- Canada

- /

- Residential REITs

- /

- TSX:KMP.UN

Did Rising Revenue but Lower Profit Reshape Killam Apartment REIT's (TSX:KMP.UN) Investment Narrative?

Reviewed by Sasha Jovanovic

- Killam Apartment REIT recently reported its third quarter 2025 financial results, with revenue rising to C$98.47 million but net income falling to C$41.86 million compared to the same period last year.

- This combination of higher sales alongside significantly lower profits has attracted attention from analysts and market participants, influencing sentiment toward the REIT.

- We’ll explore how Killam’s higher revenue but lower net income is shaping the current investment narrative for the company.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

What Is Killam Apartment REIT's Investment Narrative?

To see value in Killam Apartment REIT, investors typically focus on the stability and long-term income from residential property assets, backed by a tradition of regular dividends. The recent Q3 results, with higher revenue but a sharp drop in net income, add a layer of caution. This shift has prompted some analysts to trim price targets, but the headline catalyst for the stock remains the resilience of rental demand and property values. A key risk to watch coming out of this update is the impact of sizeable one-off items and ongoing margin pressure, which now seem more pressing. While the results don’t shake up the fundamental investment thesis, they do put profitability under the spotlight for the next few quarters. Current share price trends suggest the reaction has been muted so far, but questions about income consistency may weigh heavier.

However, the rising pressure on profit margins could become a bigger concern for income-focused investors.

Exploring Other Perspectives

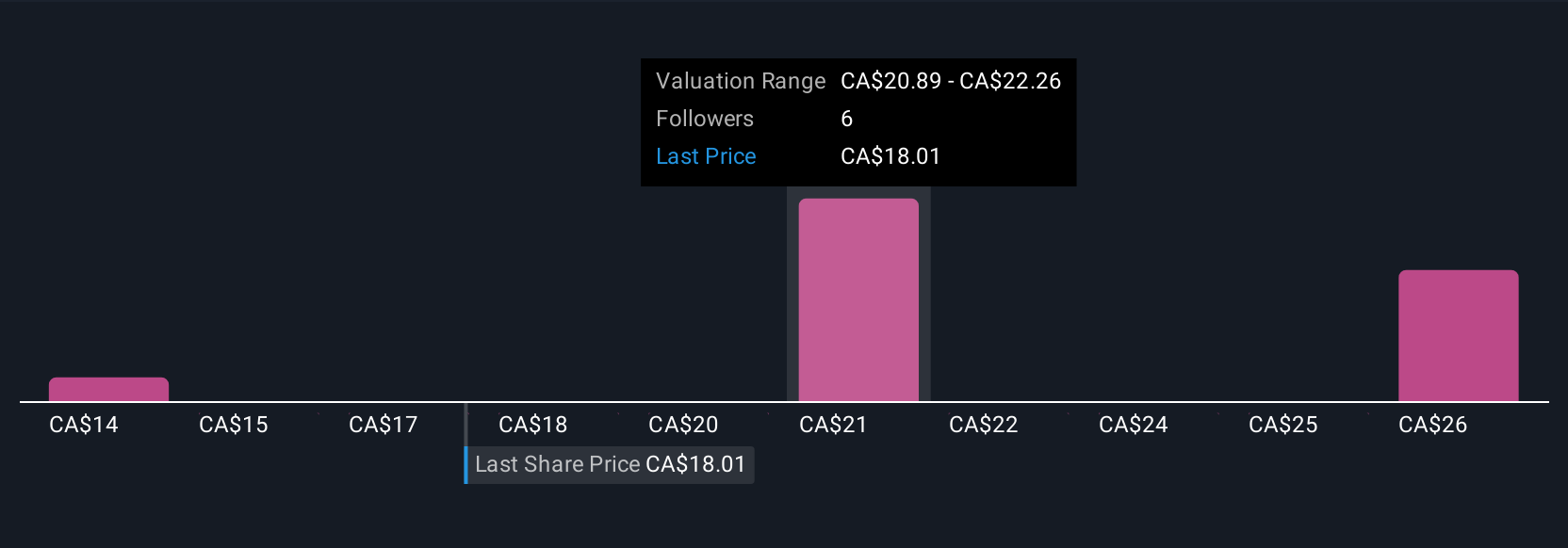

Explore 3 other fair value estimates on Killam Apartment REIT - why the stock might be worth just CA$21.09!

Build Your Own Killam Apartment REIT Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Killam Apartment REIT research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Killam Apartment REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Killam Apartment REIT's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Killam Apartment REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KMP.UN

Killam Apartment REIT

Killam Apartment REIT, based in Halifax, Nova Scotia, is one of Canada's largest residential real estate investment trusts, owning, operating, managing and developing a $5.5 billion portfolio of apartments and manufactured home communities.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives