- Canada

- /

- Retail REITs

- /

- TSX:PMZ.UN

How Primaris REIT’s Bigger Distributions and Earnings Gains (TSX:PMZ.UN) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Primaris Real Estate Investment Trust recently reported third-quarter earnings, showing sizeable increases in both sales and net income compared to the prior year, and declared both a November 2025 monthly distribution of $0.0717 per unit and an annual distribution increase to $0.88 per unit starting with the December 2025 distribution.

- This combination of stronger financial results, a raised annual payout, and updated guidance suggests growing management confidence and improving fundamentals in the business.

- We'll explore how the newly announced distribution increase shapes Primaris's investment narrative and signals future cash flow confidence.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Primaris Real Estate Investment Trust's Investment Narrative?

For shareholders of Primaris Real Estate Investment Trust, the core belief remains anchored in the resilience of Canadian retail real estate and the company's ability to deliver reliable income and gradual growth. The latest quarterly results and newly announced distribution increase add weight to the view that Primaris’s operations are on a firmer footing, with management showing renewed assurance in both cash flow strength and occupancy outlook. This news could shape upcoming catalysts, particularly as improved profitability and higher distributions may help to offset investor concerns about prior lease disclaimers and potential tenant risks like the HBC lease exits. While the most immediate headwinds, such as diluted share count and ongoing interest coverage challenges, remain relevant, the higher payout and better earnings trajectory suggest a modest shift in the risk profile. Short-term, the distribution raise signals confidence, yet the impact of possible tenant vacancies is still a key consideration. Yet, with stronger income, tenant turnover risk still remains on the radar for investors.

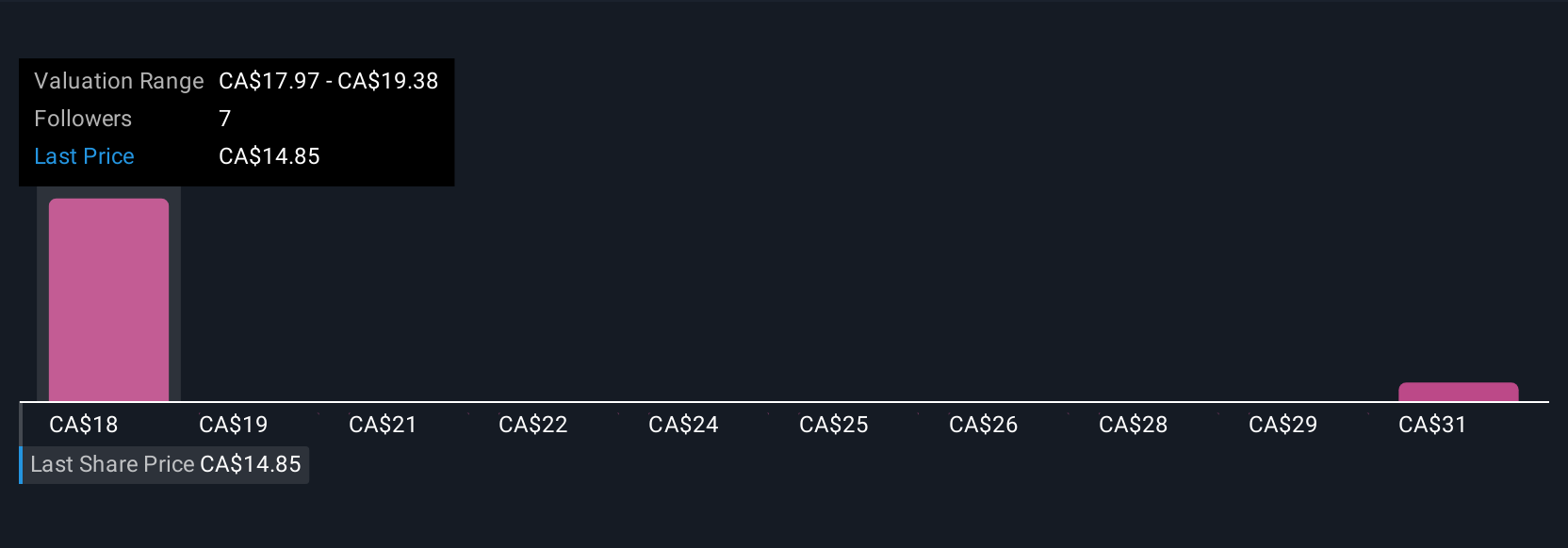

Primaris Real Estate Investment Trust's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Primaris Real Estate Investment Trust - why the stock might be worth just CA$18.16!

Build Your Own Primaris Real Estate Investment Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Primaris Real Estate Investment Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Primaris Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Primaris Real Estate Investment Trust's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PMZ.UN

Primaris Real Estate Investment Trust

Primaris is Canada’s only enclosed shopping centre focused REIT, with ownership interests primarily in enclosed shopping centres in Canadian markets.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives