- Canada

- /

- Office REITs

- /

- TSX:D.UN

Here's Why I Think Dream Office Real Estate Investment Trust (TSE:D.UN) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Dream Office Real Estate Investment Trust (TSE:D.UN). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Dream Office Real Estate Investment Trust

How Fast Is Dream Office Real Estate Investment Trust Growing Its Earnings Per Share?

In the last three years Dream Office Real Estate Investment Trust's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, Dream Office Real Estate Investment Trust's EPS soared from CA$2.28 to CA$3.23, over the last year. That's a commendable gain of 42%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Dream Office Real Estate Investment Trust's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. This approach makes Dream Office Real Estate Investment Trust look pretty good, on balance; although revenue is flattish, EBIT margins improved from 56% to 59% in the last year. That's a real positive.

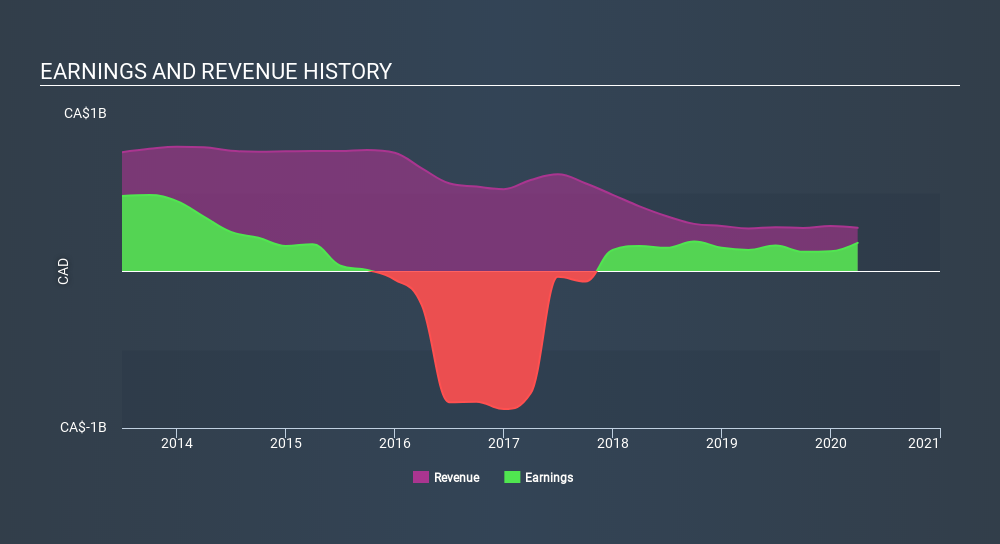

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Dream Office Real Estate Investment Trust's balance sheet strength, before getting too excited.

Are Dream Office Real Estate Investment Trust Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it Dream Office Real Estate Investment Trust shareholders can gain quiet confidence from the fact that insiders shelled out CA$917k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the Chairman & CEO, Michael Cooper, who made the biggest single acquisition, paying CA$897k for shares at about CA$17.95 each.

I do like that insiders have been buying shares in Dream Office Real Estate Investment Trust, but there is more evidence of shareholder friendly management. I refer to the very reasonable level of CEO pay. For companies with market capitalizations between CA$536m and CA$2.1b, like Dream Office Real Estate Investment Trust, the median CEO pay is around CA$2.3m.

The Dream Office Real Estate Investment Trust CEO received CA$1.5m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Dream Office Real Estate Investment Trust Worth Keeping An Eye On?

You can't deny that Dream Office Real Estate Investment Trust has grown its earnings per share at a very impressive rate. That's attractive. And that's not the only positive, either. We have both insider buying and reasonable and remuneration to consider. On balance the message seems to be that this stock is worth looking at, at least for a while. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Dream Office Real Estate Investment Trust (at least 1 which doesn't sit too well with us) , and understanding these should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Dream Office Real Estate Investment Trust, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSX:D.UN

Dream Office Real Estate Investment Trust

Dream Office Real Estate Investment Trust (“Dream Office REIT” or the “Trust”) is an open-ended investment trust created pursuant to a Declaration of Trust, as amended and restated, under the laws of the Province of Ontario.

Fair value with moderate growth potential.

Market Insights

Community Narratives