As global markets show signs of easing trade tensions and U.S. small- and mid-cap equities continue their upward trend, investors are increasingly attentive to the opportunities within the small-cap sector. Amidst this backdrop, identifying stocks that demonstrate strong fundamentals and insider confidence can be particularly appealing, as these factors often indicate potential resilience and growth in uncertain economic climates.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.7x | 0.5x | 42.41% | ★★★★★★ |

| Nexus Industrial REIT | 5.3x | 2.7x | 24.72% | ★★★★★★ |

| Tristel | 27.2x | 3.8x | 27.77% | ★★★★★☆ |

| Chorus Aviation | NA | 0.4x | 19.64% | ★★★★★☆ |

| Savills | 23.5x | 0.5x | 43.89% | ★★★★☆☆ |

| Sing Investments & Finance | 7.0x | 3.5x | 44.54% | ★★★★☆☆ |

| Norcros | 24.2x | 0.6x | 28.17% | ★★★☆☆☆ |

| FRP Advisory Group | 12.7x | 2.3x | 7.32% | ★★★☆☆☆ |

| Westshore Terminals Investment | 13.6x | 3.9x | 37.12% | ★★★☆☆☆ |

| Calfrac Well Services | 35.2x | 0.2x | 26.00% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Dicker Data (ASX:DDR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dicker Data is a technology distributor specializing in wholesale computer peripherals, with a market capitalization of A$1.95 billion.

Operations: The company generates revenue primarily from wholesale computer peripherals, with a recent reported figure of A$2.28 billion. The cost of goods sold (COGS) is significant, amounting to A$1.95 billion, impacting its gross profit margin which was 14.56%. Operating expenses include general and administrative costs totaling A$146.98 million, alongside non-operating expenses such as depreciation and amortization at A$14.14 million. Net income reached A$78.69 million with a net income margin of 3.45%.

PE: 19.2x

Dicker Data, a player in the tech distribution sector, has recently partnered with CrowdStrike to enhance its cybersecurity offerings across Australia and New Zealand. This strategic move could leverage growing demand in the region. Despite reporting A$2.28 billion revenue for 2024, earnings slightly dipped to A$78.69 million from the previous year. While insider confidence is not highlighted by recent purchases, projected earnings growth of 9% annually suggests potential value amidst its high debt reliance on external borrowing sources.

Nyab (OM:NYAB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nyab is a company involved in heavy construction, with a market cap of €0.53 billion.

Operations: The company generates revenue primarily from heavy construction, with a recent revenue figure of €345.94 million. Cost of goods sold (COGS) is significant, accounting for €265.01 million, impacting the gross profit margin which stands at 23.39%. Operating expenses include general and administrative costs amounting to €39.26 million, alongside non-operating expenses of €8.59 million. The net income margin is reported at 4.84%.

PE: 20.5x

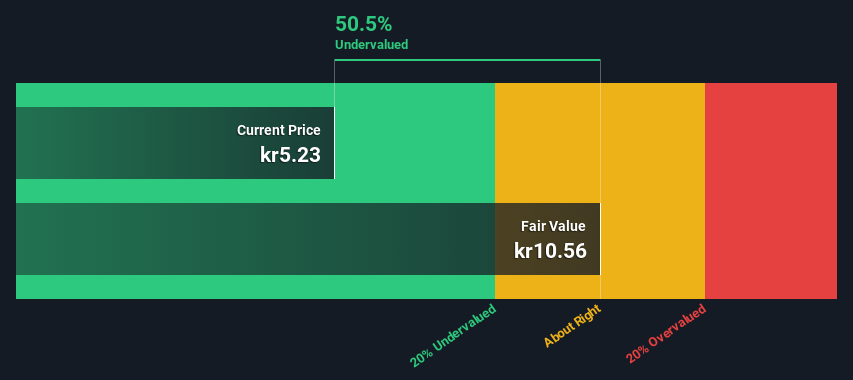

Nyab, a company operating in construction and infrastructure, has recently secured multiple contracts, including a SEK 409 million project with the Swedish Transport Administration. Their financial performance shows growth with sales reaching €345.94 million for 2024. Despite relying on external borrowing for funding, which poses higher risk, insider confidence is evident through recent share purchases. The company's strategic projects and management changes position it well for future growth prospects in Sweden's infrastructure sector.

- Dive into the specifics of Nyab here with our thorough valuation report.

Gain insights into Nyab's past trends and performance with our Past report.

Nexus Industrial REIT (TSX:NXR.UN)

Simply Wall St Value Rating: ★★★★★★

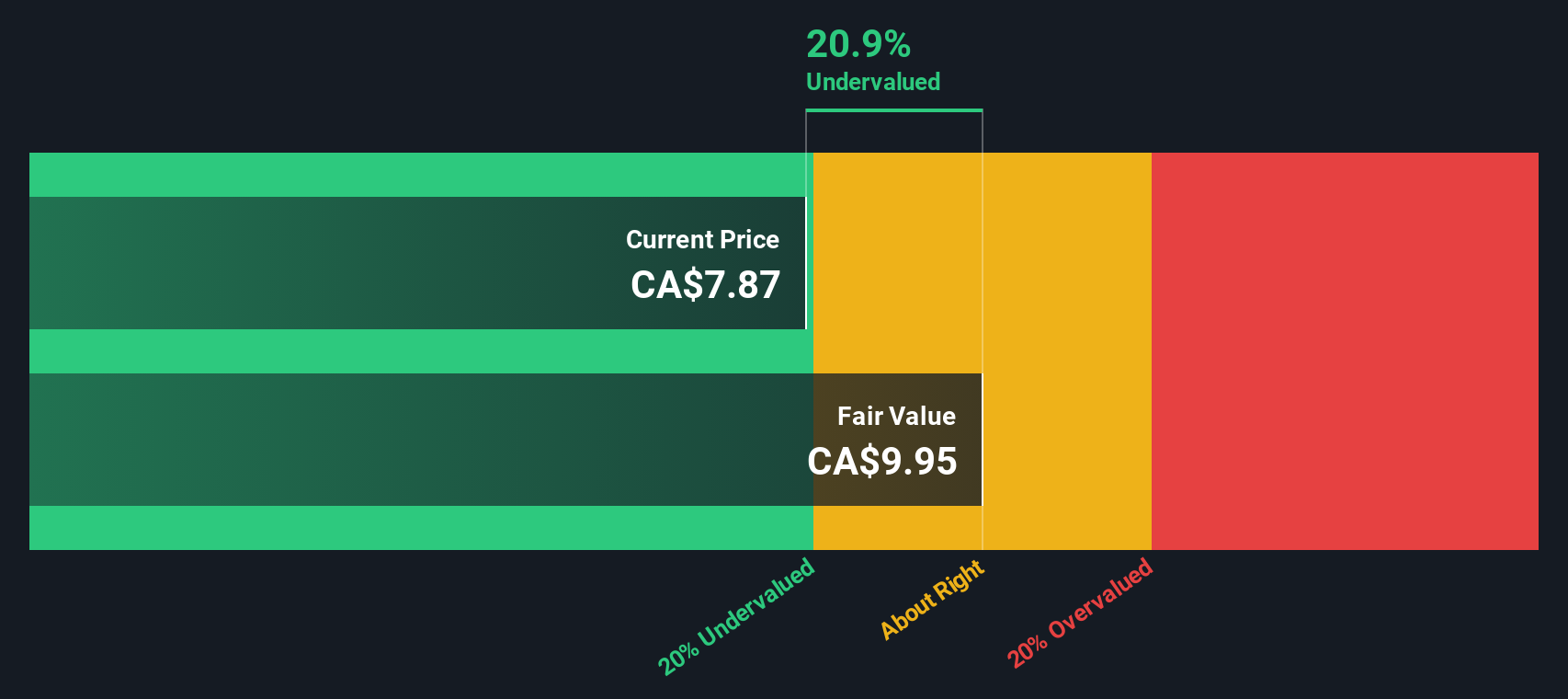

Overview: Nexus Industrial REIT focuses on owning and managing a diversified portfolio of industrial properties, with a market capitalization of CA$1.05 billion.

Operations: Nexus Industrial REIT generates revenue primarily from investment properties, with a recent quarterly revenue of CA$177.57 million. The company has shown a gross profit margin of 71.94% in the latest period, reflecting its ability to manage costs relative to its revenues effectively. Operating expenses are noted at CA$7.81 million, while non-operating expenses stand at CA$29.05 million, impacting overall profitability and net income margins significantly over time.

PE: 5.3x

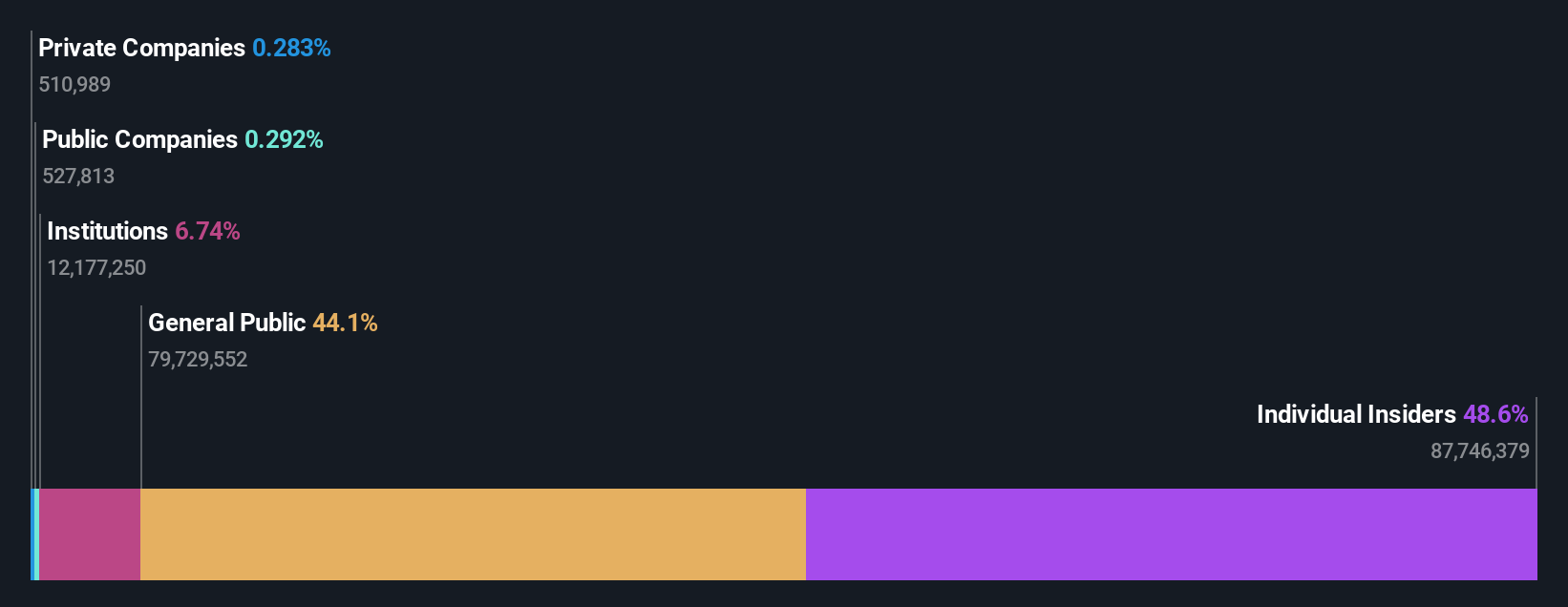

Nexus Industrial REIT, a smaller player in the industrial real estate sector, recently reported CAD 175.7 million in sales for 2024, up from CAD 157.65 million the previous year. Despite this growth, net income fell to CAD 90.88 million from CAD 160.03 million due to large one-off items affecting earnings quality. The company maintains a monthly dividend of CAD 0.0533 per share but faces challenges with declining earnings forecasts and higher-risk external borrowing as its sole funding source. However, insider confidence is evident through recent share purchases by insiders over the past few months, signaling potential trust in future performance despite current financial hurdles.

Turning Ideas Into Actions

- Click here to access our complete index of 158 Undervalued Global Small Caps With Insider Buying.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DDR

Dicker Data

Engages in the wholesale distribution of computer hardware, software, and related products for corporate and commercial markets in Australia and New Zealand.

Adequate balance sheet and fair value.

Market Insights

Community Narratives