- Canada

- /

- Retail REITs

- /

- TSX:FCR.UN

First Capital REIT (TSX:FCR.UN) Turns Profitable, Undercutting Bearish Sentiment on Earnings Quality

Reviewed by Simply Wall St

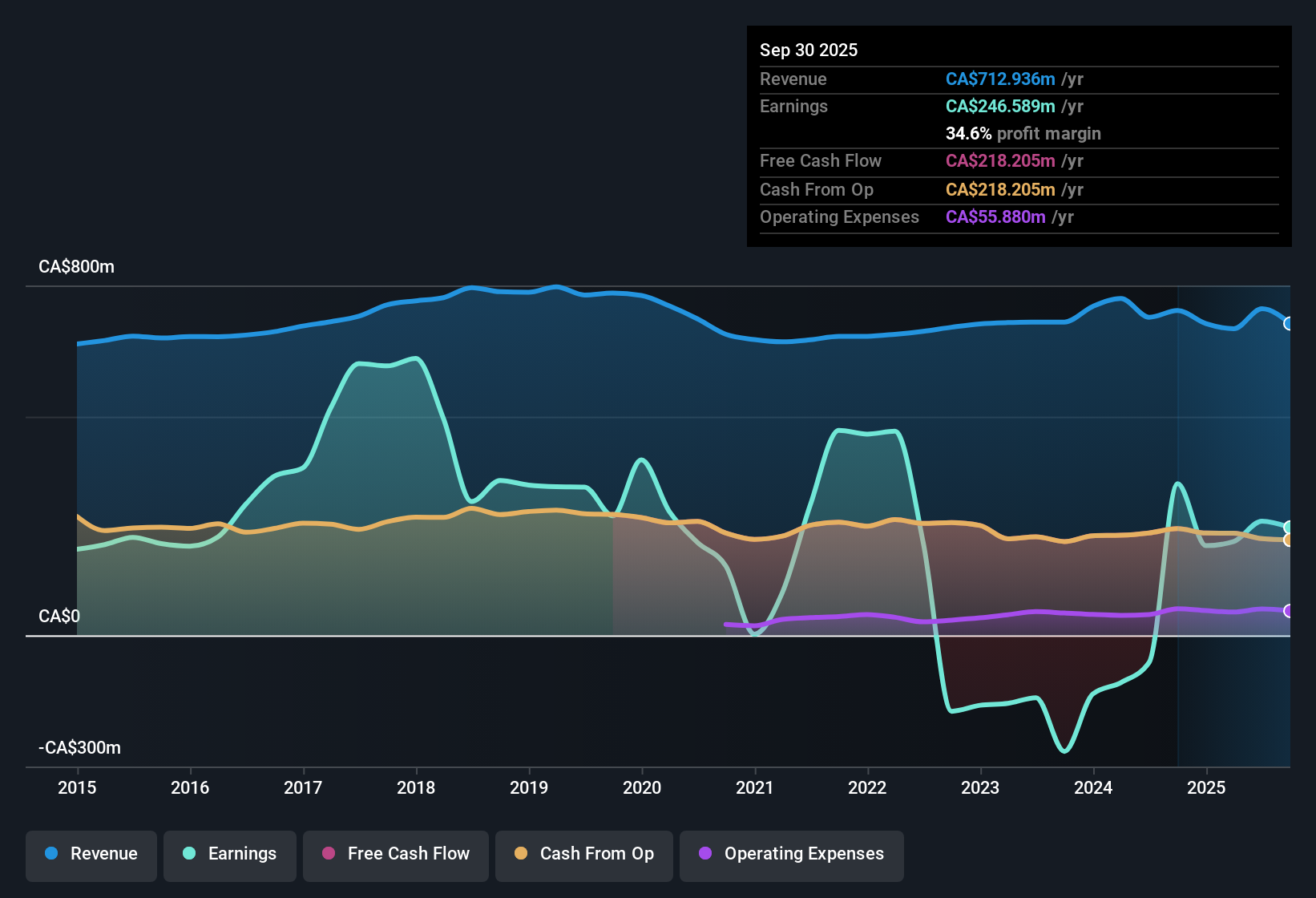

First Capital Real Estate Investment Trust (TSX:FCR.UN) has just posted a notable turnaround by achieving profitability, even as earnings have declined by 13.2% per year over the last five years. Revenue is forecast to grow at just 2% per year, underperforming the broader Canadian market’s expected 5.1% growth rate. However, the company’s net profit margin has improved from last year and reported earnings are regarded as high quality.

See our full analysis for First Capital Real Estate Investment Trust.Next, we will set these earnings figures against the most-watched narratives for FCR.UN. We will highlight which popular market views hold up and which get put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Moves Up Despite Tepid Growth

- Net profit margin increased from last year, giving First Capital REIT a more efficient bottom line even as revenue is only forecast to rise 2% per year, which is well below the Canadian market’s 5.1% annual average.

- Stability in income from necessity-based urban retail properties directly supports the view that FCR.UN can keep delivering steady cash flows, even with slow growth pressures.

- Proactive steps such as capital recycling and ongoing portfolio optimization are seen as positive signals for operational discipline.

- The absence of major negative disclosures or cash flow shocks further supports the “boring but safe” approach, positioning the REIT as a consistent dividend payer even in a sluggish revenue environment.

Dividend Sustainability Faces Scrutiny

- The risk of the current dividend not being sustainable is flagged in light of weak earnings and revenue momentum, along with a financial position that is not rated as strong.

- Bears frequently highlight that slow top-line expansion combined with sector-wide cost pressures could challenge distribution growth.

- Pressure from elevated interest rates and muted rental market gains could make dividend adjustments more likely unless cash flows increase meaningfully.

- Execution on asset recycling or debt management will remain under close scrutiny, as any shortfall could reinforce skeptical views on management’s ability to maintain or grow payouts.

Valuation Discount Stands Out Versus Peers

- FCR.UN currently trades at a Price-to-Earnings ratio of 15.5x, noticeably below the North American Retail REIT average of 22.3x and its peer group average of 17.7x. In addition, the share price of CA$19.01 is well under its DCF fair value of CA$23.96.

- Investors focused on value are likely to see this discount as attractive, especially given the REIT’s recent move into profitability despite lackluster long-term earnings growth.

- While the sector’s slow aggregate growth rate should temper expectations of sharp price appreciation, the current gap to fair value offers a clear entry point for those emphasizing relative bargains.

- Potential upside from ongoing portfolio optimization and operational stability may help close the valuation gap if market sentiment grows more favorable to defensive yield plays.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First Capital Real Estate Investment Trust's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

First Capital REIT's weak earnings momentum and questionable dividend sustainability raise some concerns about its overall financial strength and future payouts.

If you want to focus on companies with healthier finances, we recommend using solid balance sheet and fundamentals stocks screener (1979 results) to discover alternatives with robust balance sheets and stronger fundamentals built for the long haul.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FCR.UN

First Capital Real Estate Investment Trust

First Capital Real Estate Investment Trust, with $9.4 billion in assets acquires, develops, owns and operates open-air grocery-anchored shopping centres in neighbourhoods with the strongest demographics in Canada.

Good value average dividend payer.

Market Insights

Community Narratives