- Canada

- /

- Health Care REITs

- /

- TSX:NWH.UN

Will NorthWest Healthcare Properties REIT's (TSX:NWH.UN) Internalization Drive Sustainable Efficiency Gains for Investors?

Reviewed by Sasha Jovanovic

- NorthWest Healthcare Properties Real Estate Investment Trust reported third quarter 2025 results in the past week, showing sales of C$104.29 million and a return to profitability with net income of C$16.17 million, compared to a net loss in the previous year.

- The REIT highlighted operational improvements, including a 4.4% rise in same property net operating income and advancement in internalizing management of Vital Trust, indicating focus on driving efficiencies and financial flexibility.

- We'll examine how NorthWest's move to internalize Vital Trust management could impact its investment story and outlook for efficiency gains.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is NorthWest Healthcare Properties Real Estate Investment Trust's Investment Narrative?

To see NorthWest Healthcare Properties REIT as a long-term holding, you have to believe in the resilience and future demand for healthcare real estate alongside management’s ability to drive operational efficiencies despite recent revenue declines. The latest quarterly results show a return to profitability, an uptick in same property net operating income, and the move to internalize management of Vital Trust, all of which could be meaningful short-term catalysts for improved margins and streamlined operations. At the same time, material risks remain: revenue is still trending downward, interest costs continue to outpace earnings, and a short track record of dividend stability poses questions for income-focused investors. With executive and board changes, the path to consistent performance is not guaranteed, but recent progress may challenge earlier concerns about persistent losses and instability. Yet, not all investors will be comfortable with the ongoing revenue declines and board turnover.

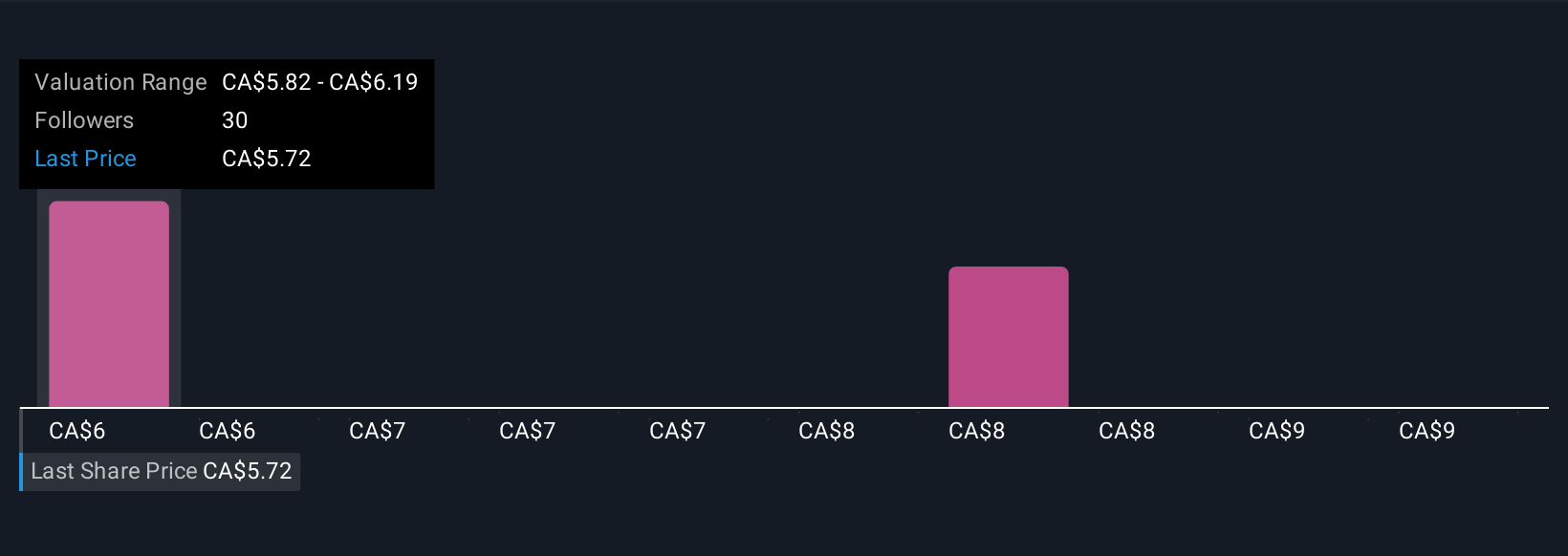

NorthWest Healthcare Properties Real Estate Investment Trust's shares have been on the rise but are still potentially undervalued by 31%. Find out what it's worth.Exploring Other Perspectives

Explore 6 other fair value estimates on NorthWest Healthcare Properties Real Estate Investment Trust - why the stock might be worth as much as 66% more than the current price!

Build Your Own NorthWest Healthcare Properties Real Estate Investment Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NorthWest Healthcare Properties Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free NorthWest Healthcare Properties Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NorthWest Healthcare Properties Real Estate Investment Trust's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthWest Healthcare Properties Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWH.UN

NorthWest Healthcare Properties Real Estate Investment Trust

Northwest Healthcare Properties Real Estate Investment Trust ("Northwest", or the "REIT"), is a Canadian open-end trust established on January 1, 2010 and governed pursuant to a third amended and restated Declaration of Trust dated September 15, 2020, as amended by amendments dated as of March 30, 2023, September 21, 2023, June 18, 2024 and May 14, 2025, under the laws of the Province of Ontario ("Declaration of Trust").

Average dividend payer with moderate growth potential.

Market Insights

Community Narratives