our estimated fair P/E ratio of 19.6x, the case for undervaluation becomes even stronger. This suggests that market sentiment may be lagging behind the company’s improving fundamentals and recent growth momentum.

Explore the SWS fair ratio for Primaris Real Estate Investment Trust

Result: Price-to-Earnings of 12.6x (UNDERVALUED)

However, risks such as fluctuating consumer demand or an unexpected downturn in retail property values could challenge the current outlook and have a negative impact on future performance.

Find out about the key risks to this Primaris Real Estate Investment Trust narrative.

Another View: Discounted Cash Flow Analysis

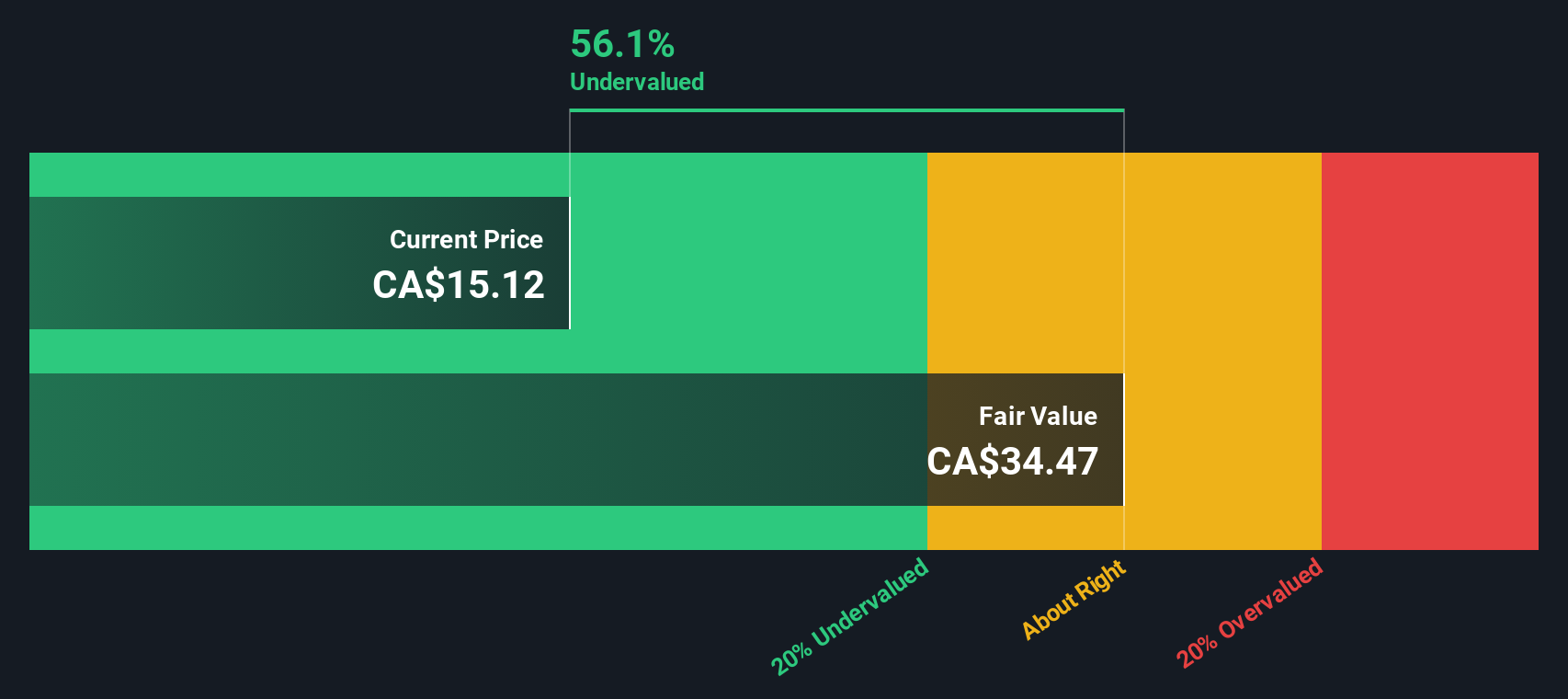

Looking at valuation from a different angle, our SWS DCF model estimates Primaris shares are trading at a sizable discount to their fair value. This approach considers all expected future cash flows instead of focusing solely on the latest earnings. Does this deeper valuation suggest a long-term opportunity, or could market caution be warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Primaris Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Primaris Real Estate Investment Trust Narrative

If our take does not quite match your perspective or you prefer a hands-on approach, you can easily build your own viewpoint using the same data in just a few minutes. Do it your way

A great starting point for your Primaris Real Estate Investment Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not just settle for one promising pick. Give yourself an advantage by checking out different strategies and industries, all in one place.

- Uncover high-yield opportunities and boost your income stream by reviewing these 22 dividend stocks with yields > 3% which is packed with reliable payers and growing distributions.

- Capitalize on emerging trends in technology by tapping into these 26 AI penny stocks. Here you will find companies leading advancements in artificial intelligence.

- Spot value no one else sees and seize potential bargains through these 832 undervalued stocks based on cash flows featuring stocks trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PMZ.UN

Primaris Real Estate Investment Trust

Primaris is Canada’s only enclosed shopping centre focused REIT, with ownership interests primarily in enclosed shopping centres in Canadian markets.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives