- Canada

- /

- Residential REITs

- /

- TSX:KMP.UN

Is Killam Apartment REIT a Bargain After the 5.1% Year to Date Rise?

Reviewed by Bailey Pemberton

If you are holding Killam Apartment REIT stock or considering whether now is the right moment to invest, you are certainly not alone in weighing your options. Over the last year, Killam’s price action has been anything but boring, with a recent uptick of 1.0% in the last week helping to balance out a weaker 1-year performance at -6.3%. In a broader context, things look more encouraging, as Killam Apartment REIT has posted a 35.0% gain over three years and a solid 24.2% over five years. Despite a slight dip of 1.6% over the last month, the stock is up 5.1% year-to-date, suggesting that investors still see opportunity here, even as the broader real estate sector faces shifting economic winds and changing interest rate expectations.

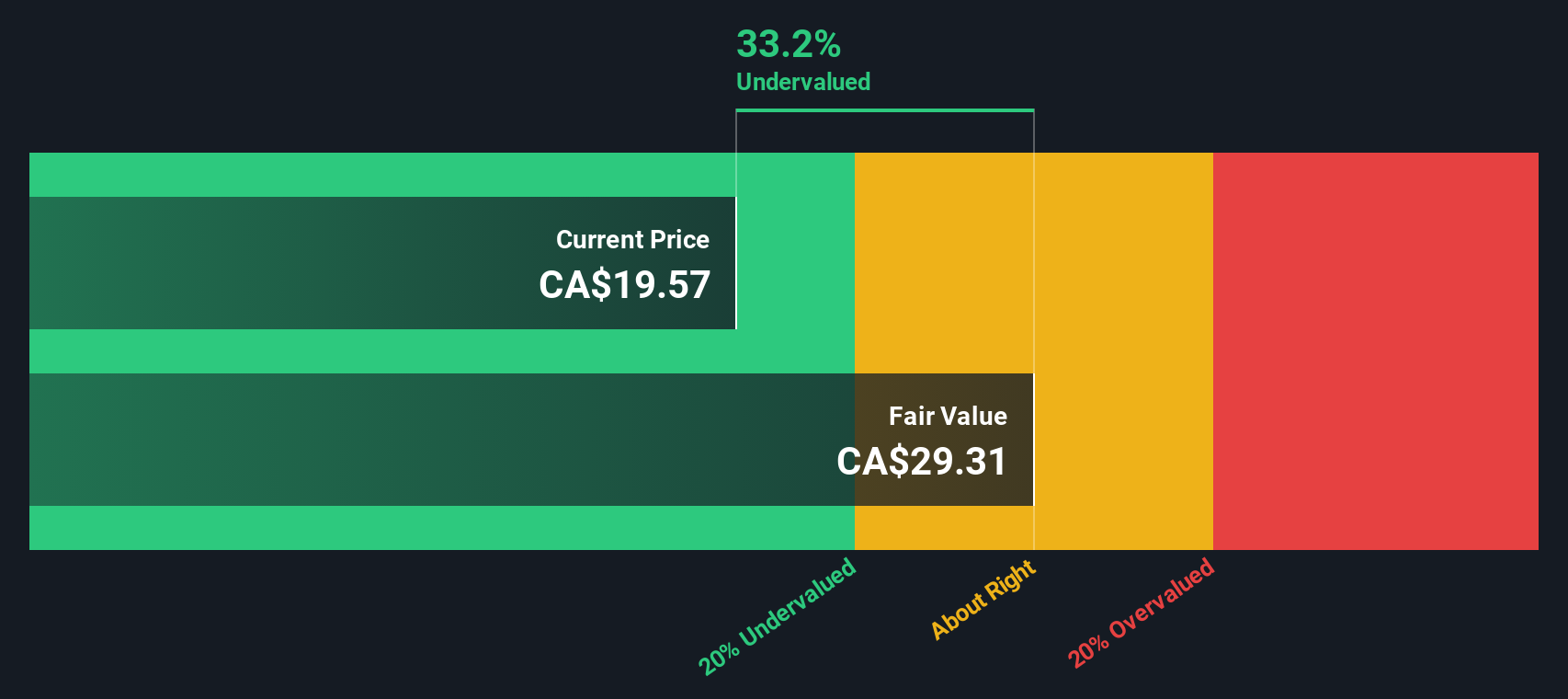

With these moves in mind, the big question is, Is Killam Apartment REIT undervalued or fairly priced right now? According to a detailed valuation review, the company scores a strong 5 out of 6 on the value scale, which is seen by many as a signal that it is undervalued by a wide range of measures. In the following sections, we will break down what this valuation score really means by looking at the most popular ways analysts judge whether a real estate investment trust is a bargain. Additionally, we will show you an easy way to cut through the noise and determine true value for yourself.

Approach 1: Killam Apartment REIT Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows, in this case adjusted funds from operations, and then discounting those amounts back to today’s value. This approach gives investors a sense of what the business is really worth, beyond current market sentiment.

For Killam Apartment REIT, the current free cash flow sits at CA$121.73 million. Analysts project modest annual growth, with free cash flow expected to reach CA$200.91 million in 2035 according to Simply Wall St’s extrapolated estimates. While analyst coverage typically extends five years into the future, these additional projections help model ongoing performance for long-term holders.

Based on this analysis, the DCF model calculates an intrinsic value of CA$27.80 per share. Compared to the current share price, this suggests Killam Apartment REIT is trading at a 35.2% discount. This indicates the stock appears significantly undervalued by this metric.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Killam Apartment REIT is undervalued by 35.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Killam Apartment REIT Price vs Earnings

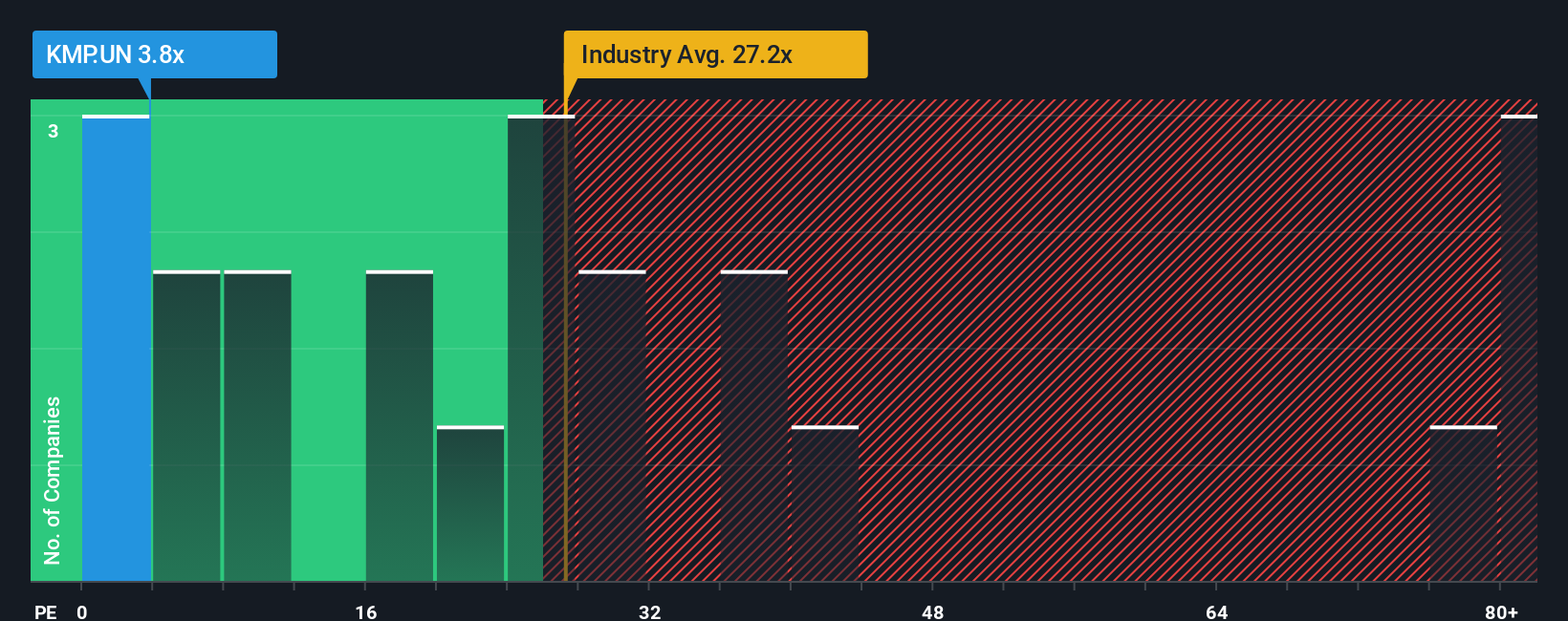

For profitable companies like Killam Apartment REIT, the price-to-earnings (PE) ratio is a widely used metric for understanding valuation. The PE ratio shows how much investors are willing to pay for each dollar of earnings, making it especially helpful when the business has steady profits.

What counts as a fair or normal PE ratio depends a lot on both the company’s expected growth and the risks it faces. Generally, higher-growth companies or those with reliable income can support a higher PE, while riskier or slower-growing businesses tend to warrant a lower multiple.

Right now, Killam Apartment REIT is trading at a PE ratio of just 3.89x. That is strikingly low when compared to its peer group average of 6.53x and the broader Residential REITs industry average of 20.50x. While these benchmarks offer useful context, they do not account for some important company-specific factors.

This is where the Fair Ratio from Simply Wall St comes in. The Fair Ratio is designed to provide a better target than peer or industry averages by factoring in Killam’s own earnings growth, profit margins, risks, market cap, and industry specifics. By weighing these variables together, the Fair Ratio aims to answer what the multiple really should be, not just what others in the space are trading at.

In this case, Killam Apartment REIT’s actual PE is well below what the Fair Ratio would suggest, indicating that the stock remains significantly undervalued using this measure as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Killam Apartment REIT Narrative

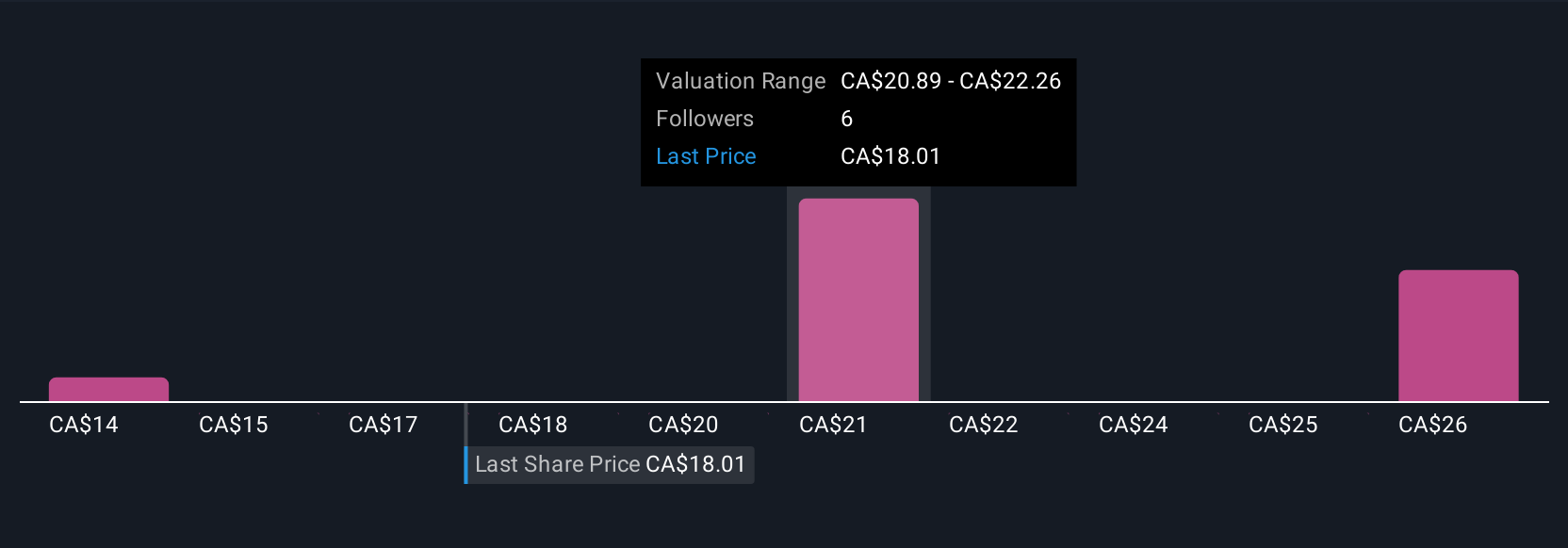

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal investment story, where you connect your perspective on a company, such as your estimates for fair value, revenue growth, and future profits, with the company’s financial forecast to arrive at a fair value that truly makes sense for you.

This approach moves beyond just ratios or static models by linking the story behind a company to its numbers, helping you see how your assumptions play out in real time. Narratives are easy to use and available to all investors through the Community page on Simply Wall St, which is used by millions of informed investors worldwide.

They offer a clear comparison between Fair Value and the current Price, allowing you to decide with confidence if it is the right moment to buy or sell. What makes Narratives especially powerful is that they update dynamically as fresh news, earnings, or data come in, so your view evolves as the facts do.

For example, some investors’ Narratives for Killam Apartment REIT predict strong value growth based on rising rents, while others see a more modest outlook due to higher interest rates and market risks.

Do you think there's more to the story for Killam Apartment REIT? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Killam Apartment REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KMP.UN

Killam Apartment REIT

Killam Apartment REIT, based in Halifax, Nova Scotia, is one of Canada's largest residential real estate investment trusts, owning, operating, managing and developing a $5.5 billion portfolio of apartments and manufactured home communities.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives