H&R REIT (TSX:HR.UN) Valuation in Focus After Q2 Results and Dividend Affirmation

Reviewed by Simply Wall St

If you own H&R Real Estate Investment Trust (TSX:HR.UN) or are considering it for your portfolio, the latest news may have caught your attention. The trust recently released its second quarter results, showing a slight decline in sales compared to last year, but also a meaningful reduction in net losses. In addition to these results, management affirmed its monthly dividend, a move that indicates a continued commitment to consistent payouts even as the trust reports negative earnings. These announcements have led investors to consider whether improved financial discipline and steady dividends could influence the overall outlook for HR.UN.

The movement in the stock price provides additional context. Shares have climbed over 18% in the past three months and are up an impressive 36% over the past year, reversing a longer-term trend of modest returns. This recent momentum has appeared as the company navigates ongoing net losses and modest revenue growth. The reaffirmed dividend and narrower quarterly losses suggest that management is taking active steps to manage costs and maintain investor confidence, which may influence perceptions around risk and downside protection for a real estate trust like this.

With shares rising, losses narrowing, and dividends remaining steady, the question now is whether H&R’s current price still offers value. Has the market already factored in the turnaround, or could there be additional potential ahead?

Price-to-Sales of 4.6x: Is it justified?

Based on the price-to-sales ratio, HR.UN appears expensive relative to both its direct peers and the broader North American REITs sector.

The price-to-sales (P/S) ratio compares a company’s market value to its annual revenue. This provides insight into how much investors are willing to pay for each dollar of sales. For real estate investment trusts, this multiple is especially useful because it highlights whether market optimism about future growth and stability is warranted by current fundamentals.

In HR.UN’s case, the company’s P/S ratio of 4.6x is significantly higher than the peer average of 2.8x and the North American REIT industry average of 3.3x. This suggests that the current valuation may be pricing in expectations of stronger future performance or a premium for perceived quality. It may not necessarily reflect observable earnings or revenue growth to date.

Result: Fair Value of $12.11 (OVERVALUED)

See our latest analysis for H&R Real Estate Investment Trust.However, persistent net losses and lingering overvaluation risk could challenge the bullish narrative if operational improvements do not materialize as expected.

Find out about the key risks to this H&R Real Estate Investment Trust narrative.Another View: Discounted Cash Flow Tells a Different Story

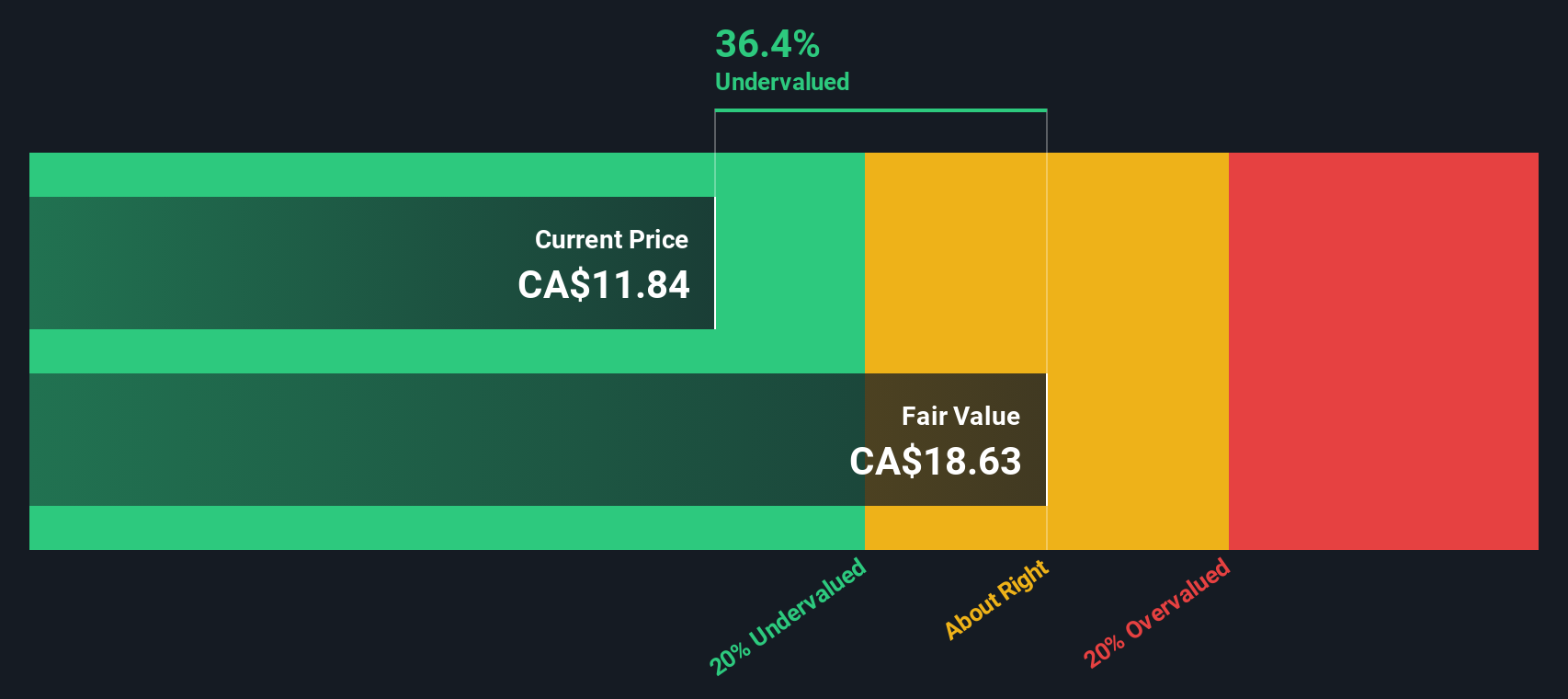

Using our DCF model, the outlook contrasts sharply with what the sales multiple suggests. This approach implies HR.UN could actually be undervalued and highlights a possible disconnect between fundamentals and market sentiment. Which perspective will prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own H&R Real Estate Investment Trust Narrative

If you want to dig deeper or see things from another perspective, you can easily create your own viewpoint based on the latest data in just a few minutes, or you can do it your way.

A great starting point for your H&R Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock more value from your investing journey by seeking out strategies and sectors you may have overlooked. Exciting opportunities await as you step beyond the familiar. Supercharge your portfolio by exploring investments that offer potential for resilience, growth, and innovation. Smart moves start here.

- Capitalize on the surge in artificial intelligence by spotting tomorrow’s breakout AI companies through AI penny stocks.

- Grow your passive income by targeting stable businesses with generous yields using dividend stocks with yields > 3%.

- Embrace the next wave of healthcare innovation and uncover standout AI-driven medical firms via healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H&R Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HR.UN

H&R Real Estate Investment Trust

H&R REIT is one of Canada's largest real estate investment trusts with total assets of approximately $9.9 billion as at June 30, 2025.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives