- Canada

- /

- Real Estate

- /

- TSX:MRC

Are Morguard's (TSE:MRC) Statutory Earnings A Good Reflection Of Its Earnings Potential?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding Morguard (TSE:MRC).

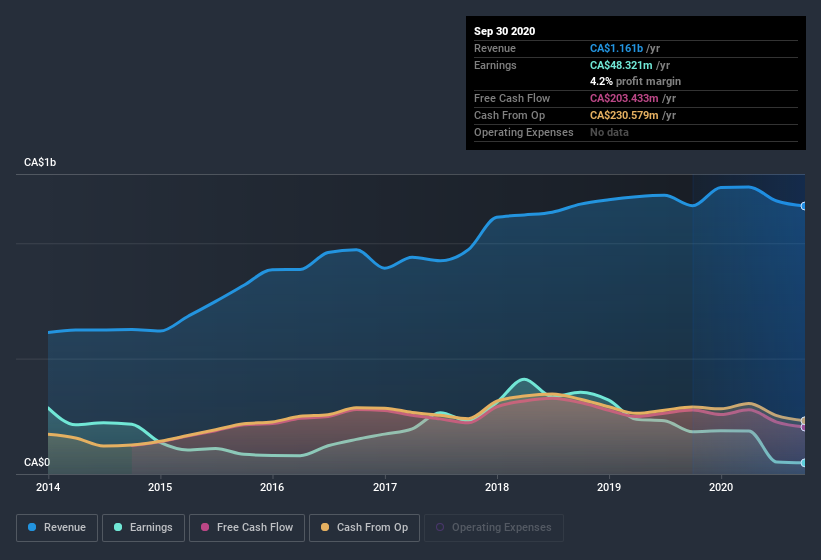

It's good to see that over the last twelve months Morguard made a profit of CA$48.3m on revenue of CA$1.16b. While it managed to grow its revenue over the last three years, its profit has moved in the other direction, as you can see in the chart below.

See our latest analysis for Morguard

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. Therefore, we think it is well worth considering the impact that unusual items and a spike in non-operating revenue have had on Morguard's statutory profit result. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Operating Revenue Or Not?

Most companies divide classify their revenue as either 'operating revenue', which comes from normal operations, and other revenue, which could include government grants, for example. Generally speaking, operating revenue is a more reliable guide to the sustainable revenue generating capacity of the business. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. It's worth noting that Morguard saw a big increase in non-operating revenue over the last year. Indeed, its non-operating revenue spiked from CA$1.16b last year to CA$1.16b this year. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. In order to better understand a company's profit result, it can sometimes help to consider whether the result would be very different without a sudden increase in non-operating revenue.

How Do Unusual Items Influence Profit?

On top of the non-operating revenue spike, we should also consider the CA$417m impact of unusual items in the last year, which had the effect of suppressing profit. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. In the twelve months to September 2020, Morguard had a big unusual items expense. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Our Take On Morguard's Profit Performance

In its last report Morguard benefitted from a spike in non-operating revenue which may have boosted its profit in a way that may be no more sustainable than low quality coal mining. Having said that, it also took a hit from unusual items, which could bode well for next year, assuming the expense was one-off in nature. Given the contrasting considerations, we don't have a strong view as to whether Morguard's profits are an apt reflection of its underlying potential for profit. If you want to do dive deeper into Morguard, you'd also look into what risks it is currently facing. When we did our research, we found 4 warning signs for Morguard (1 is a bit unpleasant!) that we believe deserve your full attention.

Our examination of Morguard has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Morguard or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:MRC

Morguard

A real estate investment and management company, engages in property ownership, development, and investment advisory services in Canada and the United States.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026