- Canada

- /

- Health Care REITs

- /

- TSX:NWH.UN

Assessing NorthWest Healthcare Properties REIT (TSX:NWH.UN) Valuation After Q3 2025 Results and Strategic Updates

Reviewed by Simply Wall St

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN) just released its Q3 2025 earnings report, highlighting a clear turnaround in net income and a renewed focus on operational efficiency. These results drew investor attention for good reason.

See our latest analysis for NorthWest Healthcare Properties Real Estate Investment Trust.

Following its turnaround in quarterly results, NorthWest Healthcare Properties REIT has seen clear momentum in the share price, notching a 23.1% year-to-date share price return and a total shareholder return of 18.7% over the past year. Ongoing strategic moves such as the Vital Trust internalization and portfolio simplification appear to be boosting investor confidence and suggest continued recovery potential, even as the company rebuilds from longer-term declines.

If you're watching this rebound unfold and want to discover more opportunities in real estate and healthcare, check out See the full list for free.

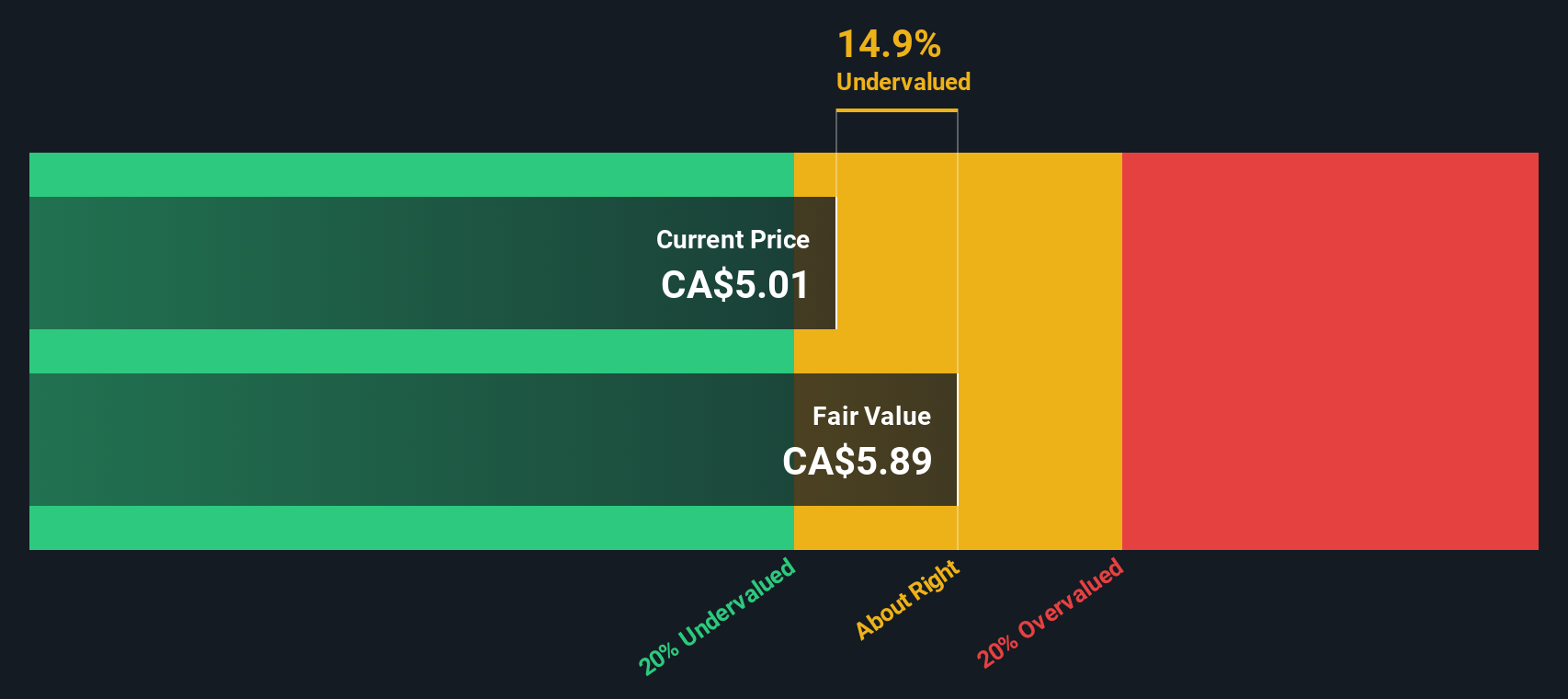

With shares still trading at a notable discount to intrinsic value, investors may wonder if NorthWest Healthcare Properties REIT is still undervalued or if recent gains mean the market is now fully pricing in future growth potential.

Price-to-Earnings of 27.6x: Is it justified?

At a current price-to-earnings (P/E) ratio of 27.6x, NorthWest Healthcare Properties REIT trades above both its sector and peer averages, despite its recent return to profitability. The last closing price was CA$5.49, positioning the company as more expensive than most of its industry.

The P/E ratio measures how much investors are willing to pay today for a dollar of future earnings. In the context of a REIT, it is especially significant because it signals whether the market anticipates ongoing profit improvements or is cautious about sustainability. For NorthWest Healthcare Properties REIT, the elevated multiple implies shareholders are factoring in material earnings growth or a shift in future fundamentals.

Compared to the Global Health Care REITs industry average of 25.1x and a peer group average of 6.8x, NorthWest's P/E is notably higher. Against the estimated fair P/E of 23x for the stock, the market is currently applying a premium that could signal either over-optimism or a justified re-rating if projected earnings materialize.

Explore the SWS fair ratio for NorthWest Healthcare Properties Real Estate Investment Trust

Result: Price-to-Earnings of 27.6x (OVERVALUED)

However, ongoing revenue declines and the company’s lackluster multi-year total returns remain risks that could affect investor sentiment in the future.

Another View: Discounted Cash Flow Perspective

While NorthWest Healthcare Properties REIT currently trades at a premium to industry peers based on its price-to-earnings ratio, our DCF model suggests a different story. The SWS DCF model estimates fair value at CA$8.27, which is 33.6% above the current price. This signals significant undervaluation from a cash flow standpoint. Could this mean the rally is only getting started?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NorthWest Healthcare Properties Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NorthWest Healthcare Properties Real Estate Investment Trust Narrative

If you prefer your own analysis or want to look beyond these numbers, you can dive into the data and develop your own insights in just a few minutes with Do it your way.

A great starting point for your NorthWest Healthcare Properties Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize your next opportunity by checking out top stocks with unique potential. The Simply Wall Street Screener can help you sort winners from the crowd. Don't leave great ideas on the table.

- Maximize your portfolio’s income potential by reviewing these 15 dividend stocks with yields > 3%, offering impressive yields above 3% for smart, steady returns.

- Capture the next wave of financial innovation by researching these 82 cryptocurrency and blockchain stocks, at the forefront of decentralized technology and digital assets.

- Spot hidden value early with these 3585 penny stocks with strong financials, where robust fundamentals meet exciting growth prospects in lesser-known names.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthWest Healthcare Properties Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWH.UN

NorthWest Healthcare Properties Real Estate Investment Trust

Northwest Healthcare Properties Real Estate Investment Trust ("Northwest", or the "REIT"), is a Canadian open-end trust established on January 1, 2010 and governed pursuant to a third amended and restated Declaration of Trust dated September 15, 2020, as amended by amendments dated as of March 30, 2023, September 21, 2023, June 18, 2024 and May 14, 2025, under the laws of the Province of Ontario ("Declaration of Trust").

Average dividend payer with moderate growth potential.

Market Insights

Community Narratives